Gold price at new highs? Sellers say no

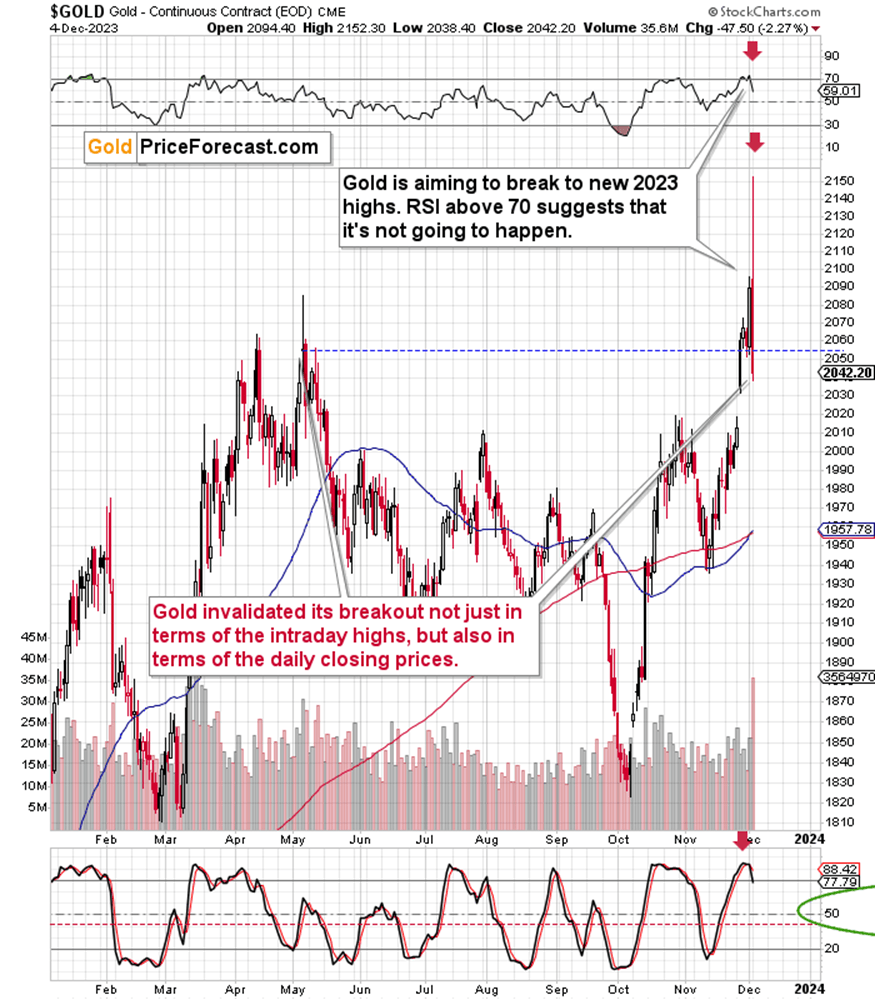

The huge rally in gold and the monstrous decline that followed provided a sign of epic proportions.

Powerful bearish combination

Gold price’s huge-volume reversal is the last thing that anyone even remotely interested in the precious metals market should ignore.

Gold price was just soaring to new highs like there was no tomorrow, and then it happened. “NO” – was the sellers’ response, said with a voice that doesn’t accept any comebacks. Gold price fell so hard that they not only canceled the quick rally but even erased whatever they had gained on Friday. And some of the previous gains, too.

Invalidations of breakouts are generally immediate sell signals. The same goes for “shooting star” reversal candlesticks, which we saw yesterday. In particular, when that candlestick formation is confirmed by high volume.

Since gold reversed on enormous volume, and it invalidated its key breakout (above the previous all-time highs), we have an immensely powerful bearish combination here.

The GDXJ invalidation

And mining stocks?

Miners have been very weak compared to gold, except for maybe a week or so. Miners are not even close to testing their all-time highs. They were not even close to their 2023 highs, let alone their 2020 highs.

And yet, the GDXJ suffered an invalidation of its own. It moved back below the 61.8% Fibonacci retracement level based on its 2023 decline. As I already wrote above, invalidations are sell signals, so the above serves as a bearish confirmation of what we saw in gold.

If that wasn’t enough, we saw sell signals from the RSI indicator as it moved back below the 70 level in both gold and GDXJ. In the case of the latter, it happened after the RSI was in one of the most overbought conditions in years. The fact that previous such situations accompanied the most important tops is not to be ignored.

This combination of factors is extremely bearish for the short term. Since the medium-term trend in the miners has been down for many months, and together with the above, it creates a massive trading opportunity. It looks like our 11-completed-unleveraged-trade winning streak will grow further shortly.

Now, can gold still reverse its course and soar to new highs, taking the mining stocks with it? Yes, it can indeed happen. There are very specific signs that would foretell that, and we might see them any day or hour here, but they are not present at the moment of writing these words.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Przemyslaw Radomski, CFA

Sunshine Profits

Przemyslaw Radomski, CFA (PR) is a precious metals investor and analyst who takes advantage of the emotionality on the markets, and invites you to do the same. His company, Sunshine Profits, publishes analytical software that any