Gold forecast: CPI as the key catalyst for the next XAU/USD move

- Gold remains structurally bullish, with price consolidating above a key 4H bullish Fair Value Gap after an impulsive expansion.

- The incoming U.S. CPI release is the primary volatility catalyst, likely determining whether price continues higher or retraces into premium demand zones.

- Higher-timeframe structure remains intact, suggesting any CPI-driven pullback is corrective unless key imbalance levels fail.

Structure first, CPI second

Gold continues to trade at elevated levels, but the current phase is no longer about expansion — it is about acceptance and reaction.

After a strong impulsive leg higher, price has paused and begun consolidating near highs. This behavior is consistent with institutional digestion, not distribution. The market is now positioned in a premium zone, waiting for CPI to provide the next liquidity-driven catalyst.

Rather than invalidating the bullish trend, CPI is more likely to act as a trigger for a retracement into value or a continuation breakout, depending on how inflation data reshapes real yield and dollar expectations.

Drivers with CPI in focus

Inflation expectations and real yield sensitivity

Gold is acutely sensitive to inflation outcomes—not simply headline inflation, but how CPI reshapes real interest rate expectations.

- A cooler-than-expected CPI print would reinforce the narrative of easing inflation pressures, likely pushing real yields lower and supporting gold’s upside.

- A hotter-than-expected CPI print could temporarily lift yields and the U.S. dollar, pressuring gold in the short term through repricing of policy expectations.

Importantly, even upside CPI surprises may struggle to reverse gold’s broader trend unless they signal a sustained re-acceleration of inflation that forces a materially more hawkish stance from the Fed.

Federal Reserve policy repricing risk

CPI remains one of the Federal Reserve’s most influential data points. Markets are currently positioned for a policy environment where restrictive conditions cannot be sustained indefinitely.

Gold benefits from:

- Any CPI outcome that reduces confidence in prolonged tight policy

- Evidence that inflation is cooling faster than expected, increasing the probability of policy flexibility

Conversely, CPI-induced volatility can create short-term drawdowns, but these are increasingly viewed by market participants as tactical repositioning opportunities rather than structural reversals.

Safe-haven demand ahead of high-impact data

As CPI approaches, risk appetite across equities and risk-sensitive assets often becomes more cautious. This environment typically benefits gold, especially when positioning turns defensive ahead of binary macro events.

Gold’s ability to hold elevated levels into major data releases is a signal of underlying strength, suggesting buyers are willing to maintain exposure despite headline risk.

