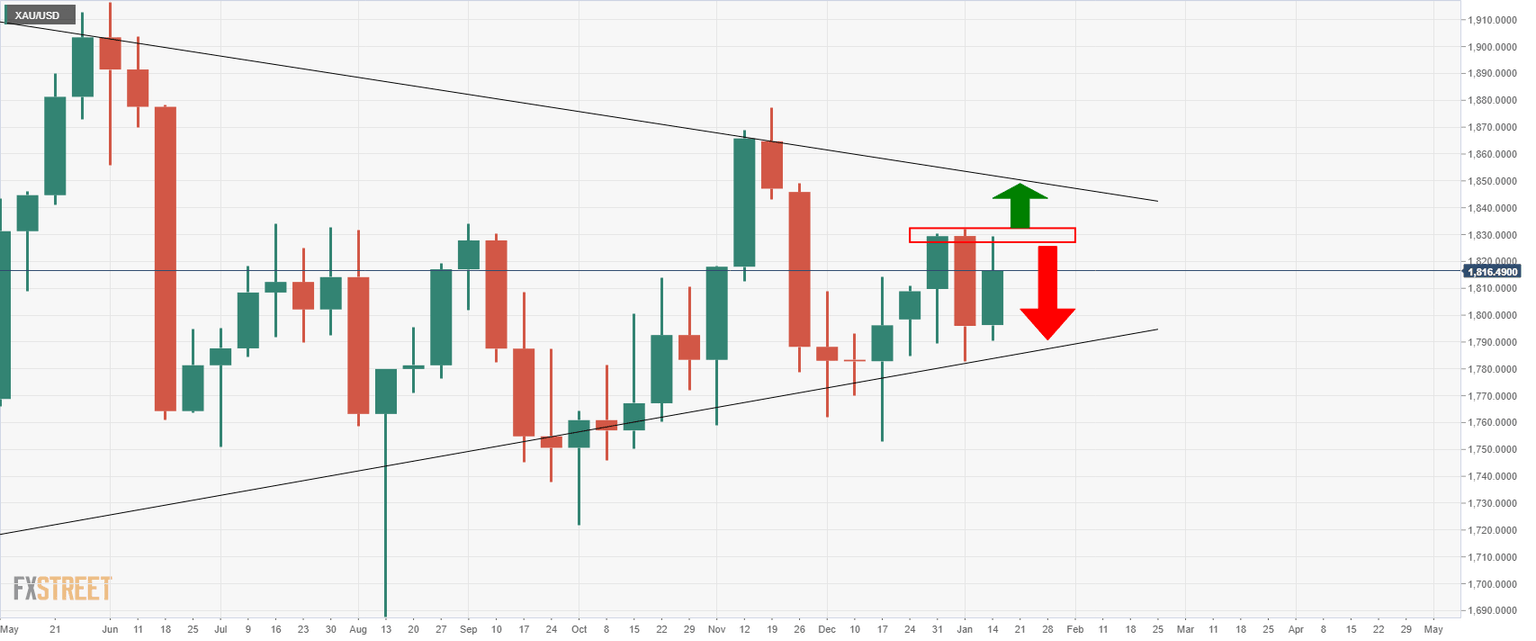

Gold, Chart of the Week: Bearish confluences below $1,830

- Gold bears are out and a break of $1,800 opens risk to the $1,780s.

- Bulls would argue that real rates will increase only modestly.

Gold can be analysed from a bearish perspective as per the following top-down analysis. This rhymes with the hawkish signals coming from the Federal Reserve and the market expectations suggesting a March Fed funds hike is imminent. Investors have extended short positioning and sold longs with yields across the curve moved convincingly higher.

Gold monthly chart

The monthly W-formation is a bearish reversion pattern where the neckline comes in at $1,783 with a confluence of the dynamic support line.

Gold weekly chart

The weekly chart is showing that gold is struggling to break the prior double highs and a failure again last week makes for a bearish triple top.

Gold daily chart

The daily chart is pressuring the W-formation's neckline near $1,815 which guards a deeper test of the bullish impulse's range between $1,782.93 and $1,828.11. The low meets the trend line support, so a break there would be significantly bearish.

Gold 4-hour chart

The 4-hour chart sees the price on the back foot but a correction could be on the cards for the open in what would be a retest of the $1,821 structure. No matter which way, the outlook is bearish and there are prospects of a move into the depths of the $1,800s to meet the $1,801 prior low. However, a break above $1,829 and a close in the $1,830's would negate the bearish outlook.

Additionally, the Federal Reserve chairman Jerome Powell was telling the Senate Banking Committee last week that he is keen to fight inflation, but he also implied a very measured course of action. As analysts at TD securities argued, ''this implies that real rates will increase only modestly and that gold may jump higher as shorts cover.'

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.