Gold forecast: Will Fed cuts and geopolitical risks drive new highs?

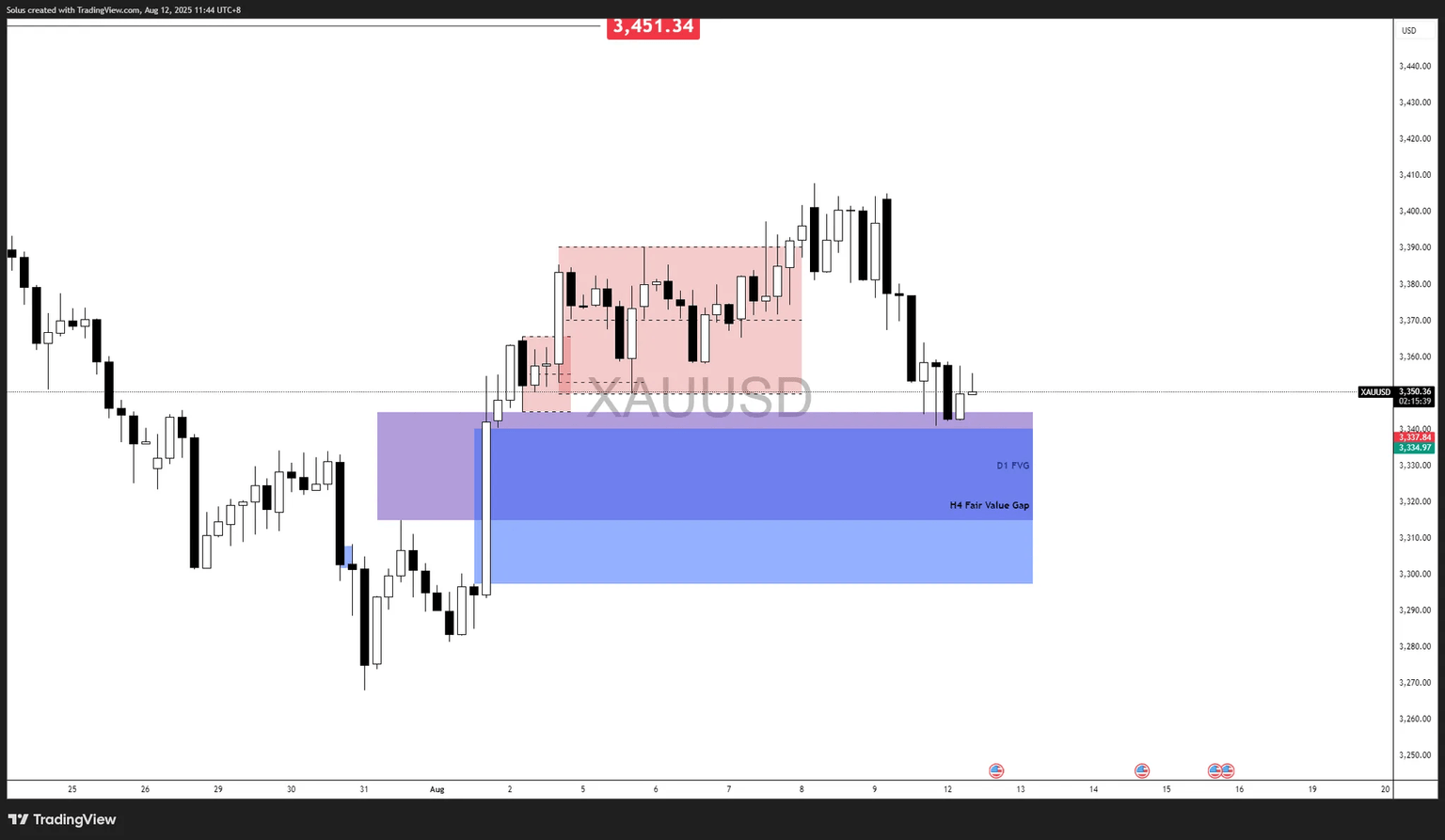

- Gold holds critical Daily & 4H FVG support near $3,334, with momentum hinging on breakout or breakdown signals.

- Dovish Fed bets and strong miner earnings keep the macro backdrop supportive for upside continuation.

- Technical forecast: Break above $3,420 opens path to $3,450; loss of $3,310 risks drop toward $3,250.

Gold’s recent rally to near-record highs has entered a consolidation phase after peaking above $3,400. The pullback was accelerated by profit-taking and easing tariff fears after U.S. officials clarified that imported gold bars would not face tariffs.

The macro backdrop remains broadly bullish:

- Dovish Fed bets surged after soft U.S. labor data, with markets now pricing in a high probability of a September rate cut.

- Geopolitical hedging remains a driver as global trade tensions and currency market volatility persist.

- Mining sector resilience—Barrick Mining’s better-than-expected earnings underscore strong industry fundamentals at current gold prices.

This mix keeps gold’s safe-haven appeal alive, but the technical structure will determine whether the next leg is higher or lower.

Fundamental impact on Gold

- Tariff Confusion → Short-term Volatility: Last week’s rumor-driven spike and drop showcased gold’s sensitivity to policy headlines.

- Fed Rate Cut Speculation → Supportive for Bulls: Lower rates weaken the USD and bolster non-yielding assets like gold.

- Strong Miner Earnings → Confidence in Rally: Positive earnings from top producers back the sustainability of high gold prices.

Technical outlook

Gold is currently trading inside a Daily Fair Value Gap overlapping with a 4H Fair Value Gap between $3,330–$3,400. This confluence forms a strong support zone that could dictate the next directional move.

