Gold: Corrective move still seems to have some room to play out as the negative drift continues [Video]

![Gold: Corrective move still seems to have some room to play out as the negative drift continues [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Gold/stack-of-golden-bars-in-the-bank-vault-60756080_XtraLarge.jpg)

Gold

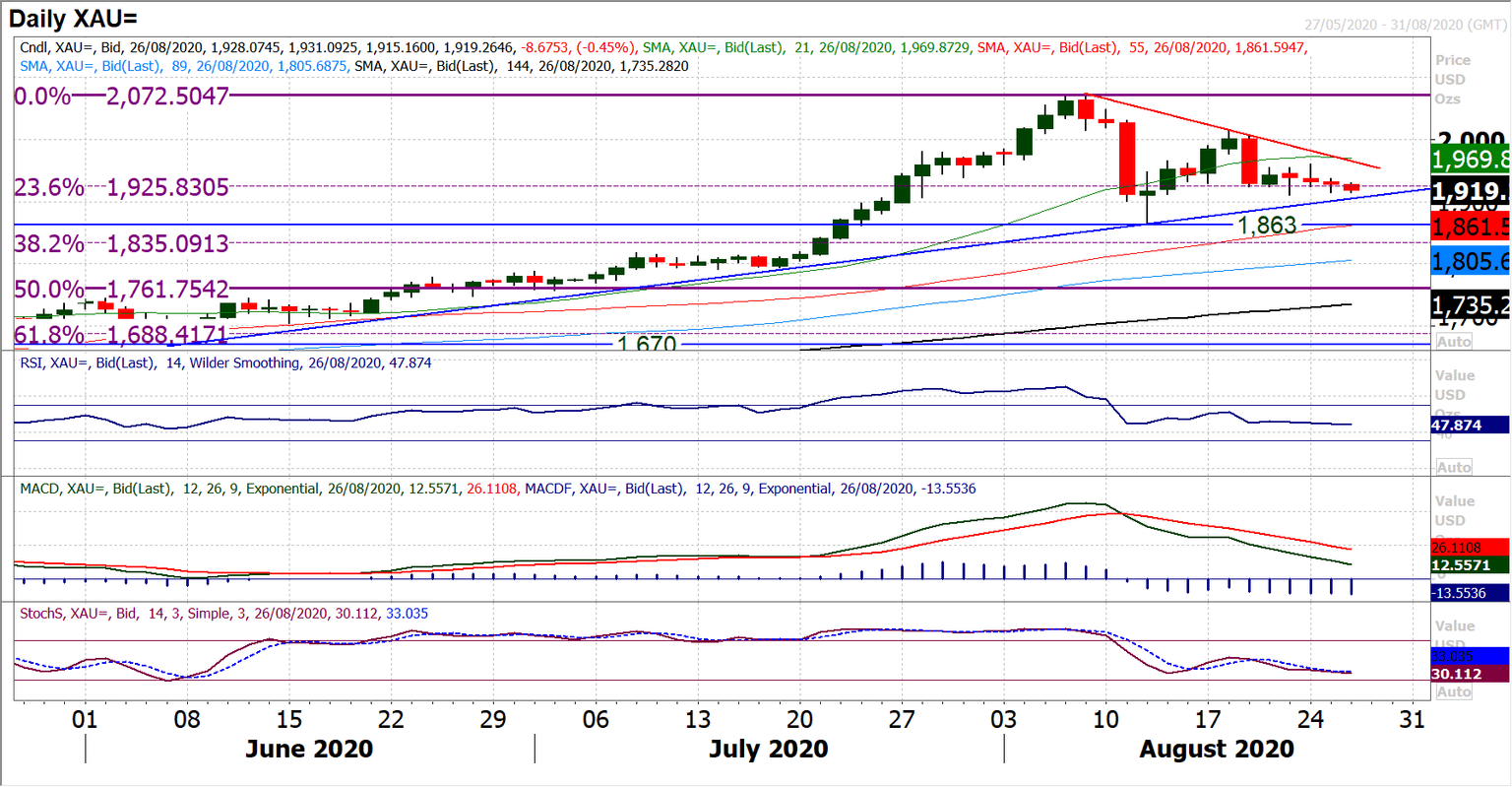

With Treasury yields rising, gold is on a negative drift, something which is a pretty standard play. How gold sits after the next 48 hours though could be key for the ongoing outlook. We are expecting a decisive move on the back of Fed chair Powell’s speech tomorrow. In the run up to this there has been a sense of consolidation, but within this there is a mild corrective drift too. The past few sessions has seen gold slipping back in a series of small-bodied but negative candlesticks. This is pulling the market back towards the support of an 11 week uptrend which sits at $1905 today. For now, last week’s low at $1911 is intact but the hourly chart shows a pull towards a test of $1906/$1911 support band. The hourly chart also shows that the old basis of support around $1929 has turned into resistance this morning, leaving $1929/$1936 as a near term barrier to gains today. A breach of $1900 would open the way for a move back to test $1863. We still see the medium term outlook as positive, but this near term corrective move still seems to have some room to play out as the negative drift continues. A move above $1955/$1961 resistance would begin to breach a three week corrective downtrend and put the bulls in a better position, but only above $2015 would the market be truly bullish once more.

Author

Richard Perry

Independent Analyst