What the market is telling us

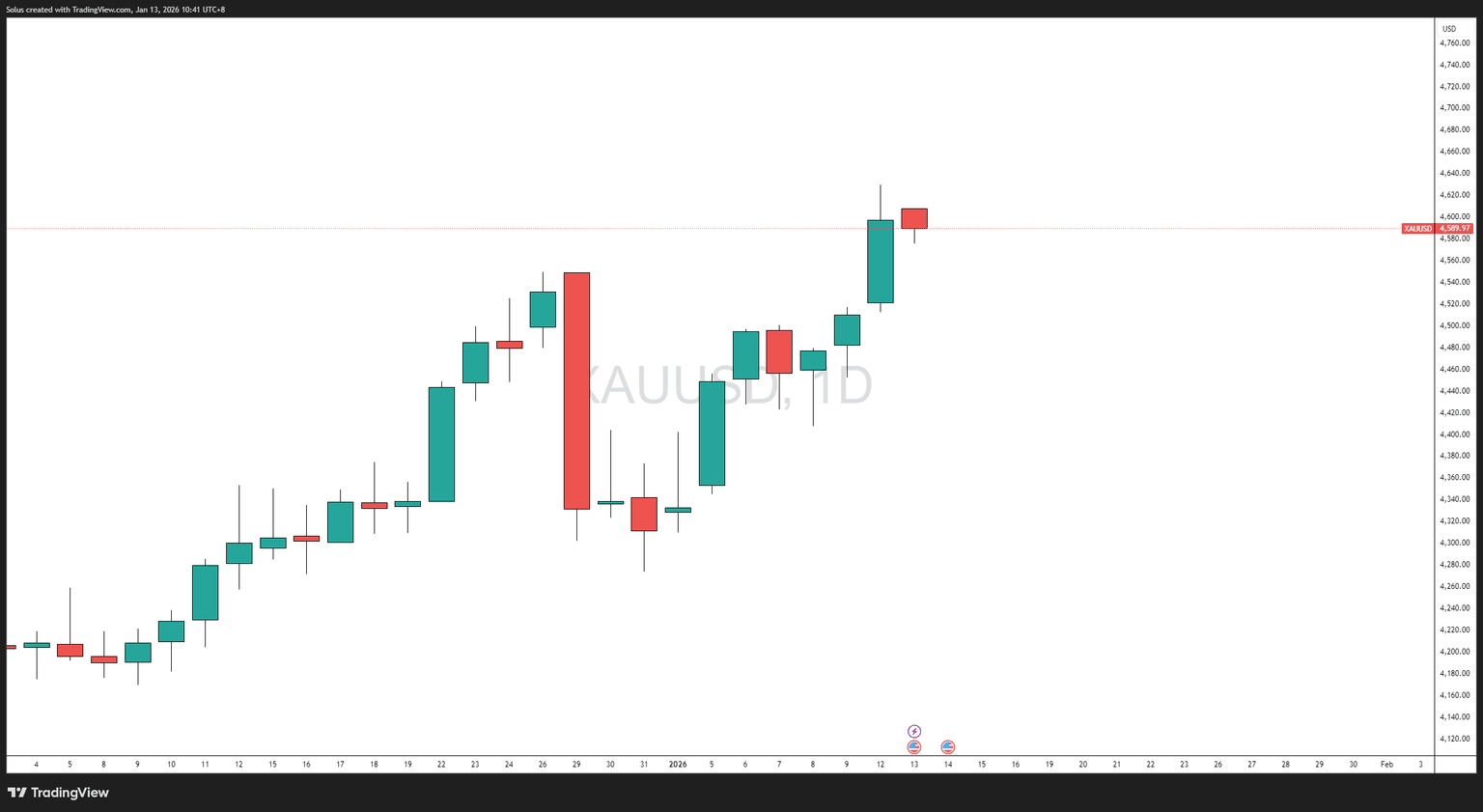

Daily Structure – Trend integrity remains intact

On the daily timeframe, gold continues to print higher highs and higher lows, maintaining bullish market structure despite intermittent volatility.

The recent daily pullbacks have:

- Failed to break structure

- Respected prior demand zones

- Shown rejection wicks rather than sustained bearish closes

This reinforces the idea that sellers lack follow-through at current levels, and that downside moves are primarily liquidity-driven corrections, not trend reversals.

