Gold Elliott Wave analysis [Video]

![Gold Elliott Wave analysis [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Gold/raw-gold-55156544_XtraLarge.jpg)

Gold Elliott Wave analysis

Gold is experiencing a retreat after reaching a fresh all-time high in August 2024. While this dip might appear concerning, it could be a temporary correction before buyers reenter the market, potentially driving prices to new highs. However, technical analysis suggests that a larger pullback could be on the horizon.

Daily chart analysis

From a long-term perspective, Gold completed its supercycle wave (IV) in the ongoing bullish trend that began in December 2015. The completion of wave (IV) set the stage for the initiation of a new impulse wave (V). Within this impulse, waves I and II of the primary degree were completed in May and October 2023, respectively. Currently, Gold is progressing within the intermediate degree wave (3) of the primary degree wave 3 (circled) of cycle degree wave III, as seen on the daily chart.

The price action indicates that wave (3) is nearing completion with a diagonal wave 5 structure, which suggests that a corrective wave (4) could soon follow. Despite the potential pullback, the broader trend remains bullish, and further upside movement is expected after the completion of the correction. The completion of wave (3) would likely lead to a consolidation phase before the market resumes its upward trajectory in wave (5).

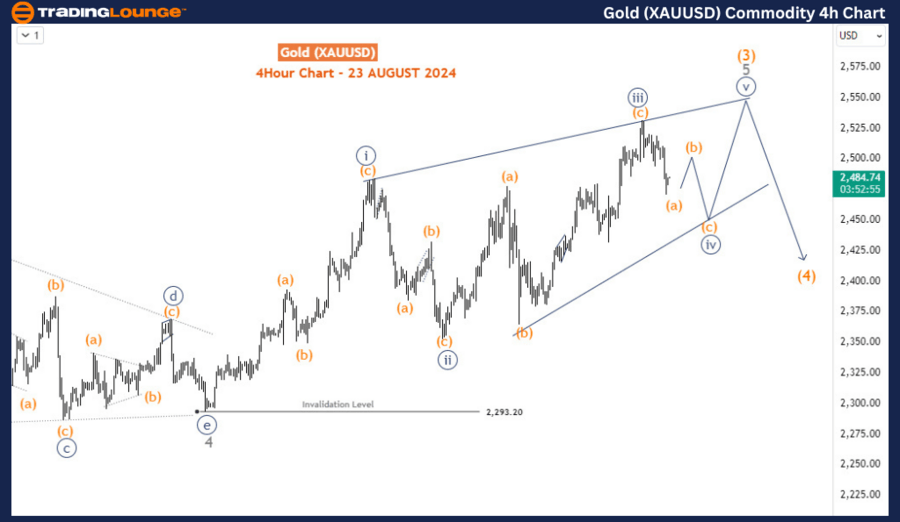

Four-hour chart analysis

The H4 chart offers more detailed insight into the short-term structure. The chart shows the development of a diagonal for wave 5, emerging after a breakout from the wave 4 triangle range in June 2024 at the 2293 level. The initial rally took Gold above this resistance, confirming the start of wave 5. The internal structure of wave 5 indicates that waves i-iii (circled) have been completed, while the ongoing dip represents the formation of wave iv (circled).

One final push higher is anticipated in wave v (circled), which could take Gold above the psychological level of 2500 and closer to 2550. This zone could act as a potential exit point for buyers, marking the end of wave (3). If this scenario plays out, a larger pullback would likely ensue as part of wave (4) before the next bullish leg begins.

Overall, while the long-term outlook for Gold remains positive, traders should be prepared for short-term volatility and a possible corrective dip before the market continues its upward trend.

Gold Elliott Wave analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.