Gold breaks all-time highs as XAU/USD enters price discovery

- Gold enters price discovery, decisively breaking above its prior all-time high at $4,381, confirming dominant buyer control.

- The breakout is structurally sound, supported by strong displacement and acceptance above former resistance.

- Technical focus shifts to the bullish FVG, where continuation or corrective pullback will define the next phase.

From breakout to reaction phase

Gold has officially transitioned from consolidation into price discovery, clearing its previous all-time high near $4,381 and sustaining trade above it. This move was not impulsive or news-driven; instead, it unfolded through clean expansion, brief consolidation, and renewed continuation, signaling institutional participation rather than speculative chasing.

What stands out in the current structure is not the breakout itself — that phase has already completed — but how price is behaving at premium levels. Instead of sharp rejection, gold is showing controlled pauses and shallow pullbacks, suggesting that buyers are comfortable defending higher prices rather than rushing to take profits.

This behavior is characteristic of markets that are accepting new value, not rejecting it.

Why Gold is holding strength at all-time highs

Several forces continue to underpin gold’s resilience:

- Persistent hedging demand amid uncertainty around global growth, debt, and long-term monetary stability.

- Reduced sensitivity to USD fluctuations, indicating demand driven by allocation rather than currency mechanics alone.

- Institutional accumulation, evident through orderly structure and lack of aggressive sell-offs.

- Technically favorable conditions, as former resistance transitions into support.

Gold is no longer reacting emotionally to headlines — it is absorbing volatility, which typically precedes trend continuation.

