Gold looking awfully weak

On February 26th, the Gold price reached $1714.90, the lowest level since June 16th, 2020. The key reason why the precious metal plummeted was the strengthening of the American currency, which skyrocketed due to a rally in the US bond yield.

Physical demand for Gold remains rather limited due to a drop in personal income all over the world because of the COVID-19 pandemic. Need for Gold as a “safe haven” asset is also pretty low: investors’ attitude towards risks is quite good, and the farther the better.

In this light, prospects of the precious metal are quite unimpressive – market players are really very confident that the pandemic will be over soon and that inflation will boost and the US Federal Reserve might get rid of its stimulus programs much earlier than it was thought before. As a result, there are not many options for Gold to rise.

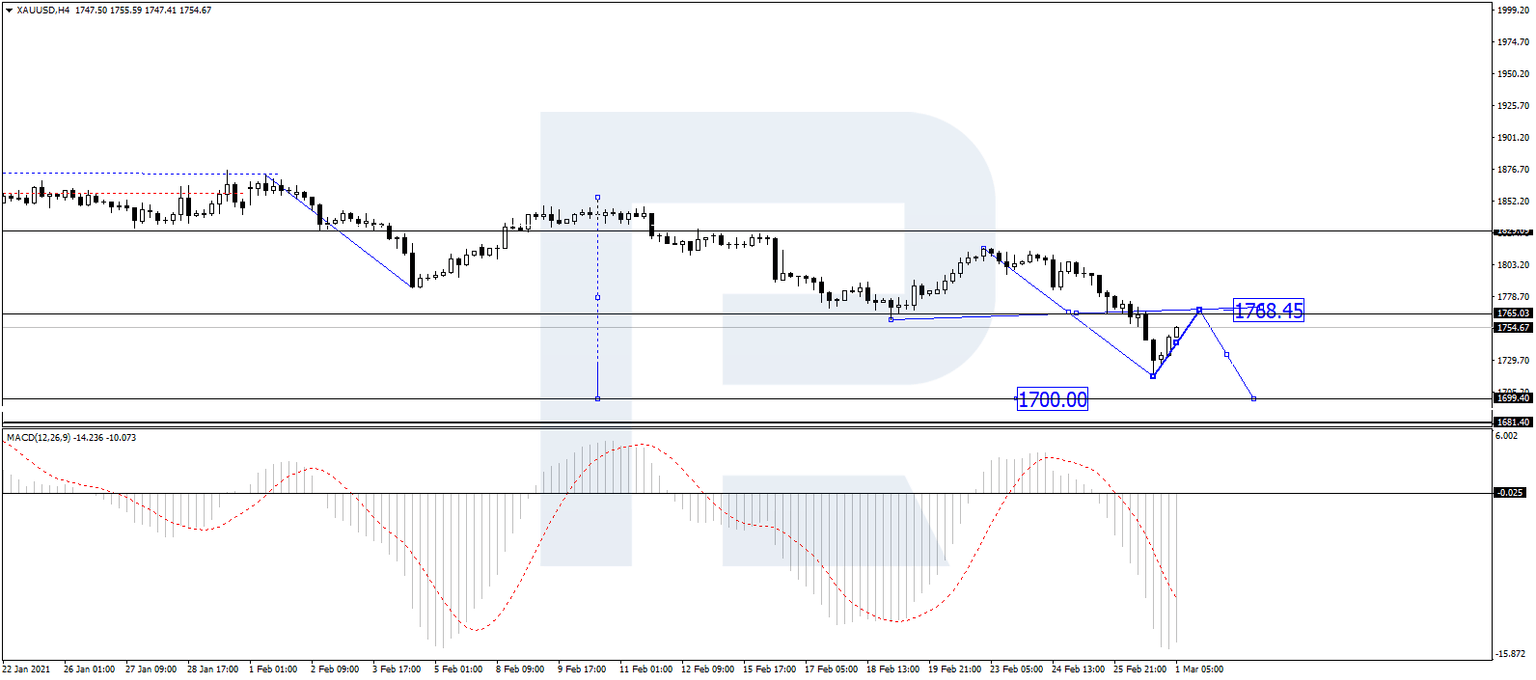

As we can see in the H4 chart, XAU/USD continues forming the fifth descending wave with the target at 1700.00. After reaching this level, the asset is expected to consolidate there. If later the price breaks the range to the upside, the market may start a new rising wave with the first target at 1900.00. From the technical point of view, this scenario is confirmed by MACD Oscillator: its signal line is falling below 0, thus implying a further descending movement on the price chart.

In the H1 chart, XAU/USD is growing towards 1770.00. Possibly, the pair may rebound from this level to the downside and then resume trading within the downtrend with the target at 1700.00. From the technical point of view, this scenario is confirmed by the Stochastic Oscillator: its signal is moving above 80, thus implying that the market is trading within the “overbought area”. The line is expected to move downwards and break 50.

Author

Dmitriy Gurkovskiy

RoboForex

Dmitriy was fond of literature and movies about business, financial markets and psychology since childhood.