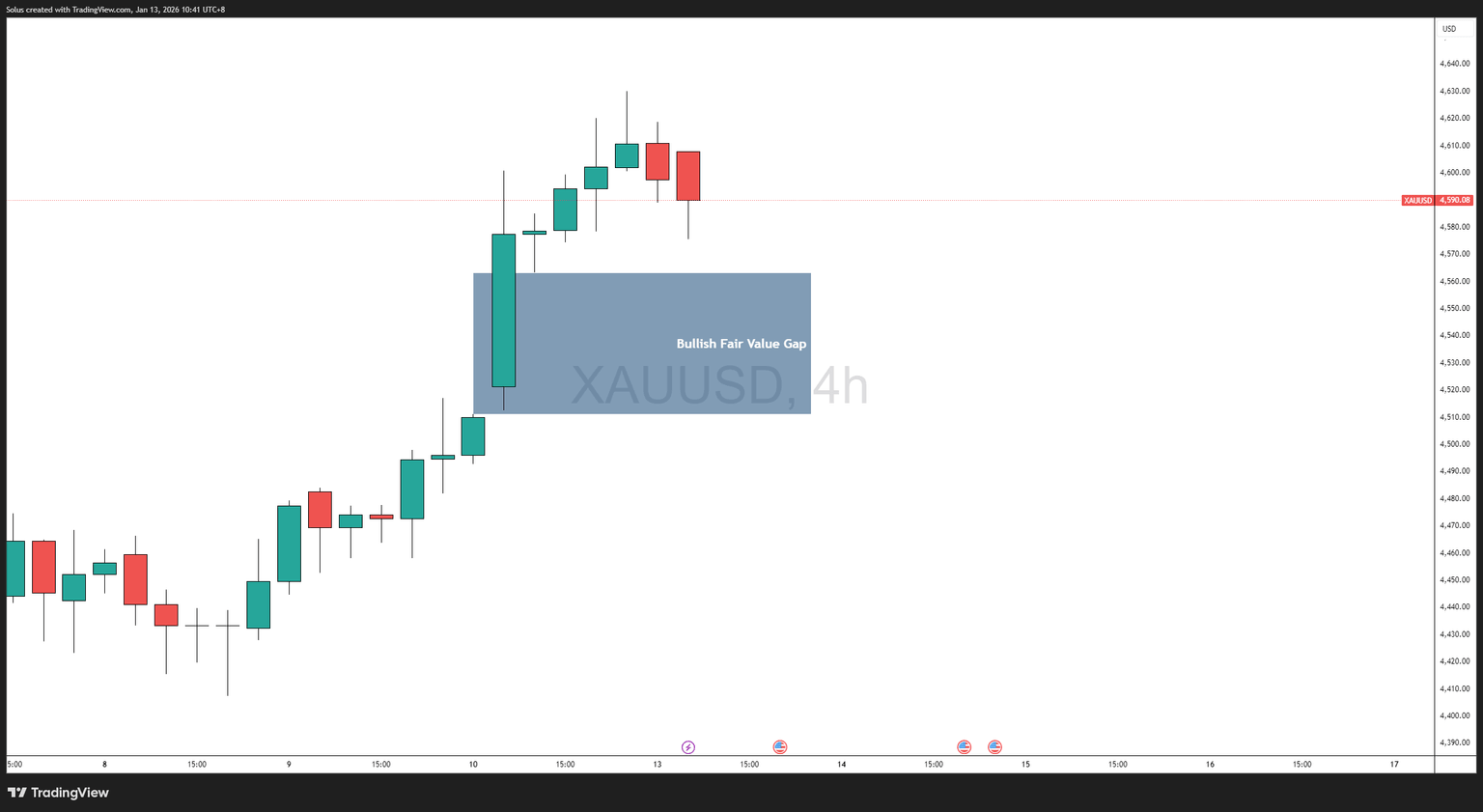

4H structure – Bullish fair value gap in control

On the 4-hour chart, gold left behind a clear bullish Fair Value Gap following an aggressive displacement to the upside. Price is currently trading above this imbalance, signaling that buyers remain in control of short-term structure.

This Fair Value Gap represents:

- Institutional inefficiency from aggressive buying

- A high-probability reaction zone if price retraces

- A technical “decision point” ahead of CPI

As long as price holds above or reacts cleanly within this FVG, the bullish narrative remains valid.

CPI as the liquidity catalyst

CPI matters not because it changes the trend — but because it determines where liquidity is taken next.

