Gold glistens as it eyes $2,222 mark, while Silver struggles with bearish pressure

Amid fluctuating markets, gold prices shine brightly, holding steady around $2175.00 with ambitions to reach the $2222.86 target, buoyed by strong technical indicators. In contrast, silver faces challenges, slipping below the $24.60 mark to suggest a potential bearish trend ahead. This divergence paints a complex picture for investors in the precious metals sector, as gold's bullish signals contrast sharply with silver's struggle under bearish pressure.

Gold's bullish prospects vs Silver's technical conundrum

For gold, holding above the crucial $2166.50 level is vital for sustaining its bullish momentum, with a break below potentially ushering in a bearish correction targeting the $2131.70 area. The expected trading range for today is pegged between $2160.00 support and $2195.00 resistance.

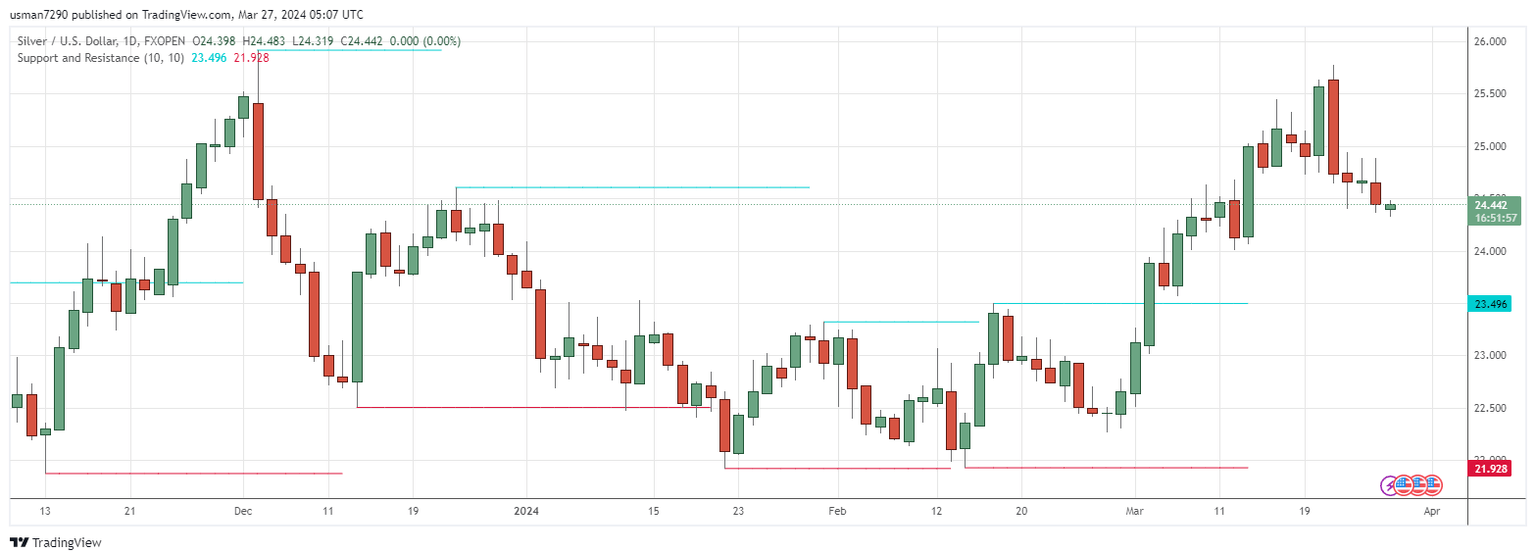

Silver, on the other hand, grapples with negative pressures and the challenging task of maintaining above the $24.30 support level, a significant point near the 38.2% Fibonacci correction level. The conflicting signals from the EMA50 and stochastic indicators have left traders and investors on the sidelines, awaiting clearer signals for the metal's next directional move.

Market dynamics and key levels

Gold's bullish wave is buoyed by continuous positive technical support, with the EMA50 and stochastic movements near the oversold areas acting as key tailwinds. The importance of the $2166.50 support level cannot be overstated, as its breach could signal the start of a new bearish correction.

For silver, the current technical landscape is marked by uncertainty, with the price action below the $24.60 level raising alarms of a deeper correction from its recent highs. The market is currently caught in a tug-of-war between bullish and bearish forces, reflected in the day's expected trading range between $24.00 support and $24.90 resistance.

Trading ideas

Investors eyeing gold may find opportunities in maintaining positions above the $2166.50 level, targeting the $2222.86 milestone with caution against potential corrections. Silver investors, faced with a more complex technical picture, might benefit from a wait-and-see approach, monitoring key levels such as the $24.30 support and $24.85 resistance for signals on the metal's next directional move.

As the market unfolds, gold's lustre continues to attract bullish sentiments, while silver's path remains shadowed by technical uncertainties. For traders and investors, the contrasting fortunes of these precious metals highlight the importance of vigilance and strategic patience in navigating the ever-evolving financial landscapes.

Author

Usman Ahmed

Forex92

Usman Ahmed is a currency trader and financial market analyst with more than a decade of active trading experience.