Gold Price Forecast: $1,730 holds the key for XAU/USD bulls amid a modest USD strength

- A modest pickup in the USD demand exerted pressure on gold for the second straight session.

- The risk-off mood, softer US bond yields extended some support and might help limit losses.

Gold edged lower during the Asian session, albeit lacked any strong follow-through selling and remained well within Friday's trading range. This marked the second consecutive day on a negative move and was exclusively sponsored by a modest pickup in the US dollar demand. A stronger greenback tends to undermine demand for dollar-denominated commodities, including the XAU/USD. The USD found some support after Fed Chair Jerome Powell's upbeat comments over the weekend, saying that the US economy is set to make a turnaround and increased growth should provide more jobs. This reinforced market expectations for a relatively faster US economic recovery from the pandemic.

During an interview with 60 Minutes, Powell added that the Fed wants inflation moderately above 2% for some time but does not want it to go materially above 2%. This comes on the back of Friday's release of the hotter-than-expected US Producer Price Index, which recorded the largest annual gains in 9-1/2 years in March, and further fueled speculations that the inflation could potentially overshoot in the near term. It is worth reporting that the markets have been pricing in an uptick in US inflation amid the optimistic outlook for the US economy, thanks to the impressive pace of coronavirus vaccinations and the US President Joe Biden's over $2 trillion infrastructure spending plan.

This, in turn, has raised doubts that the Fed will retain ultra-low interest rates for a longer period, which was seen as another factor that weighed on the non-yielding yellow metal. Hence, the market focus will remain glued to Tuesday's release of the US consumer inflation figures. In the meantime, a softer tone surrounding the US Treasury bond yields, along with a slight deterioration in the global risk sentiment might help limit losses for the safe-haven precious metal. News that one of Iran's nuclear facilities was hit by a terrorist act dented investor’s appetite for perceived riskier assets and benefitted traditional safe-haven assets, including gold.

There isn't any major market-moving economic data due for release from the US on Monday, leaving the XAU/USD at the mercy of the USD price dynamics. Apart from this, the US bond yields might also influence the commodity. Traders might further take cues from the broader market risk sentiment for some meaningful opportunities around the metal.

Short-term technical outlook

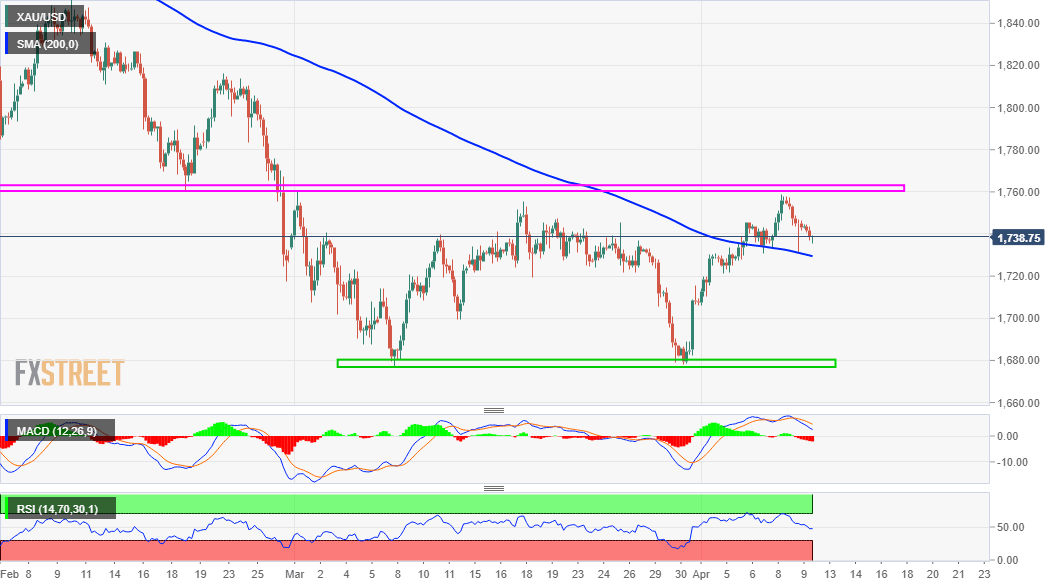

From a technical perspective, failure near a previous strong support breakpoint near the $1,760-65 region might have shifted the bias in favour of bearish traders. That said, it will still be prudent to wait for some follow-through selling below the $1,730 level before positioning for any further depreciating move. The next relevant support is pegged near the $1,720 area, below which bears might aim to challenge the $1,700 mark. The commodity could eventually drop to retest multi-month lows support near the $1,677-76 region, which constitutes the formation of a bullish double-bottom.

Meanwhile, the mentioned support-turned-resistance the neckline of the bullish double-bottom pattern. A sustained strength beyond will be seen as a fresh trigger for bullish traders and set the stage for additional gains. The commodity might then accelerate the momentum towards an intermediate resistance near the $,1,782-84 area before eventually aiming to reclaim the $1,800 round-figure mark.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.