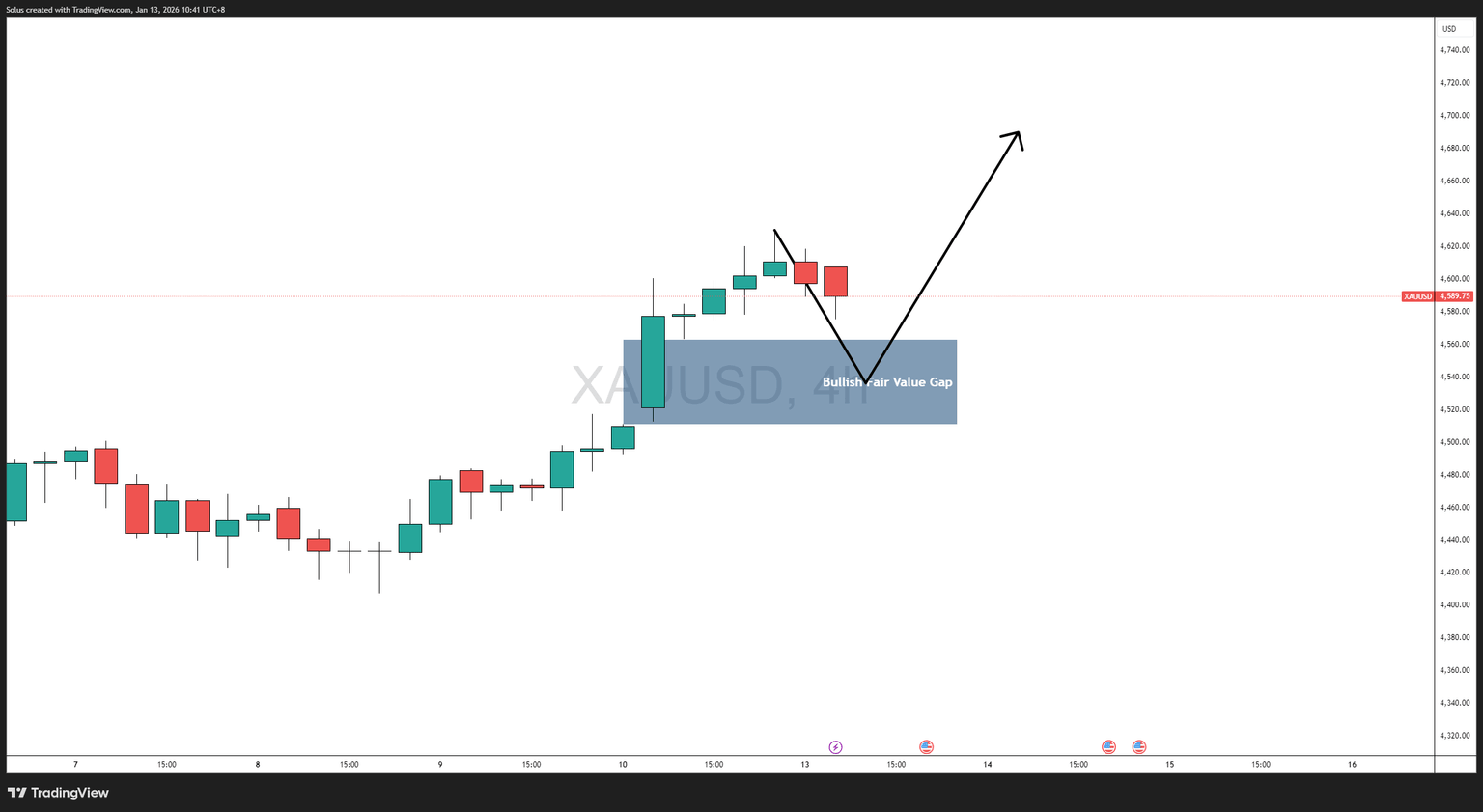

If CPI prints softer or in-line

- Real yields likely compress

- The U.S. dollar weakens or stalls

- Gold holds above the 4H FVG or reacts shallowly

In this scenario, CPI becomes a continuation catalyst, allowing gold to resume expansion toward new highs after rebalancing inefficiencies.

