Breakout at hand or not

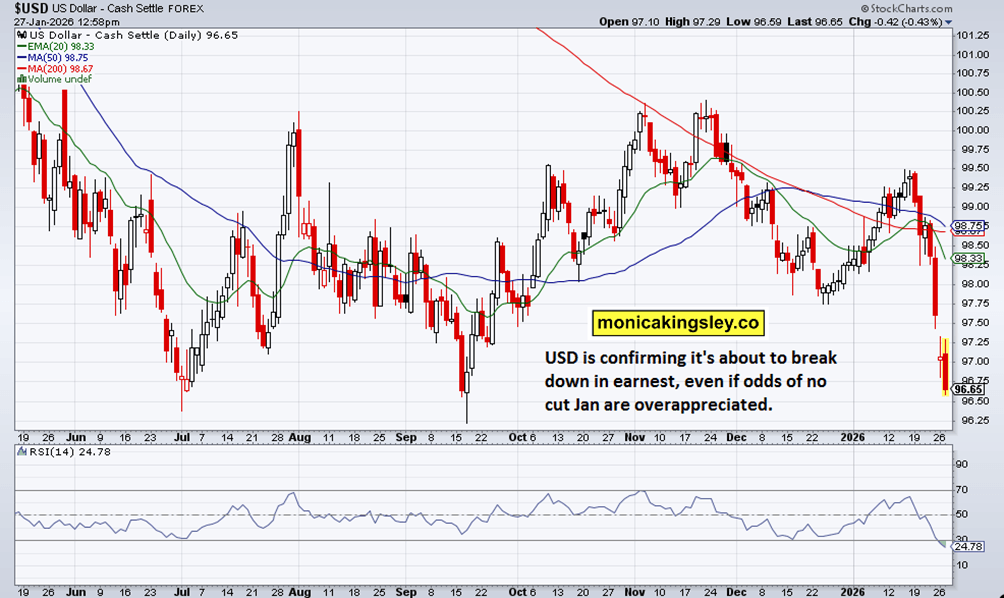

S&P 500 neatly recovered from the bearish Sunday gap, and neither Nasdaq showed signs of giving up the bullish progress. And test of the bullish resolve, and off the opening bell, straight up. Precious metals running, delivering more client gains, sidestepping the slump in the second half of the day. Precious metals recovered, USD is wobbling badly as talked in Saturday‘s extensive analysis, and ES had overcome two important resistances, so is it out of the woods, or time for a little wobble first?

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.