Gold holds steady but could rise on tariff developments

The price of Gold remains stable at $3,354 per troy ounce this Tuesday, recovering some of the previous day’s losses. Market attention remains firmly fixed on US trade policy developments.

President Donald Trump has formally notified leaders from 25 countries of new tariffs, including a 30% levy on imports from the EU and Mexico, set to take effect on 1 August. Trump warned that nations responding with retaliatory measures could face even stricter US restrictions, though he left room for further negotiations before the tariffs are imposed.

Investors are now awaiting the release of the US Consumer Price Index (CPI) for July, which may offer fresh clues on the Federal Reserve’s next steps regarding interest rates.

While physical gold demand remains steady, central bank purchases continue to provide strong strategic support for prices. Meanwhile, the US dollar’s trajectory is having little immediate impact on gold’s movements.

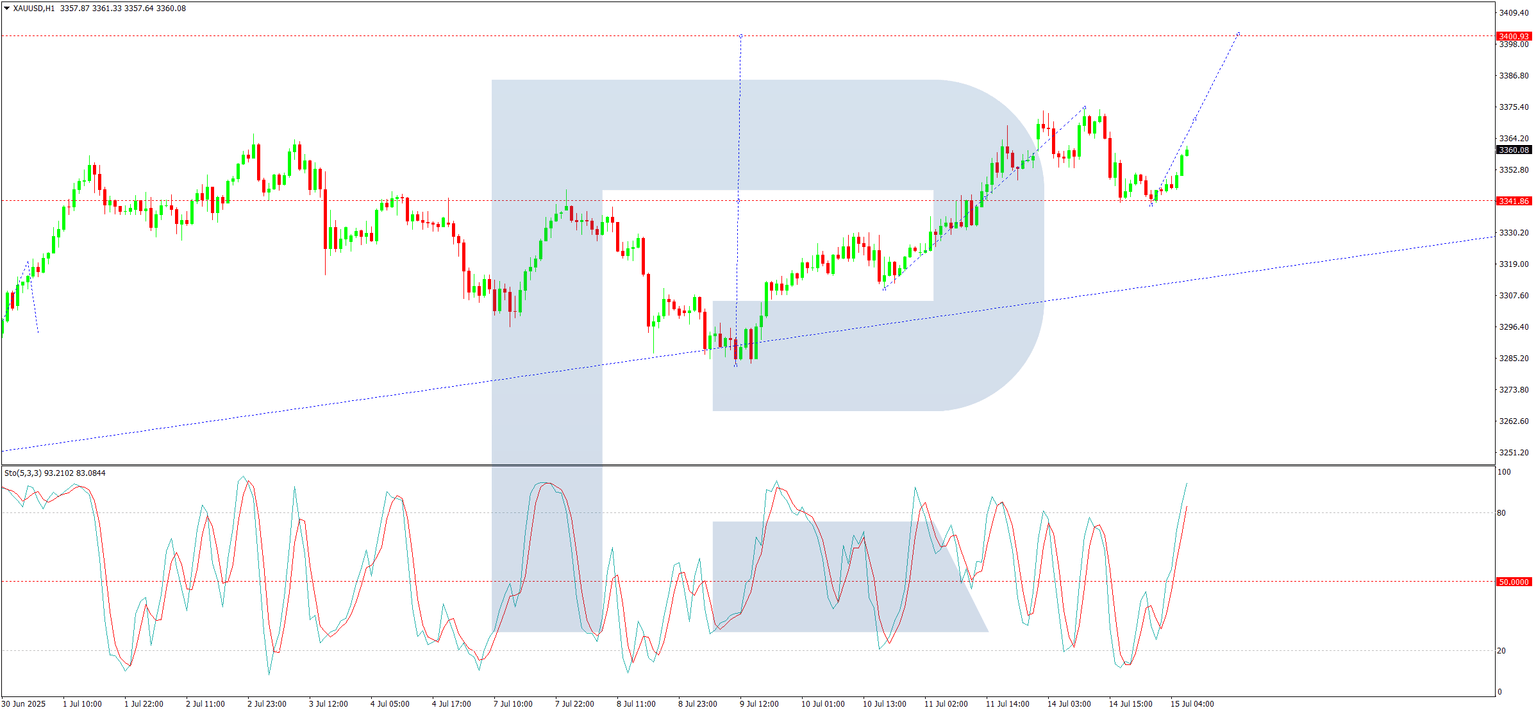

Technical analysis: XAU/USD

Four-hour chart

On the H4 chart, XAU/USD broke above the 3,340 level, hitting its local target of 3,373. Today, the market has seen a technical pullback to 3,340 (testing from above) before initiating a new upward wave towards 3,400. Once this wave concludes, we anticipate a corrective retracement to 3,340, followed by a potential further rise to 3,434. This scenario is supported by the MACD indicator, where the signal line remains above zero and pointing firmly upwards.

One-hour chart

On the H1 chart, the correction to 3,340 has completed, and the next growth wave towards 3,400 is underway. Today, we expect an advance to 3,370, after which a brief consolidation phase may form. A breakout above this range would reinforce bullish momentum towards 3,400. The Stochastic oscillator aligns with this outlook, with its signal line above 50 and rising sharply towards 80.

Conclusion

Gold’s near-term trajectory hinges on trade policy shifts and US economic data, while technical indicators suggest further upside potential after consolidation.

Author

RoboForex Analysis Department

RoboForex

RoboForex Analysis Department provides timely market insights, expert technical analysis, and actionable forecasts across forex, commodities, indices, and equities.