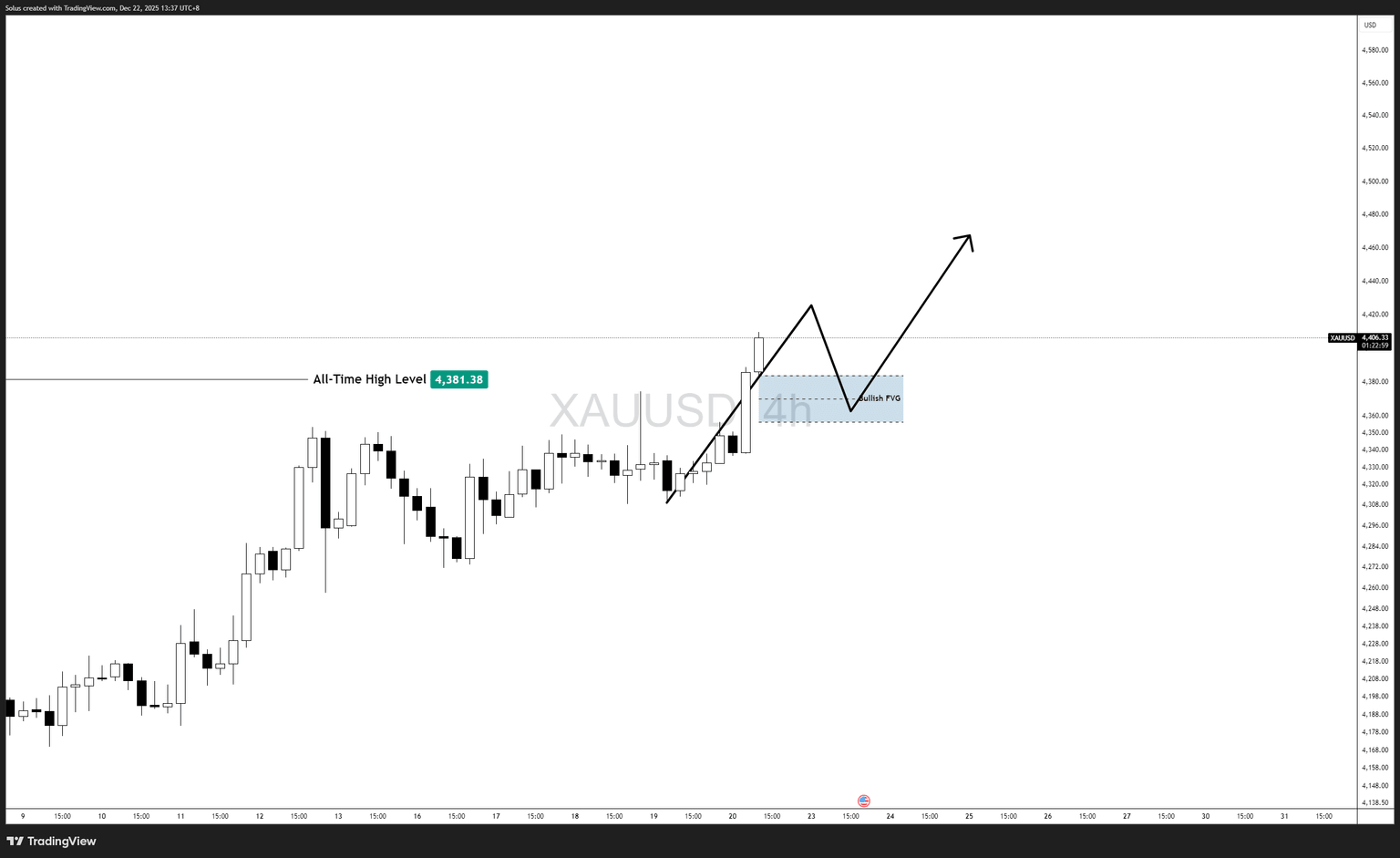

Technical outlook: Structure after the ATH break

On the 4-hour chart, gold printed a strong impulsive leg above the all-time high, leaving behind a bullish Fair Value Gap (FVG). This FVG now acts as the key technical reference point for both bullish continuation and bearish correction scenarios.

The market is no longer deciding direction — it is managing premium.

