Gold price forecast: Bullish scenario begins to materialize

- Gold continues to build bullish momentum, reclaiming key Fair Value Gaps as price eyes a breakout above $3,370.

- Institutional forecasts from HSBC, J.P. Morgan, and Morgan Stanley project gold reaching up to $4,000 amid fiscal uncertainty and global risk.

- Geopolitical tensions and tariff deadlines are keeping markets in risk-off mode, reinforcing gold’s safe-haven appeal above key technical zones.

Gold sustained recovery amidst risk-off mode

Over the past few sessions, gold has continued to solidify its recovery structure, confirming a shift in sentiment from bearish caution to bullish momentum. While many were anticipating a deeper retracement after the recent highs, gold bulls seem to be taking control again, driven by a combination of strong institutional forecasts, technical reclaim of key levels, and ongoing geopolitical tensions.

This development aligns with our earlier forecast Gold price forecast: Bullish and bearish scenario amid Israel-Iran conflict and US tariff tensions

Fundamental tailwinds: Institutional forecasts support continued upside

Gold’s bullish momentum isn’t just technical—it’s being fueled by institutional conviction:

- HSBC recently revised its 2025 forecast for gold to $3,215, with potential spikes up to $3,600 amid fiscal uncertainty and policy shifts.

- Morgan Stanley and J.P. Morgan also project upside toward $3,675–$4,000, citing gold’s rising role as a hedge against economic volatility.

These forecasts are no longer just speculation - they’re being backed by price action.

Geopolitical risk: Israel-Iran tensions reinforce risk-off demand

In the Middle East, the Israel–Iran conflict remains a central catalyst for gold’s safe-haven flows. While no full-scale escalation has occurred in recent days, tensions remain high, particularly with ongoing cyber and proxy threats from both sides.

Markets remain in risk-off mode, especially as global investors reduce exposure to equities and rotate capital into defensive assets. Gold has once again become a geopolitical hedge, further fueled by tariff tensions between the U.S. and China ahead of the July 9 tariff deadline.

