Gold extends gains as US weakness and policy shifts boost demand

Gold (XAUUSD) is holding firm near recent highs as a combination of policy moves, economic stress, and rising Chinese demand supports the bullish case. U.S. legislative progress has improved sentiment, but delays in final approval keep uncertainty elevated. Soft consumer confidence and rising job cuts highlight persistent economic weakness. At the same time, markets are pricing in Fed rate cuts, making gold more attractive. These dynamics keep gold positioned for further upside despite recent market developments.

Gold holds near highs as fiscal moves, rate cut bets, and Chinese demand drive support

Gold is holding near recent highs following the U.S. Senate's approval of a funding bill to end the shutdown. This move has helped calm market nerves and sparked broader risk-on flows. Alongside this, China’s temporary suspension of its export ban on key strategic materials has improved global trade sentiment. These factors briefly slowed safe-haven flows, but gold remained firm and extended its gains.

However, several unresolved risks continue to support gold’s appeal as a safe-haven asset. The bill must still pass the House and receive President Trump’s signature, leaving room for further delays. This uncertainty continues to support safe-haven demand. At the same time, underlying economic stress remains visible. The University of Michigan’s Consumer Sentiment Index fell to 50.3 in early November, marking its lowest level since mid-2022. The sharp decline underscores persistent concerns over inflation, job security, and income prospects.

Moreover, labor market trends continue to reflect underlying stress in the economy. Job cut announcements surged by over 183% in October, marking the worst monthly print in two decades. In response, the market now sees a 66% chance of a Federal Reserve rate cut in December. Lower rates reduce the opportunity cost of holding gold, making it more attractive. Meanwhile, Chinese gold demand is soaring. ETF inflows jumped 164% year-to-date, and the People’s Bank of China raised its reserves for an 11th straight month. These forces continue to support gold’s longer-term uptrend.

Gold clears channel resistance and holds retest to strengthen bullish case

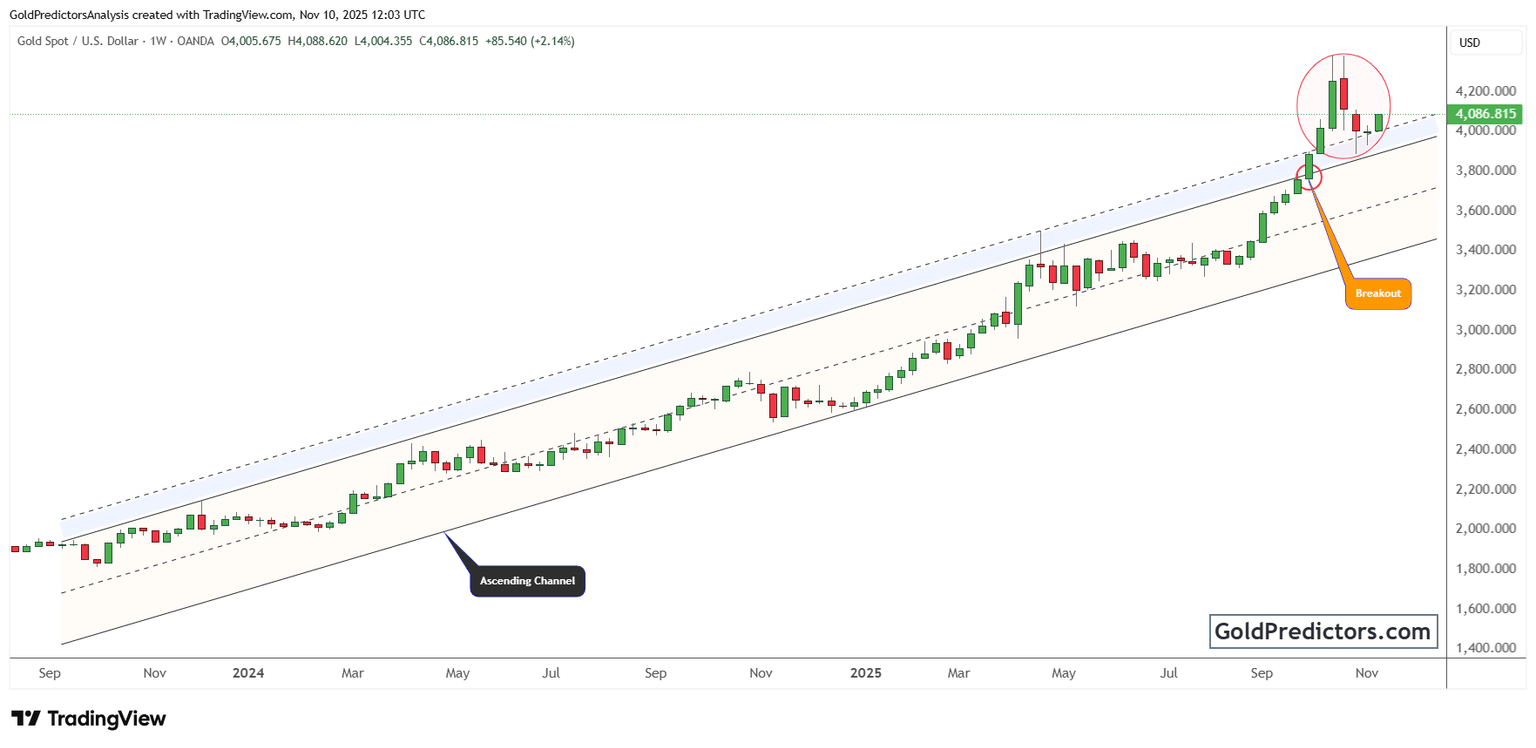

The gold chart below shows a decisive breakout from a well-formed ascending channel that had held since late 2023. This channel supported a steady and controlled uptrend, with price action consistently respecting both its upper and lower boundaries. The pattern highlighted sustained momentum and a well-defined trend throughout the multi-month advance.

Gold recently broke above the channel’s upper boundary, signaling a key technical shift. The breakout pushed the price firmly above the $4,000 level, marking the start of a more aggressive upside phase. The breakout candle showed strong volume and momentum, confirming conviction behind the move.

Following the breakout, price action pulled back briefly but remained above the breakout zone, converting former resistance into new support. This successful retest confirms the breakout’s validity and strengthens the bullish case. The former channel now acts as a solid base, and as long as gold stays above its upper boundary, the trend remains bullish.

Gold outlook: Breakout structure and macro trends support further upside

Gold remains in a strong position as macro uncertainty, soft U.S. data, and growing Chinese demand continue to support safe-haven flows. While recent policy progress has improved sentiment, unresolved political risks and signs of economic stress are keeping gold elevated. Technically, the breakout above the ascending channel confirms a structural shift in trend, with the successful retest validating bullish momentum. As long as gold holds above former resistance, the broader uptrend remains intact.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.