Gold extends consolidation

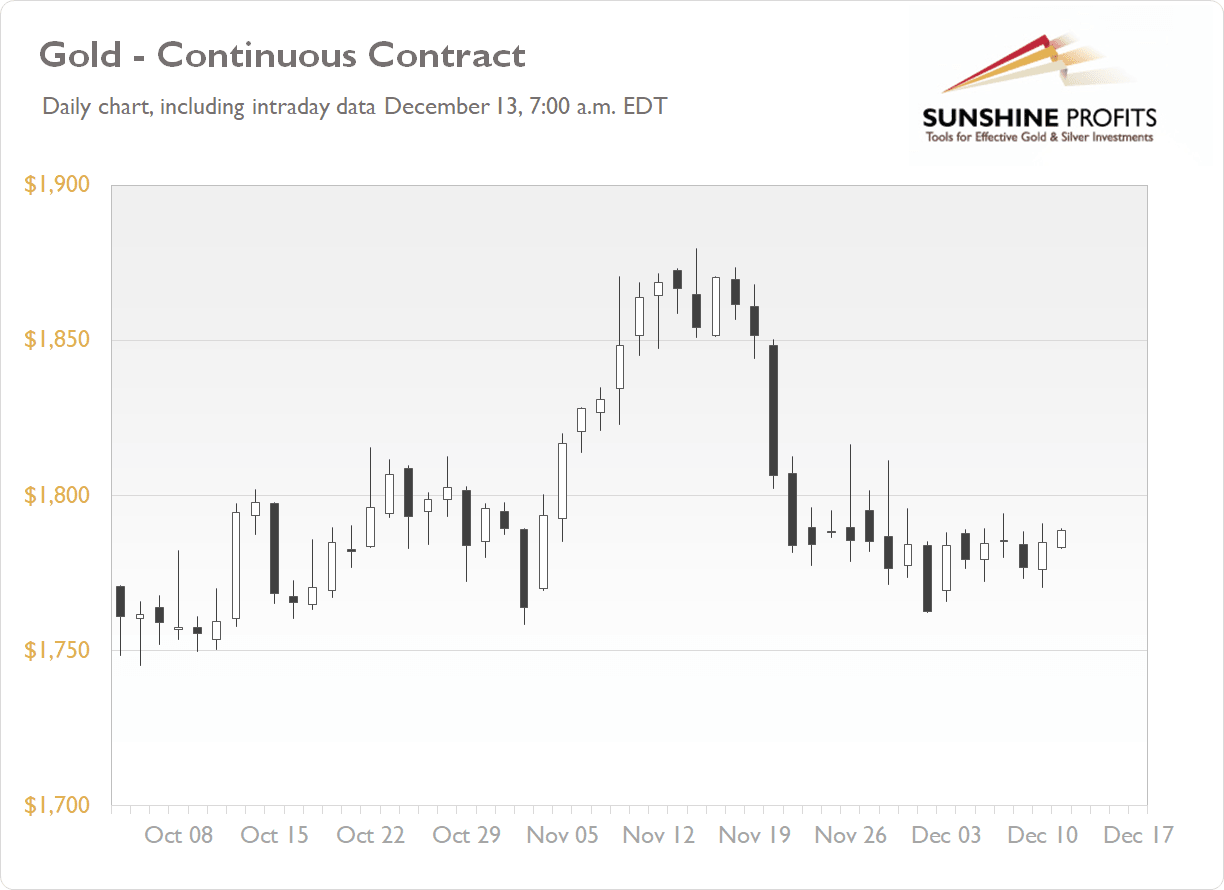

The gold futures contract gained 0.46% on Friday, as it retraced its Thursday’s loss of 0.5%. The market continues to fluctuate following the late November decline and a breakdown below the $1,800 level. It sold off in a reaction to strengthening US dollar and volatile stock prices, among other factors. This morning gold is trading slightly higher, as we can see on the daily chart (the chart includes today’s intraday data):

Gold is 0.3% higher this morning, as it gets closer to the $1,800 level again. What about the other precious metals? Silver is 0.1% higher, platinum is 0.3% lower and palladium is 0.8% lower. So precious metals’ prices are mixed this morning.

Friday’s Consumer Price Index release has been slightly higher than expected at +0.8% m/m. Today we won’t get any new important economic data announcements. The markets will be waiting for series of data releases on Tuesday and on Wednesday, including the important Wednesday’s FOMC Statement release.

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for the next two trading days:

Monday, December 13

-

12:00 p.m. U.K. - Bank Stress Test Results.

-

12:30 p.m. U.K. - BOE Governor Bailey Speech.

-

All Day - G7 Meetings.

Tuesday, December 14

-

6:00 a.m. U.S. - NFIB Small Business Index.

-

8:30 a.m. U.S. - PPI m/m, Core PPI m/m.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Paul Rejczak

Sunshine Profits

Paul Rejczak is a stock market strategist who has been known for the quality of his technical and fundamental analysis since the late nineties.