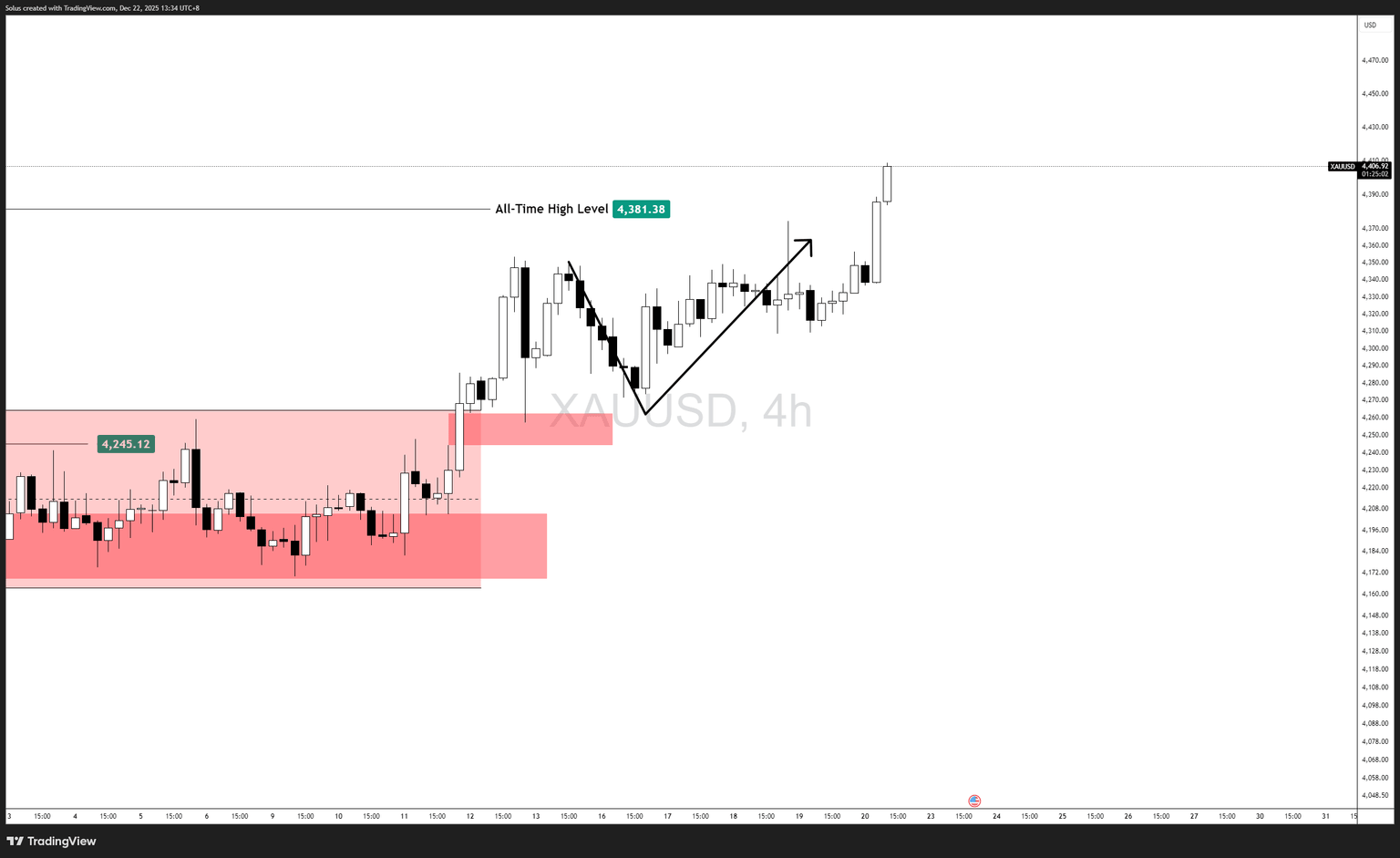

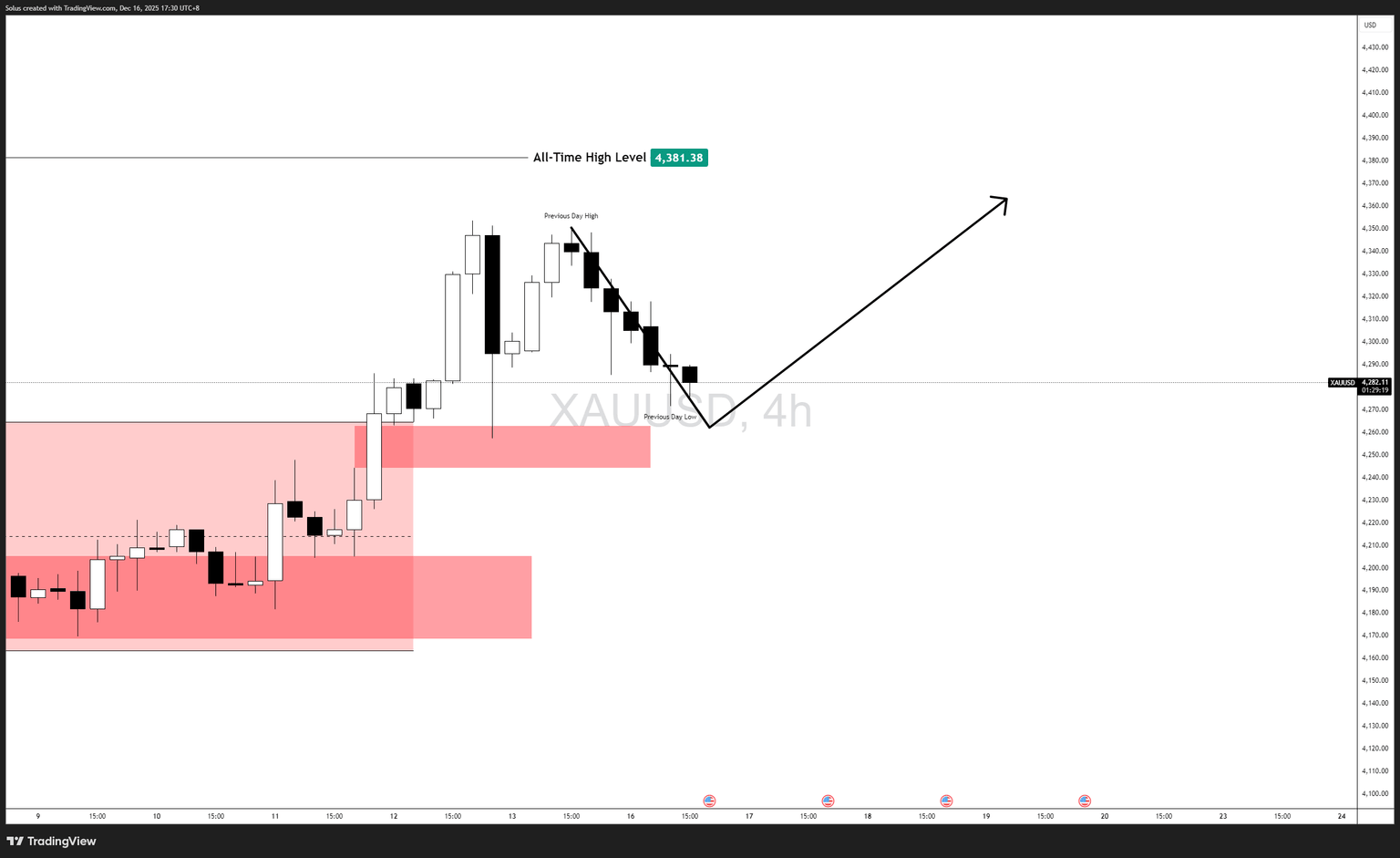

How the previous forecast played out

The prior outlook emphasized that holding above resistance — not simply breaking it — was the real confirmation.

That scenario has now materialized clearly:

- Resistance near $4,381 was reclaimed.

- Sellers failed to force price back into prior value.

- Gold consolidated above highs before extending further.

This sequence confirms that the market was building energy, not distributing, reinforcing why scenario-based planning remains more effective than directional prediction.

Bullish scenario: Pullback into bullish FVG, then continuation

The preferred bullish path involves controlled retracement, not immediate vertical extension.

What supports the bullish case

- Strong displacement confirms buyer dominance.

- A bullish FVG remains unmitigated, signaling unfinished institutional demand.

- Price holds above the former ATH, suggesting acceptance of higher valuation.

Continuation conditions

Gold remains bullish if:

- Price pulls back into the bullish FVG and fails to accept below it.

- Former ATH acts as support on retests.

- Pullbacks remain corrective, with overlapping consolidation rather than impulsive selling.

Upside targets

If the FVG holds:

- Liquidity above recent highs becomes vulnerable.

- Price may extend toward:

- $4,450 – $4,500

- Further expansion toward $4,550+ if momentum rebuilds.

Bias:

As long as the bullish FVG is respected, dips are buy-side rebalancing, not trend failure.

