Gold Price faces further downside risks as focus shifts to Fed meeting

- Gold Price remains on track to register losses for the week.

- Annual CPI in US rose to a fresh multi-decade high in September.

- The Fed is widely expected to hike its policy rate by 50 bps next week.

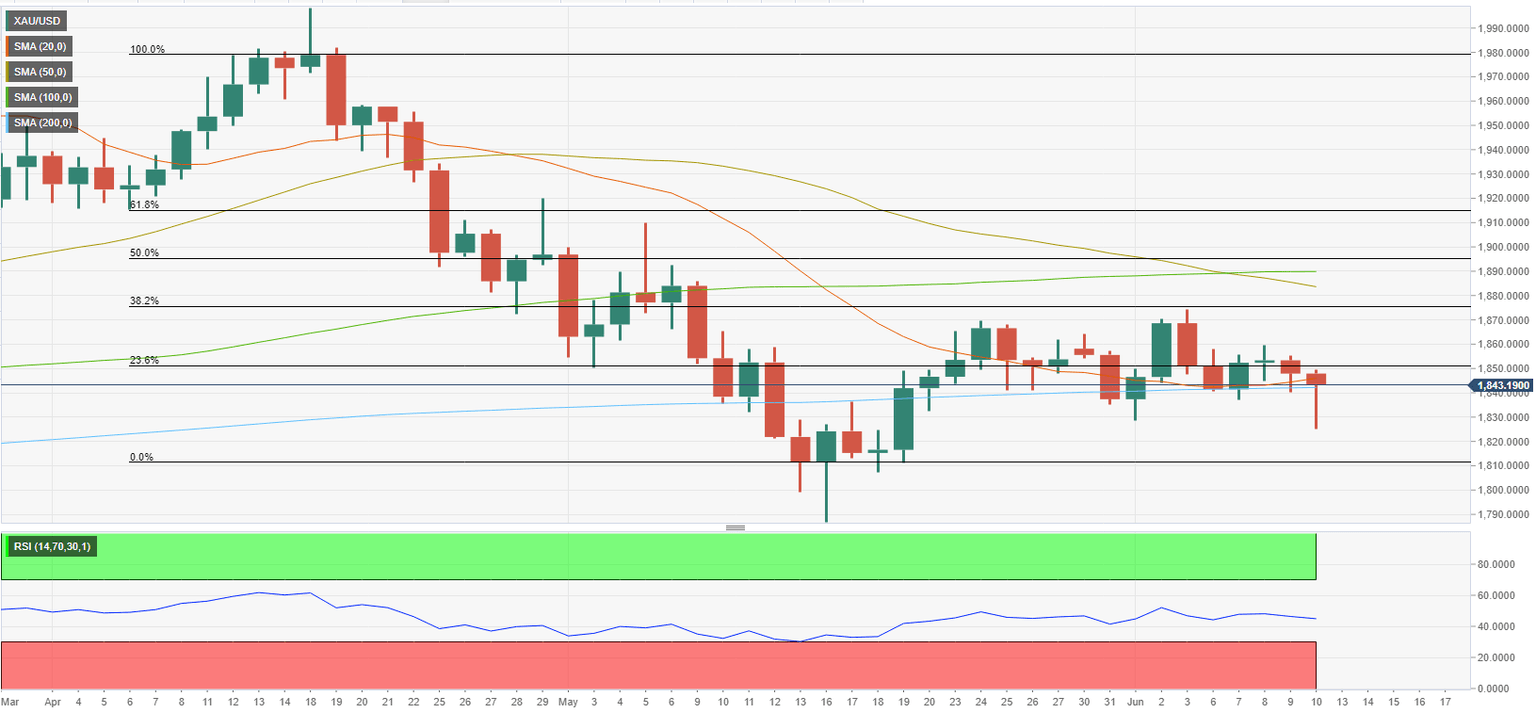

Gold Price came under technical selling pressure after falling below the 200-day SMA on Friday and extended its slide with the initial reaction to the US inflation data. After having touched its lowest level since May 19 at $1,825, however, gold retraced a portion of its daily decline. Nevertheless, XAUUSD was last seen losing 1% on a weekly basis.

Buyers move to the sidelines

The fact that XAUUSD failed to hold above the 200-day SMA suggests that buyers remain hesitant and stay on the sidelines. With the latest data from the US reminding markets that price pressures are yet to ease and that the Fed is likely to stick to its aggressive tightening stance, gold could find it difficult to attract investors.

Gold Price on the back foot after US inflation data

Inflation in the United States, as measured by the Consumer Price Index, climbed to a multi-decade high of 8.6% on a yearly basis in May, the monthly data published by the US Bureau of Labor Statistics revealed on Friday. This print came in higher than the market expectation of 8.3%. The Core CPI, which excludes volatile food and energy prices, edged lower to 6% from 6.2% in the same period but surpassed analysts' estimate of 5.9%. With the immediate reaction, XAUUSD fell to its weakest point in three weeks and struggled to stage a meaningful rebound.

US bond yields turned north in the second half of the day on Friday with hot US inflation data pointing to further monetary tightening. The benchmark 10-year yield advanced beyond 3.1% for the first time since early May. It's also worth noting that Wall Street's main indexes suffered heavy losses and the negative shift witnessed in risk sentiment ramped up the demand for safe-haven bonds, limiting yields' upside for the time being.

Next week, the Federal Reserve is widely expected to hike its policy rate by 50 basis points to the 1.25%-1.5% range. The Fed remains on track to opt for another 50 bps rate increase in July and it shouldn't be a surprise if that's confirmed. The main question is whether the Fed will pause hikes in September. "While more than two-thirds of respondents, 59 of 85, expected a 25 basis point hike in September, more than one-quarter, 23, saw the Fed hiking again by half a point," a recently conducted Reuters poll of economists revealed this week. In case the Fed or FOMC Chairman Jerome Powell pushes back against a rate hike in September, this could be seen as dovish guidance and cause US Treasury bond yields to decline. In that scenario, gold is likely to gather bullish momentum. On the other hand, the dollar should continue to outperform its rivals and weigh on XAUUSD if the Fed leaves the door open for another rate increase in September.

Federal Reserve building in Washington D.C.

The European Central Bank's (ECB) policy statement revealed on Thursday that the bank is not yet ready to commit to a 50 basis points rate hike in September and caused the shared currency to come under strong selling pressure. Next Friday, Eurostat will release the Harmonised Index of Consumer Prices (HICP) data. Investors expect the Core HICP to retreat to 3.5% in May from 3.8% in April. Since the ECB's rate outlook depends on inflation developments, a stronger-than-forecast HICP print could cause investors to start pricing a 50 bps rate increase in September. In that case, XAUEUR could decline sharply and make it difficult for XAUUSD to gain traction regardless of the dollar's market valuation.

Gold Price technical outlook

Gold Price continues to trade below the key 200-day SMA, which is currently located at $1,840. In case gold makes a daily close below that level and starts using it as resistance, this could be seen as a significant bearish development and open the door for additional losses toward $1,810 (the endpoint of the latest downtrend) and $1,800 (psychological level) afterwards.

On the other hand, initial resistance aligns at $1,850 (Fibonacci 23.6% retracement). If a dovish Fed rate guidance causes the US yields to fall next week, gold could rise above that level and extend its recovery toward $1,875 (Fibonacci 38.2% retracement) and $1,890 (100-day SMA) next.

Meanwhile, the Relative Strength Index (RSI) indicator on the daily chart is edging lower toward 40, suggesting that the slightly bearish bias stays intact in the near term.

Gold Price Report: Commodity Super Cycle

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.