Gold holds firm as shutdown risks and soft data boost demand

Gold (XAUUSD) is building momentum as weak labour data and unresolved U.S. political risks boost expectations for a December Fed rate cut. The ADP report showed significant private-sector job losses, signalling a cooling labour market. At the same time, the ongoing government shutdown has raised concerns about fiscal stability and delayed data releases. These factors have strengthened safe-haven demand and pushed gold near record highs. With markets anticipating further policy easing and key votes ahead, gold remains firmly supported by both macro drivers and technical momentum.

Gold gains support from weak US Jobs data and shutdown risks

Gold’s recent momentum has been underpinned by growing expectations of a Federal Reserve rate cut in December. The catalyst came from weak private sector job data, including a sharp drop in the ADP employment report. The data revealed that U.S. firms shed more than 11,000 jobs per week through late October, suggesting a cooling labour market. This weakness has significantly boosted the probability of monetary easing, now priced at 68% for December.

At the same time, the U.S. government shutdown continues to create uncertainty across financial markets. Although the Senate approved a funding bill, the legislation still needs to pass through the Republican-controlled House. This unresolved political risk is keeping safe-haven demand elevated. Investors remain cautious as delays could further impact data releases, government spending, and overall economic stability.

Meanwhile, markets are showing signs of a directional shift. Asian markets are gaining traction, supported by expectations of Fed rate cuts and declining bond yields. However, a modest recovery in the U.S. Dollar is limiting further upside in gold in the near term. Additionally, Treasury yields have dropped, providing some support to gold by lowering the opportunity cost of holding non-yielding assets. Still, upcoming data and the House vote will guide the next directional move.

Gold confirms breakout from decade-long triangle formation

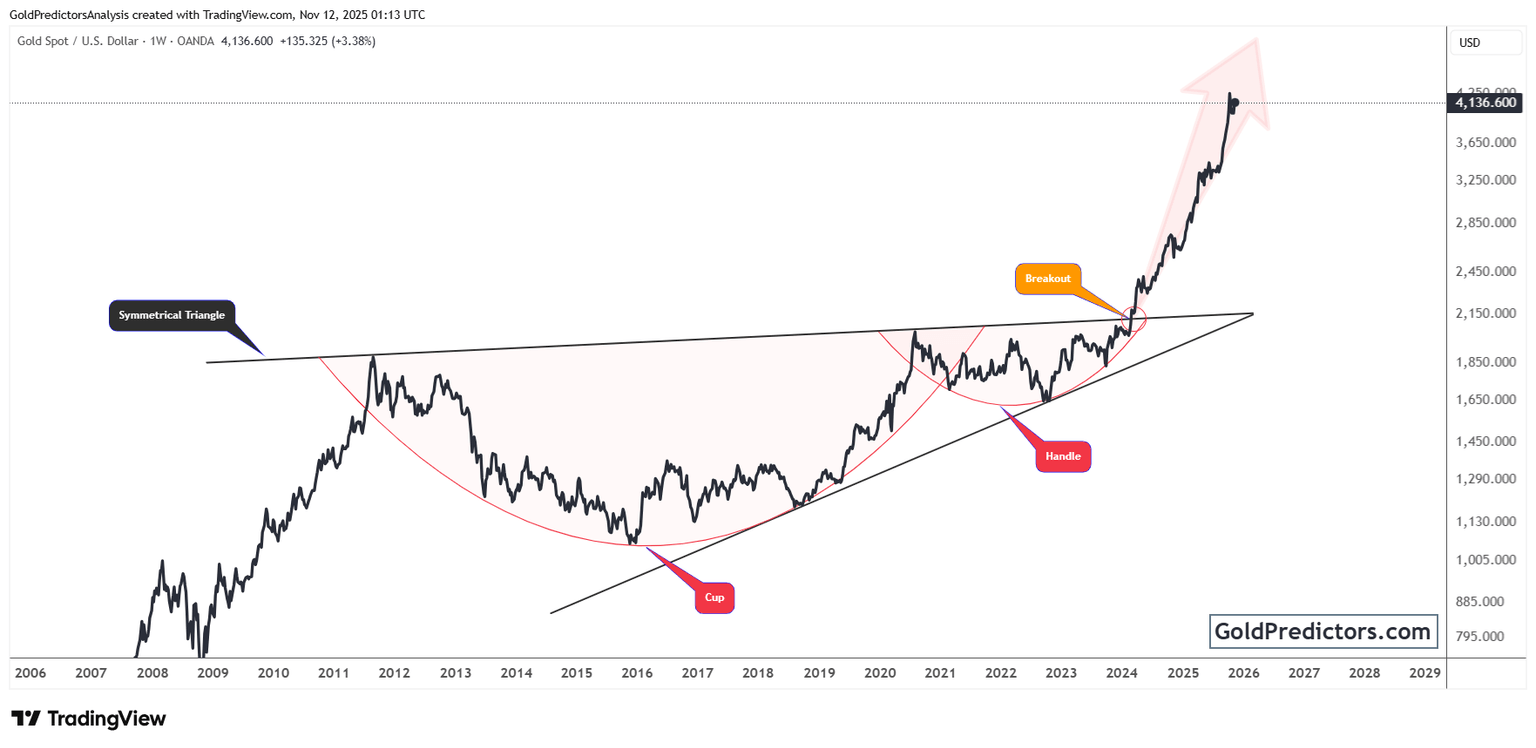

The gold chart below shows a decisive breakout from a decade-long symmetrical triangle. This formation connected two major highs, anchored by a steadily rising base. For years, price action remained confined within this tightening structure, reflecting long-term consolidation. By late 2024, gold compressed into the apex before breaking forcefully above the upper boundary, confirming a major structural shift.

Furthermore, this breakout reflects a classic "cup and handle" setup, signalling sustained upside potential. The cup developed over a broad arc, while the handle formed through a multi-year consolidation phase. The breakout occurred right at the point where the handle met the upper triangle boundary, confirming the reliability of both patterns. This alignment marks a significant shift in gold’s long-term technical outlook.

Since the breakout, gold has extended its rally with strong upward momentum. The former resistance zone now acts as firm support, with price accelerating in a sharp uptrend. The scale and duration of this base formation suggest a multi-year bull run has begun. The combined triangle and cup-depth projections suggest much higher upside if macro conditions remain favourable.

Gold outlook: Breakout strength meets supportive macro conditions

Gold is holding near record highs as macroeconomic risks, political uncertainty, and growing rate cut expectations continue to support demand. Optimism over a possible government reopening has lifted broader markets, but unresolved fiscal challenges and weak labour data keep caution in place. Meanwhile, technical momentum remains strong after the recent breakout. With major data releases and key decisions ahead, gold looks ready to extend its gains.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.