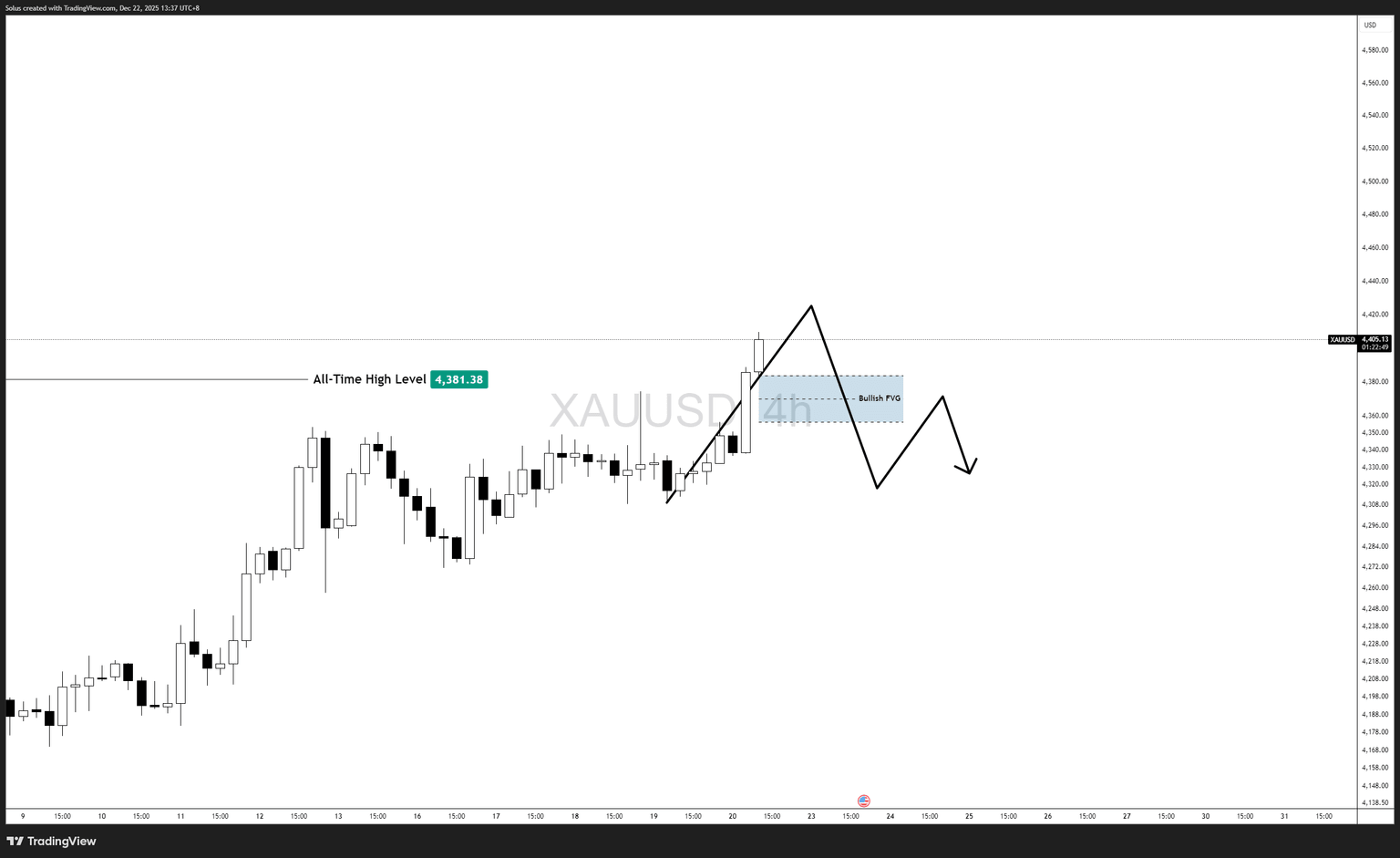

Bearish scenario: FVG failure triggers deeper correction

The bearish case is structural, not emotional — and it does not imply a full trend reversal.

What weakens the structure

Gold turns corrective if:

- Price trades through and below the bullish FVG with acceptance.

- The market fails to reclaim the ATH level on subsequent retests.

- Momentum shifts from impulsive to choppy, overlapping price action.

Downside implications

If the FVG fails:

- Price may rotate lower toward the post-breakout consolidation base.

- Deeper retracement into prior higher-low demand zones becomes likely.

This would represent:

- Profit-taking at premium levels.

- Structural rebalancing.

- Not broad bearish control unless higher timeframe supports break.

Bias:

Below the FVG, gold enters correction mode, not bear trend mode.

Final thoughts

Gold has already proven its strength.

The current phase is about reaction quality at premium levels:

- Hold the bullish FVG – continuation

- Lose the bullish FVG – corrective pullback

This is no longer a breakout trade — it is a structure management environment, where patience and level awareness matter more than chasing momentum.

Author

Jasper Osita

ACY Securities

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.