Gold Price Forecast: Bulls trying to seize control, optimism capping gains for XAU/USD

- A goodish USD rebound, an uptick in the US bond yields prompted some selling around gold on Tuesday.

- Powell’s dovish congressional testimony helped limit the intraday slide for the non-yielding yellow metal.

- The underlying bullish tone held bulls from placing aggressive bets and kept a lid on any further upside.

Gold had good two-way price moves on Tuesday and was influenced by a combination of diverging forces. The early uptick to one-week tops lost steam near the $1816 region amid a goodish US dollar rebound from six-week lows, which tends to undermine demand for the dollar-denominated commodity. Apart from this, a modest uptick in the US Treasury bond yields exerted some additional pressure and momentarily dragged the non-yielding yellow metal below the $1800 mark. The US bond market continued reacting to the prospects for a massive US fiscal spending plan and the optimism over the impressive pace of COVID-19 vaccinations that have been fueling hopes for a strong global economic recovery.

That said, the treasury yields came off the highs after the US Fed Chair Jerome Powell reiterated a very dovish policy stance. Powell – during the first day of his semi-annual testimony before Congress said that interest rates will remain low and the Fed will keep buying bonds to support the US economic recovery. This, in turn, assisted the XAU/USD to recover a major part of its early lost ground and regain some positive traction during the Asian session on Wednesday. However, the underlying bullish sentiment in the financial markets capped gains for the safe-haven precious metal.

The commodity was last seen trading around the $1810 region and remains at the mercy of the broader market risk sentiment/USD price dynamics. There isn't any major market-moving economic data due for release from the US on Wednesday. Hence, the key focus will remain on Powell's second day of testimony to the Senate Banking Committee. This will play a key role in influencing the USD and produce some meaningful trading opportunities around the XAU/USD.

Short-term technical outlook

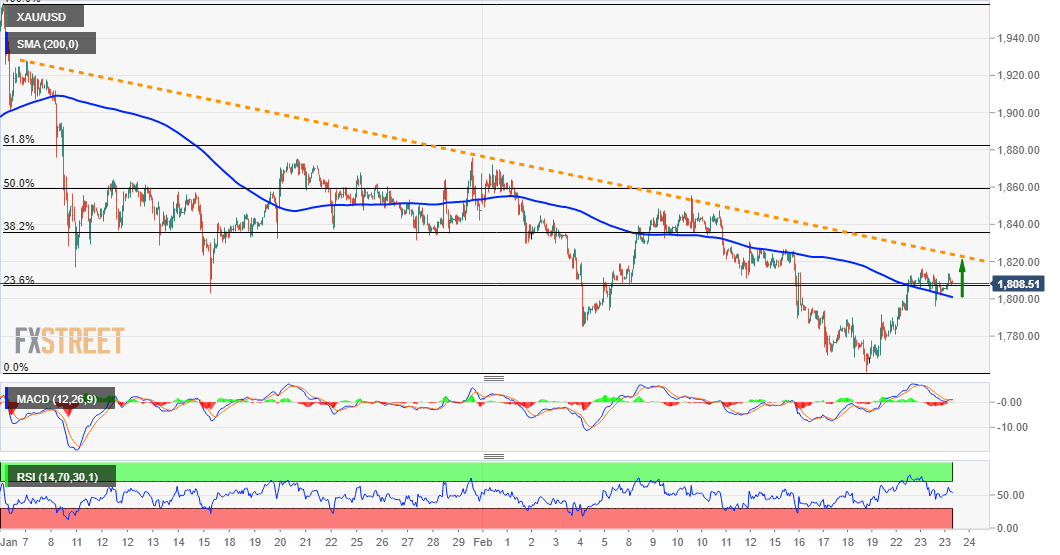

From a technical perspective, the metal has found acceptance above a confluence region comprising of 200-hour SMA and the 23.6% Fibonacci level of the $1959-$1760 downfall. This, along with the emergence of some dip-buying on Tuesday, favours bullish traders and supports prospects for additional gains. However, technical indicators on the daily chart – though have been recovering from the negative territory – are yet to confirm a bullish bias and warrant caution before positioning aggressively for any further positive move. Hence, any subsequent strength is likely to confront resistance near the $1823-25 horizontal zone. This is followed by the 38.2% Fibo. level, around the $1835 region, which if cleared will set the stage for additional gains.

On the flip side, some follow-through selling below the overnight swing lows, around the $1795 region, will negate the constructive outlook and turn the XAU/USD vulnerable. The commodity might then accelerate the slide towards the $1775-72 intermediate support en-route the $1760 region, or seven-month lows touched last Friday.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.