Price has already reacted off the lower boundary, but momentum remains muted as it approaches mid-range. The $3,420–$3,435 zone remains the major upside barrier to unlock further gains.

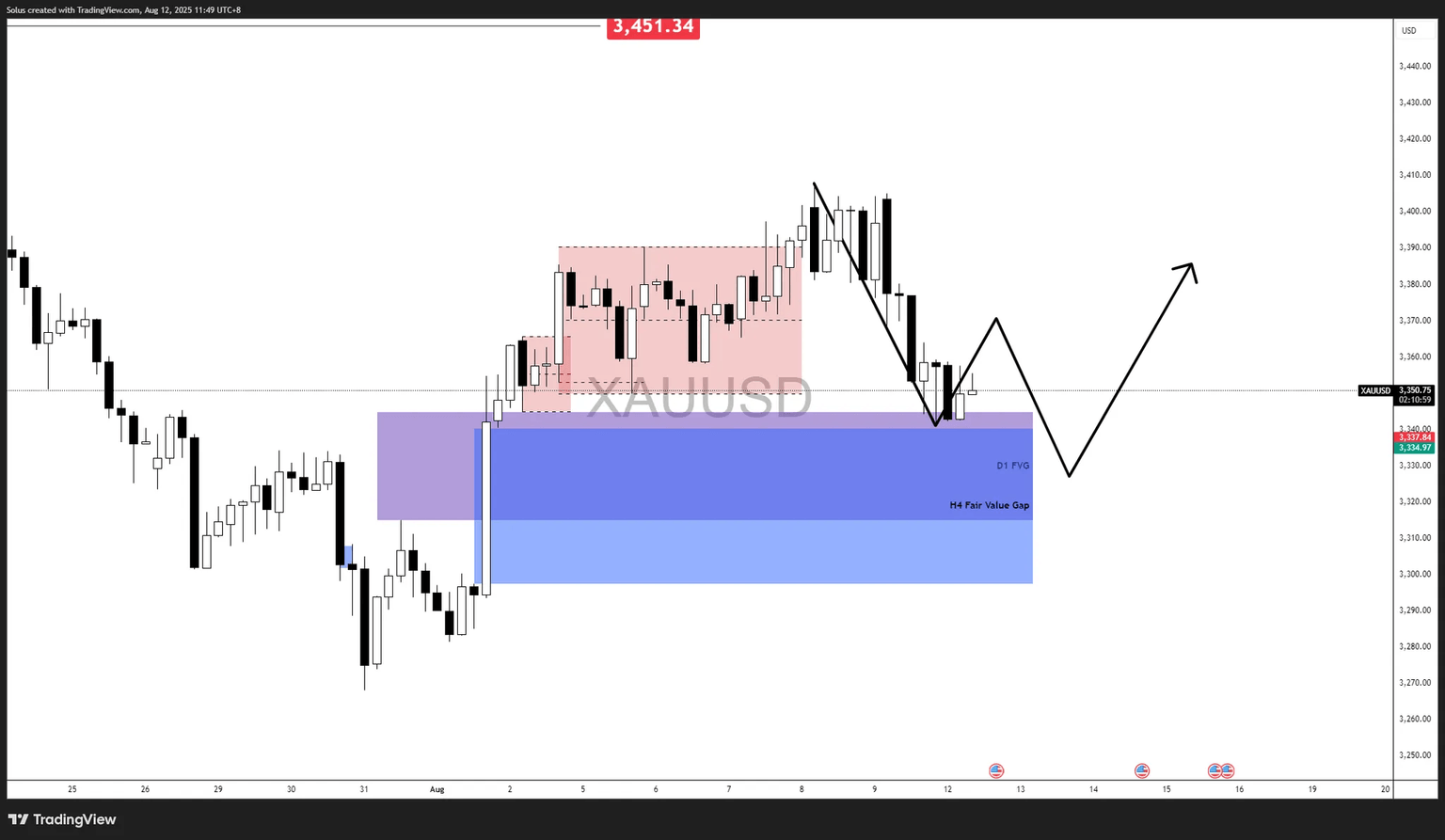

Bullish scenario: Continuation through FVG support

Gold is currently trading inside a Daily Fair Value Gap overlapping with a 4H Fair Value Gap, following a sharp decline from the $3,400+ zone. If price holds and builds structure within these FVGs, it could confirm that institutional demand is present at discount pricing.

- Bullish re-accumulation inside the FVGs (e.g., bullish engulfing, liquidity sweep, rejection wicks, range breakout).

- A clean reclaim above $3,370 to confirm short-term momentum shift, and above $3,420 to confirm breakout continuation.

Targets:

- First Target: $3,370 – minor liquidity pool

- Second Target: $3,420 – key breakout zone

- Third Target: $3,450–$3,451 – recent swing high liquidity sweep

Bearish scenario: Distribution followed by breakdown

If price fails to sustain inside the Daily/4H FVGs and starts forming lower highs beneath $3,370, it could signal that distribution is forming at premium pricing, setting up a deeper pullback toward July’s base structure.

- Breakdown through $3,334 and $3,310 (both FVG boundaries).

- Clean 4H close below $3,300 to confirm continuation.

Targets:

- First Target: $3,300 – psychological level.

- Second Target: $3,285 – near-term liquidity zone.

- Final Target: $3,265–$3,250 – deeper retracement area if macro risk diminishes.

Author

Jasper Osita

Independent Analyst

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.