Gold outlook: Trump’s “Liberation Day” is upon us

Gold bulls appear to still be in the driver's seat with Trump’s “Liberation Day” set to occur tomorrow on the 2nd of April. In today’s report we are to have a look at the market uncertainty over the upcoming tariff announcement as well as the upcoming release of the US Employment data . For a rounder view we intend to conclude the report with a technical analysis of gold’s daily chart.

“Liberation Day” set to occur tomorrow

President Trump’s “Liberation Day” is set to occur tomorrow. The anticipation of widespread tariffs across the board has already influenced the precious metal’s price and continues to do so, as no clear picture has emerged over the extent and degree of the President’s tariff ambitions. Earlier on today, the Washington Post reported that Trump’s aides are drafting a proposal that would impose a 20% tariff on at least most imports to the United States. The full scope and imposition to occur may be seen tomorrow with President Trump’s announcement from the Rose Garden at the White House, yet we must stress that a proposal is still a proposal and could still change. Yet, despite the announcement set to occur tomorrow, the tariff picture remains blurry and frankly still uncertain with President Trump stating that “We’re going to be very nice, relatively speaking, we’re going to be very kind”, implying that some countries may remain unscathed or may face ‘favourable terms’ depending on their approach. However, with the situation being as dynamic as it currently is, EU Commission President Von Der Layen has entered the mix, with Euronews reporting that Von Der Layen stated that “We have everything we need to protect our people and our prosperity. We have the largest Single Market in the world. We have the strength to negotiate. We have the power to push back”. Overall, it appears that the US is not preparing to back down from their tariff threats and in return its trade partners are preparing to retaliate in what may be an all-out trade war which may severely dampen the global economic outlook, as well as aiding a potential resurgence of inflation. Moreover, in our view US Government may be attempting to gain leverage over its trading partners first before moving into the negotiation stage but even so, it appears that other nation’s may not be backing down from the fight and thus we remain vigilant in regards to any announcement for possible leeway in trade negotiations. Hence, the continued uncertainty may funnel safe haven inflows into gold’s price given its status as a safe haven asset and as a hedge against inflation. In conclusion, we would not be surprised to see gold’s price moving higher, as the situation continues to unfold and its true impact on the economy remains to be seen.

US Employment data to add a twist to the week

The US Employment data for March, which is set to be released on Friday, adds a twist to an already interesting week, as we have discussed in our previous paragraph. The current expectations are for the NFP figure to come in at 128k, the unemployment rate at 4.2% and the average earnings on a year-on-year basis to come in at 3.9%. All three measures of the employment market in the US could imply a loosening labour market should they come in as expected or lower, as the prior month’s NFP figure was 151k the unemployment rate at 4.1% and the average hourly earnings rate at 4.0%. Hence, the implications of a loosening labour market, could spark concerns over the resiliency of the US economy, potentially fueling talks about a possible recession. Therefore, should the employment data for March showcase a loosening labour market, it may aid gold’s price as it it considered to be a hedge during times of uncertainty. However, should the employment data exceed expectations and showcase a resilient labour market or cast doubt on our aforementioned scenario it may instead weigh on the precious metal’s price.

Technical analysis

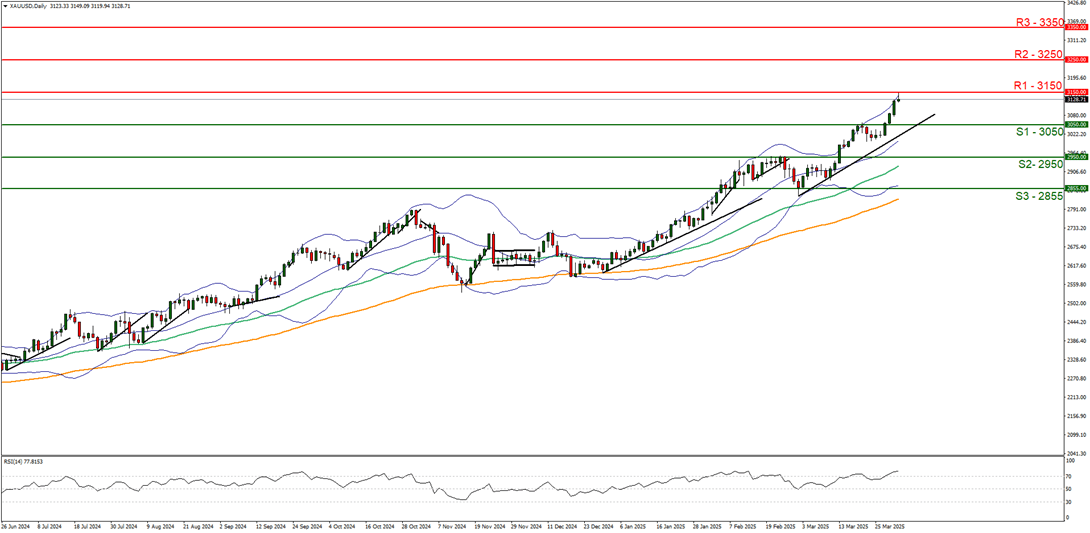

XAU/USD daily chart

-

Support: 3050(S1), 2950 (S2), 2855(S3).

-

Resistance: 3150 (R1), 3250 (R2), 3350 (R3).

On a technical level since our last report, Gold’s price appears to have moved higher with the precious metal’s price forming new all-time highs along the way. We continue to maintain our bullish outlook for the precious metal’s price and supporting our case is the RSI indicator below our chart which currently registers a figure above 70 implying a strong bullish market sentiment. Moreover, aiding our bullish outlook is the upwards moving trendline which was incepted on the 28th of February. However, the RSI’s current reading may also imply that the precious metal may be overbought and thus could be due a correction to lower ground. Nonetheless, for our bullish outlook to continue we would require a clear break above the 3150 (R1) resistance level , with the next possible target for the bulls being the 3250 (R2) resistance line. On the flip side for a sideways bias we would require gold’s price to remain confined between the 3050 (S1) support level and the 3150 (R1) resistance level. Lastly, for a bearish outlook to occur we would require a clear break below the 3050 (S1) support level, with the next possible target for the bears being the 2950 (S2) support line.

Author

Phaedros Pantelides

IronFX

Mr Pantelides has graduated from the University of Reading with a degree in BSc Business Economics, where he discovered his passion for trading and analyzing global geopolitics.