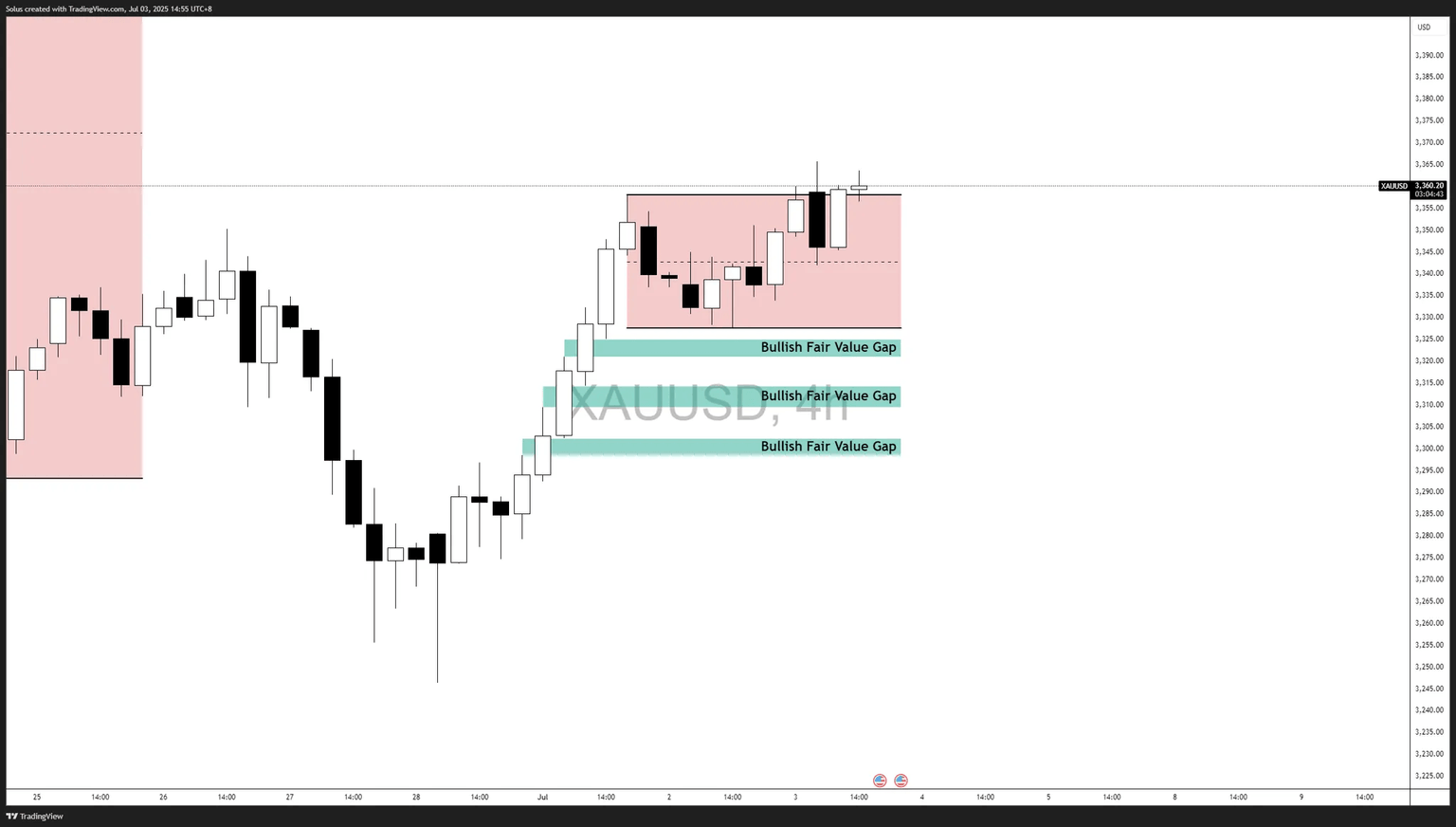

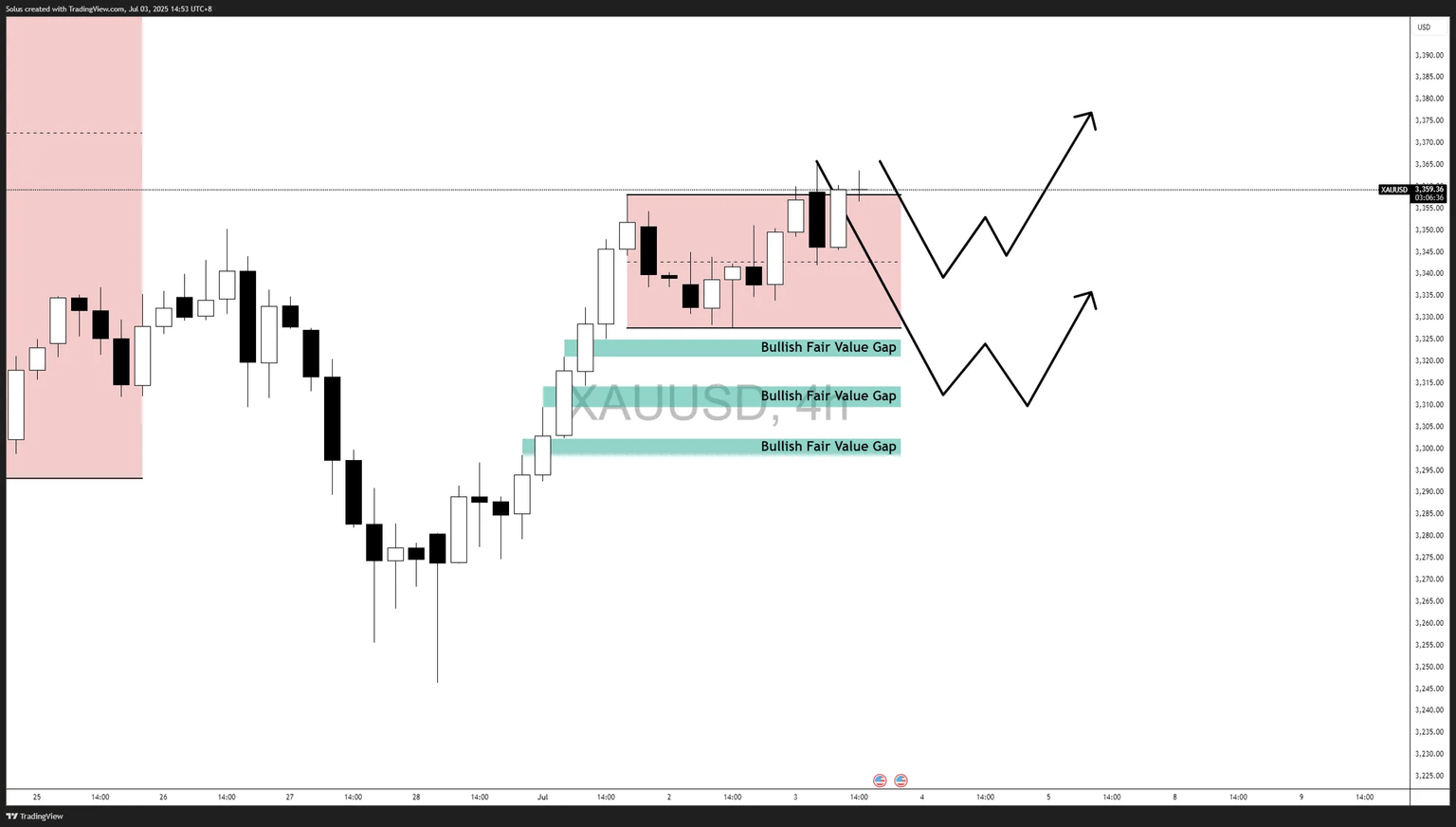

Technical outlook

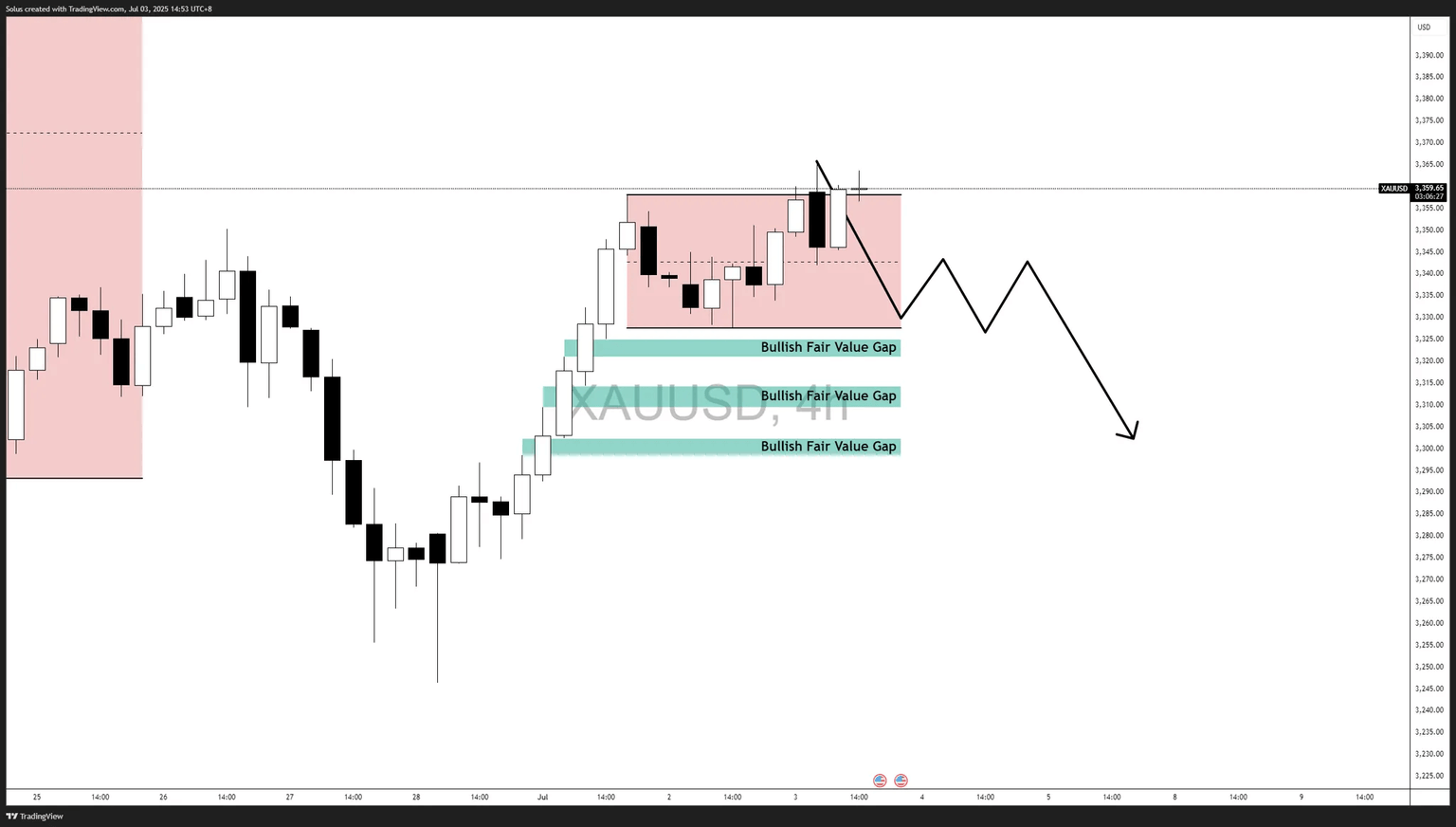

Gold has been advancing with a sustained move to the upside and few signs of strength invalidation. This upside momentum is also being supported with 3 4-Hour Fair Value Gaps that is still in-tact.

With institutions revising their forecast for new highs on Gold, we could anticipate Gold to potentially break the All-Time High level at $3,500.

