Gold Price Forecast: Bulls losing the battle, $1,800 at sight

XAU/USD Current price: $1,815.95

- The 2-year Treasury yield extends gains beyond 5% as Powell testifies for a second day.

- The United States private sector added 242K new jobs in February, according to the ADP survey.

- XAU/USD consolidates weekly losses near this year's low, bears retain control.

Spot gold spent the first half of the day consolidating weekly losses in the $1,810 price zone, turning marginally higher after Wall Street’s opening. The US Dollar lost some steam after soaring in the aftermath of Federal Reserve (Fed) Chairman Jerome Powell's first day of testimony before Congress. The chief of the American central bank made a case for keep raising rates to tame inflation, with speculative interest now expecting a faster pace of hikes extending well into 2023.

Concerns partially receded after the United States published the ADP survey on private job creation, as it came in much better than anticipated, up 242K in February. Stock markets recovered part of Tuesday’s losses, and most US indexes trade in the green. On the other hand, government bond yields are mixed as the 10-year Treasury note yields 3.94%, down for the day, while the 2-year note offers 5.03%, up 2 bps.

Fed’s chair Powell is testifying for a second consecutive day. Among other things, he said that policymakers had not decided yet on speeding up the pace of rate hikes, although he noted that the costs of failure to control inflation would be much higher than the costs of controlling it. Furthermore, he added that the terminal rate is likely to be higher than what they expected.

XAU/USD price short-term technical outlook

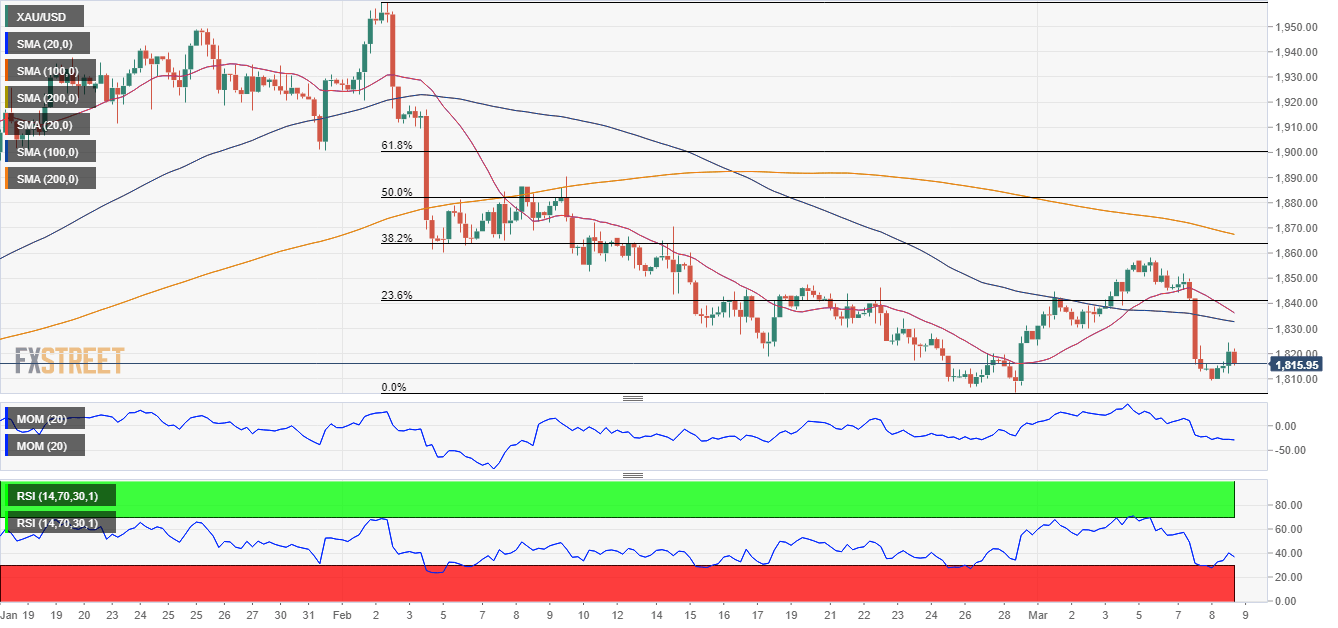

XAU/USD actually extended its weekly decline early on Wednesday to $1,809.38, not far from the year’s low posted in February at $1,804.70. It currently struggles to retain gains above $1,820, and the daily chart shows that the risk remains skewed to the downside, despite holding in the green. The pair is developing below a firmly bearish 20 Simple Moving Average (SMA), which extended its slide below the 23.6% retracement of the latest daily decline at $1,841.05. Meanwhile, the 100 SMA maintains its bullish slope, just below the aforementioned yearly low, reinforcing the relevance of the $1,800 area. Technical indicators, in the meantime, have stabilized well below their midlines, suggesting absent buying interest.

In the near term, and according to the 4-hour chart, it is clear that bears are in control. Gold trades below all its moving averages, with the 20 SMA accelerating south between the longer ones. The Momentum indicator remains directionless within negative levels, while the Relative Strength Index (RSI) indicator resumed its decline after correcting oversold conditions, currently at around 36.

Support levels: 1,804.70 1,789.60 1,774.20

Resistance levels: 1,829.90 1,841.05 1,858.30

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.