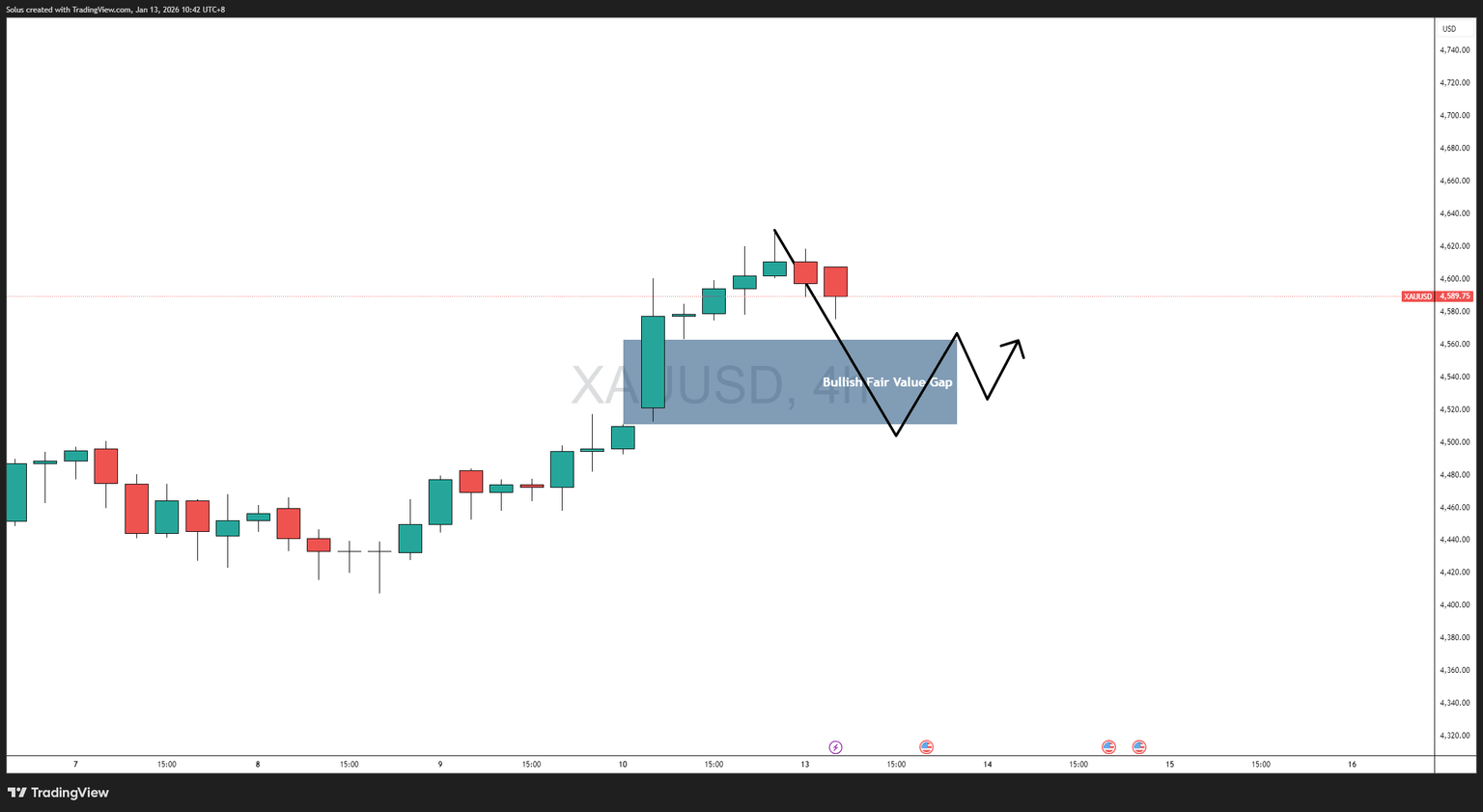

If CPI prints hotter than expected

- Real yields spike temporarily

- Dollar strength forces a retracement

- Price likely trades back into the bullish Fair Value Gap

This scenario does not automatically invalidate the trend. Instead, it creates a mean-reversion move into value, offering structural confirmation if buyers defend the imbalance zone.

Only a clean breakdown below the FVG with acceptance would suggest a deeper corrective phase.

Technical outlook

Bullish scenario: FVG hold and expansion

Gold remains bullish if:

- Price respects the 4H bullish Fair Value Gap

- CPI does not force sustained acceptance below imbalance

- Daily structure remains intact

This sets the stage for continuation toward higher premium zones, driven by institutional positioning rather than retail momentum.

Bearish scenario: Acceptance below value

A bearish shift only materializes if:

- CPI triggers a strong displacement below the Fair Value Gap

- Price accepts below imbalance with follow-through

- Daily structure begins to fracture

Without these conditions, downside moves remain corrective within a broader bullish trend.

Final thoughts

Gold is not breaking down — it is pausing at premium.

The charts show a market that has expanded aggressively, left behind inefficiencies, and is now waiting for CPI to determine how those inefficiencies are resolved. Until proven otherwise, structure favors buy-side control, with Fair Value Gaps acting as the roadmap rather than lagging indicators.

CPI will inject volatility — but structure will decide direction.

Author

Jasper Osita

Independent Analyst

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.