Gold closer to long-term high again

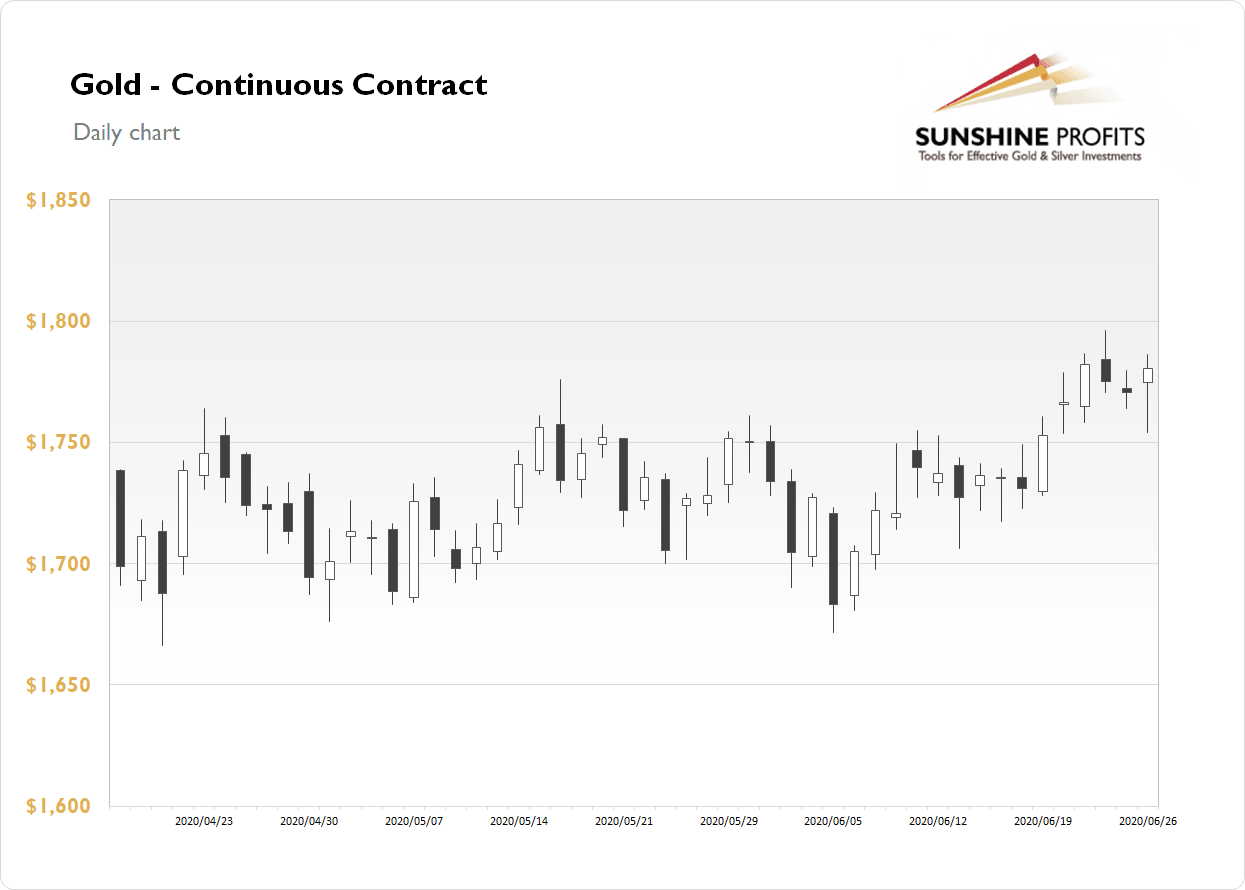

The gold futures contract gained 0.55% on Friday, as it continued to trade along Wednesday's new yearly high of $1,796.10. The market has extended its long-term uptrend last week. The recent economic data releases didn't bring any new surprises for the financial markets, however, gold broke above its local highs, as we can see on the daily chart:

Gold is trading 0.3% lower this morning, as it is further extending the short-term consolidation. What about the other precious metals? Silver gained 0.78% on Friday and today it is 0.1% lower. Platinum gained 2.07% on Friday and today it is 1.0% higher, palladium gained 2.67% on Friday and today it is up 0.9%. So precious metals are mixed on Monday's morning.

On Friday we got the Personal Spending/Personal Income numbers along with Core PCE Price Index and the Revised UoM Consumer Sentiment number. The data have been generally as expected. This week we will get the important monthly jobs data on Thursday preceded by Wednesday's ADP Non-Farm Employment Change release.

Below you will find our Gold, Silver, and Mining Stocks economic news schedule for the next two trading days:

Monday, June 29

-

10:00 a.m. U.S. - Pending Home Sales m/m

-

9:00 p.m. China - Manufacturing PMI, Non-Manufacturing PMI

-

All Day, Eurozone - Italian Bank Holiday

Tuesday, June 30

-

8:30 a.m. Canada - GDP m/m

-

9:45 a.m. U.S. - Chicago PMI

-

10:00 a.m. U.S. - CB Consumer Confidence

-

12:30 a.m. U.S. - Fed Chair Powell Testimony

-

2:00 p.m. U.S. - FOMC Member Kashkari Speech

-

9:45 p.m. China - Caixin Manufacturing PMI

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Paul Rejczak

Sunshine Profits

Paul Rejczak is a stock market strategist who has been known for the quality of his technical and fundamental analysis since the late nineties.