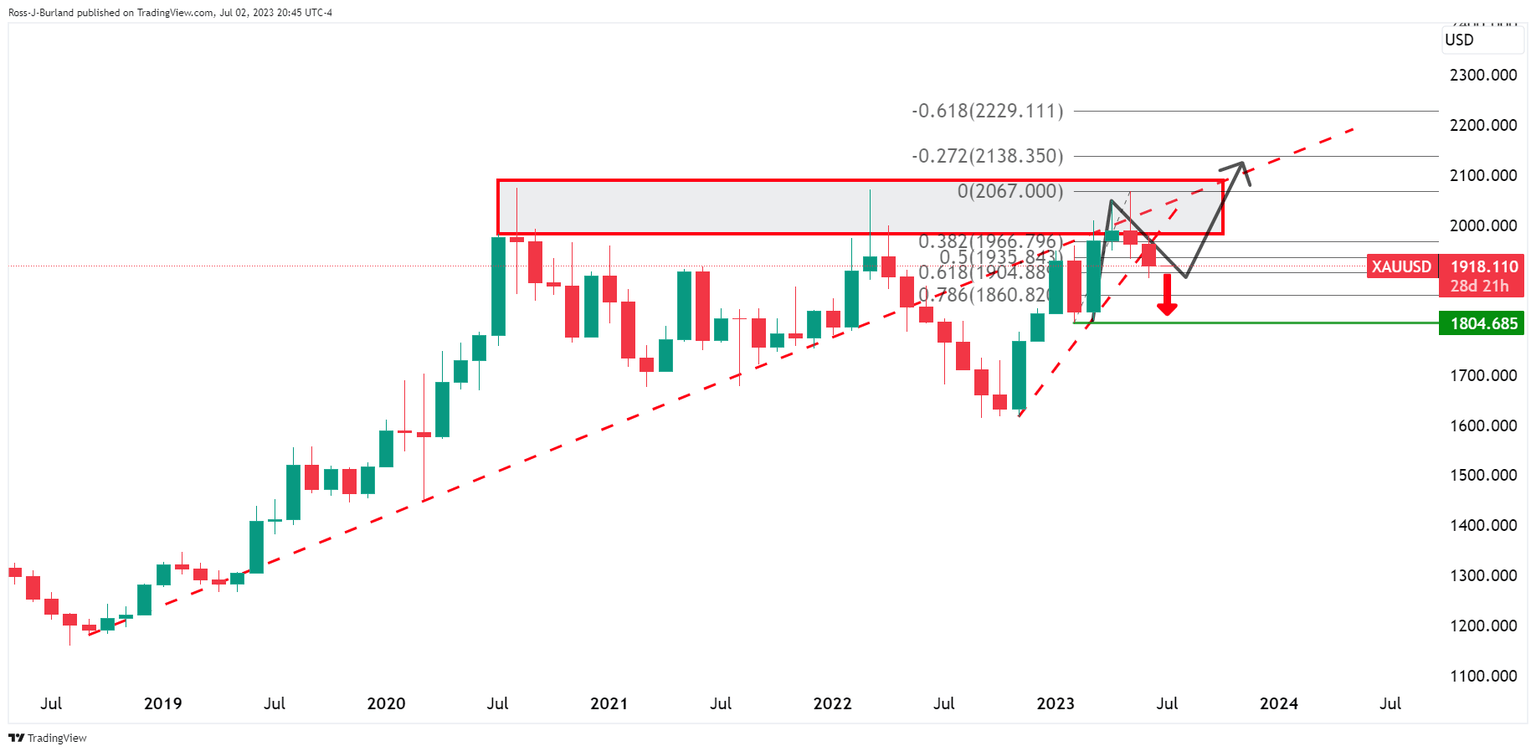

Gold, Chart of the Week: XAU/USD bulls eye $1,950 but bears stay in charge

- Gold price focus is on a downside continuation, the front-side of the bearish dynamic trend lines.

- Bulls need to crack the $1,950s in the days ahead to steer the bias the other way.

Gold price is still on the front side of the bearish trend as per the daily chart, but there are risks of an upside extension on a break of key resistance structures.

In recent weeks, investors have aggressively cut gold length amid continued hawkish rhetoric coming from the Federal Reserve. We can see that on the weekly and monthly charts as follows:

''It is likely that there was more front-end supply, which helped to take spot prices down toward $1,900/oz,'' analysts at TDSecureities said. Nevertheless, there are prospects of a correction is the bulls commit at this juncture, whereby the monthly 61.8% Fibonacci acts as support. The weekly chart has already made a 38.2% Fibonacci correction of the latest bearish impulse.

Mind you, the price is likely to find resistance given the dominant bearish trendline on the daily chart as illustrated above, especially as investors remain concerned that US core inflation is trending more than double the US central bank's inflation target.

The futures market is pricing a high probability of another 25 bps in late July from the Federal Reserve.

''While there are fewer price pressures in the economy, recent data suggest that rates will move higher on the front end of the curve and stay at elevated levels for some time, which implies that gold will continue to have little reason to move significantly higher anytime soon,'' TD Securities said.

This leaves the focus on a downside continuation, the front-side of the bearish dynamic trend lines.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.