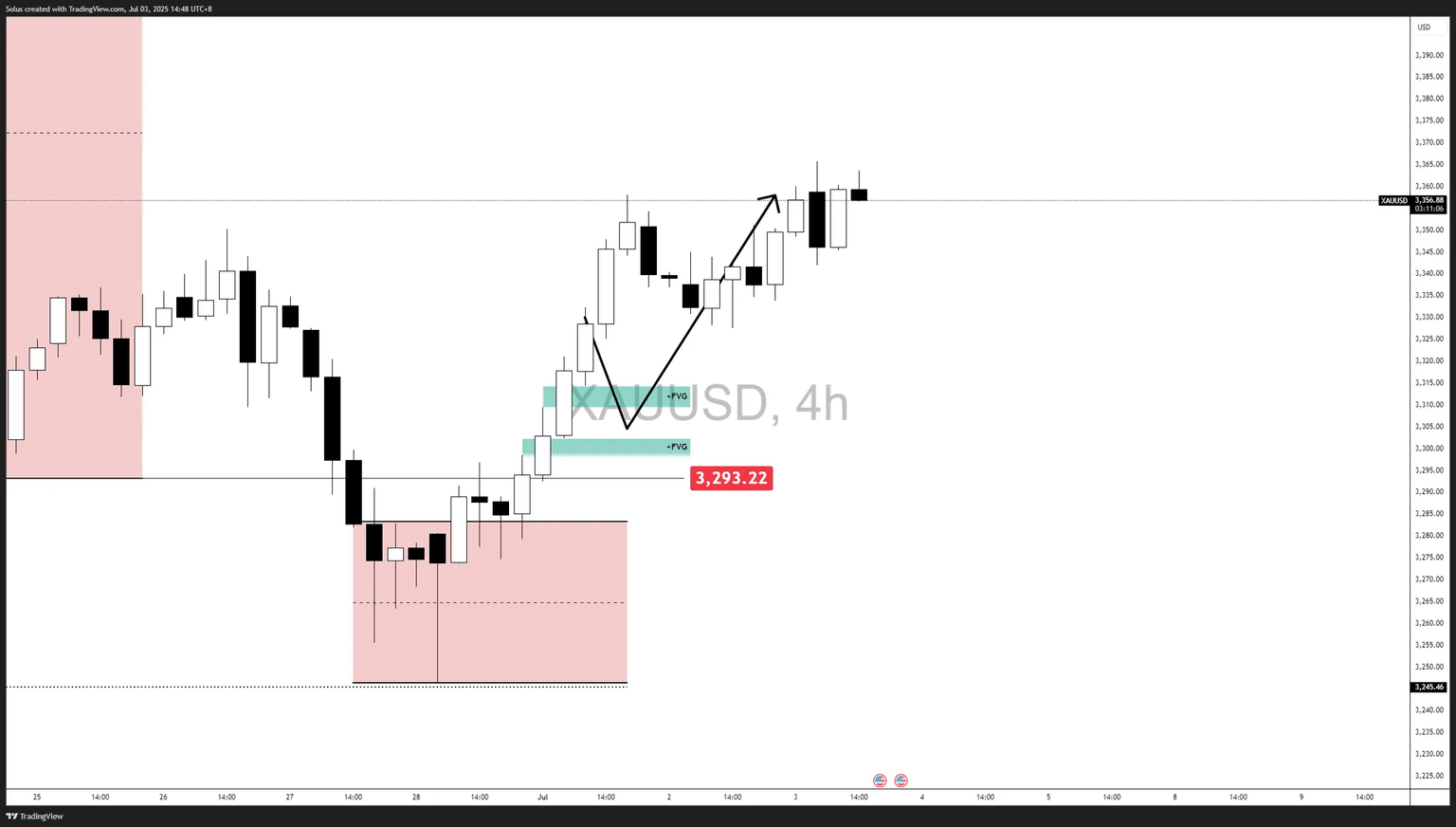

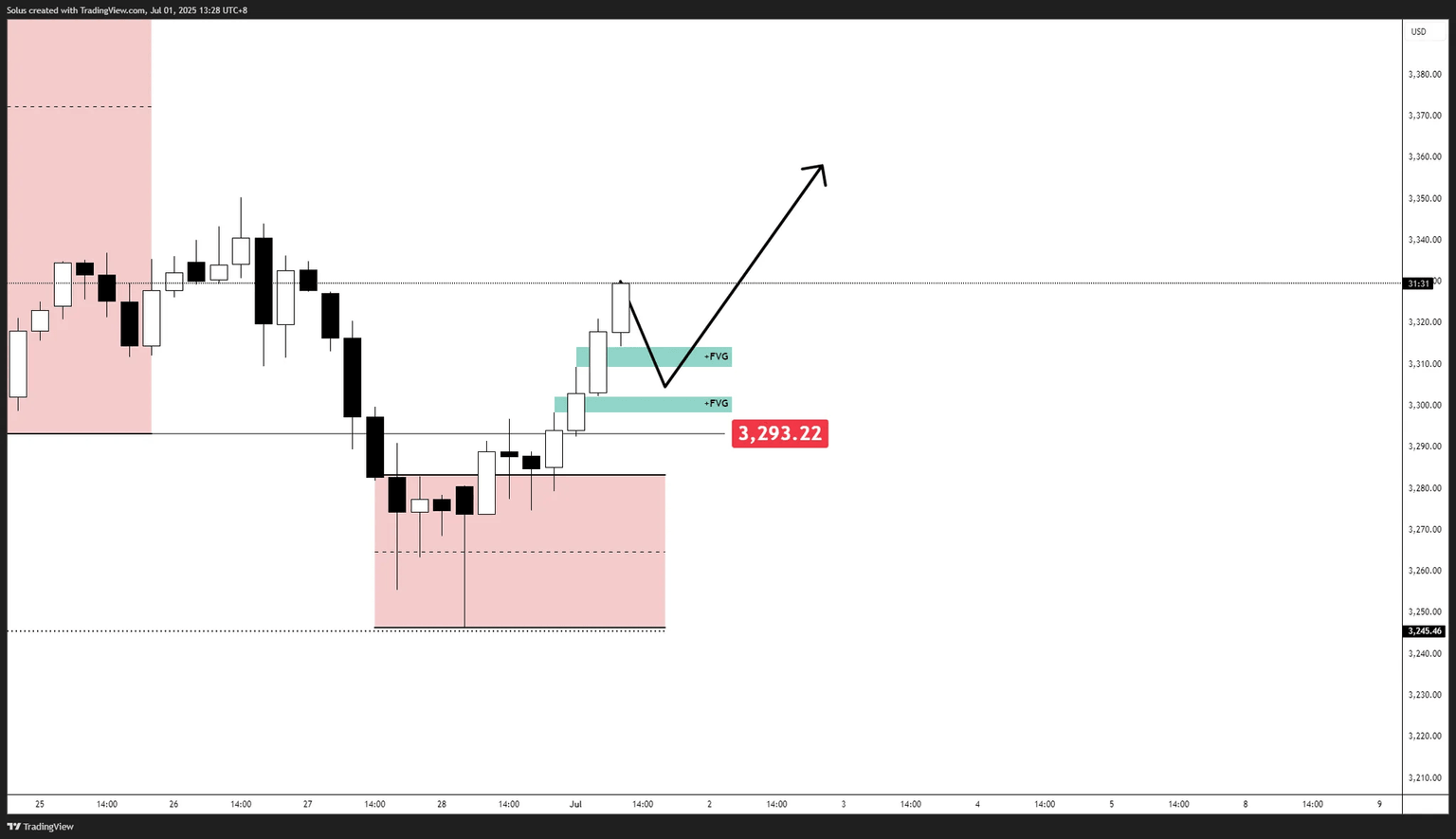

Bullish scenario: FVG reclaim and breakout continuation

Gold is currently testing the $3,360 level for new highs. We could see further upside if we see:

- A clean breakout above $3,370 confirms bullish intent and opens the path to $3,400–$3,420. (This was our outlined target based on the previous analysis: Gold price forecast: Bullish and bearish scenario amid Israel-Iran conflict and US tariff tensions)

- Fair Value Gaps remain intact:

- 1st Layer Fair Value Gap - $3,320 - $3,325

- 2nd Layer Fair Value Gap - $3,310 - $3,314

- 3rd Layer Fair Value Gap - $3,300 - $3,302

- Favorable risk sentiment (e.g., risk-off tone, weak USD, or dovish Fed narrative)

Targets:

- $3,400 - $3,450

Bearish scenario: Distribution and breakdown through FVGs

Alternatively, the current consolidation may reflect distribution at premium pricing, especially after failing to break above the $3,370 area convincingly.

- Fair Value Gaps fail to hold:

- 1st Layer Fair Value Gap - $3,320 - $3,325.

- 2nd Layer Fair Value Gap - $3,310 - $3,314.

- 3rd Layer Fair Value Gap - $3,300 - $3,302.

- Consolidation near or at $3,300 could pose a risk for further pullback on Gold.

- Shift in sentiment toward risk-on, USD strength, or hawkish Fed messaging.

Author

Jasper Osita

Independent Analyst

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.