Gold blockbuster rally reaches $4,247 as FOMO boosts safe haven rush

GOLD’s bullish structure remains firmly in place as price continues its blockbuster rally printing fresh All Time High at $4246 with small pullback refuelling the buying frenzy and making Higher High - Higher Low structure which keeps the main bullish momentum intact as bulls betting for $4300-$4350

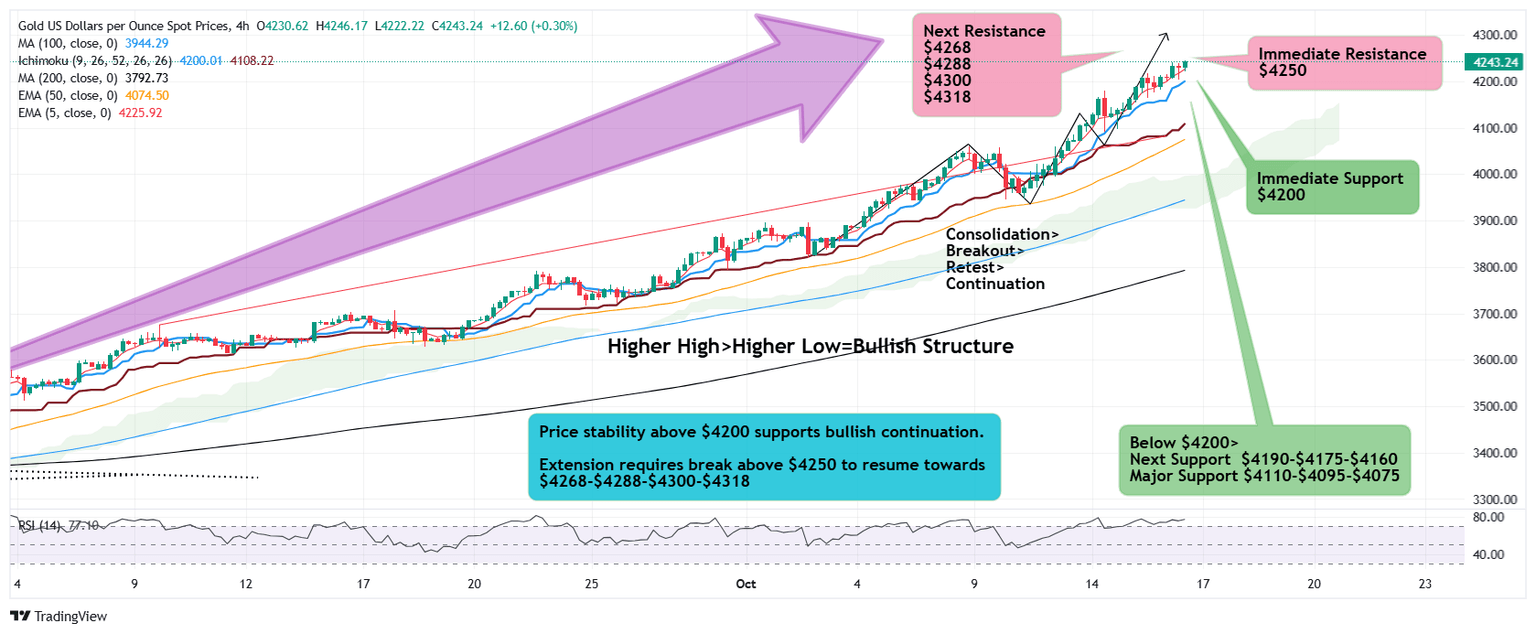

Gold 4 Hour Analytical

Fundamental drivers

1.Safe-Haven Demand Boosts Gold-

Geopolitical tensions dominate the headlines as crisis and political instability in the Middle East and Eastern Europe continue to drive safe-haven flows and act as strongest short term volatility driver. Investors are piling into Gold as global risk sentiment weakens.

2. Dovish Fed Outlook-

Recent Fed comments suggest policymakers are comfortable with holding rates steady, acknowledging slower job growth and easing inflation. Markets are now pricing in two rate cuts by early 2026, supporting bullish momentum in Gold.

3.US Dollar Weakness-

The US Dollar Index (DXY) is softening as yields drop and risk aversion grows dictating the momentum in Gold. A weaker dollar enhances Gold’s attractiveness globally. The Dollar Index failed to clear through strategic resistance aligned with 200 Day SMA 99.60 and currently sits around 98.40

4.Falling Bond Yields-

10-year Treasury yields have fallen below 4.25% reaches 3.99% and a fall below this zone will extend drop to 3.66%, reducing the opportunity cost of holding Gold. Lower yields continue to underpin demand.

5. Strong Central Bank Purchases-

Central banks, especially China and Türkiye, are maintaining steady buying patterns. This undercurrent of institutional support adds long-term stability to the uptrend.

6.Inflation Hedge Appeal-

Sticky inflation in key economies keeps investors hedging against potential price surges. Gold remains the ultimate protection in uncertain macro conditions.

7. ETF and Hedge Fund Inflows Rising-

Recent data show renewed ETF inflows, confirming investor conviction that Gold remains a strategic allocation during global market uncertainty.

8.The lingering US government shutdown shows no signs of agreement to resolve the deadlock.

Technical drivers

1.Trend Structure:

Gold continues its bullish advance and scorching rally, trading well above the 1 Hour 50 EMA aligning with psychological zone $4200, confirming strong upward momentum.

2.Breakout Confirmation:

Price broke decisively above $4200, confirming continuation of the bullish wave toward immediate resistance $4250 above which way opens to next leg higher $4268 followed by extension to $4280.

3.Support Zone:

Immediate support rests at $4200 below which retracement comes for $4190-$4175, followed by $4160. A sustained move above these levels keeps bulls in control.

4.Resistance Zone:

Next key resistance is seen near $4268-$4280, and a breakout could target $4318–$4350.

5.Momentum Indicators:

4 Hour RSI reading of 77 is indicating bullish strength without extreme overbought conditions. RSI on Daily and Weekly time frames read 85 which indicates overbought conditions. Monthly RSI reading at 92 is extremely overstretched and calls for high caution on heights.

6.Intraday Outlook:

Buying on dips remains the preferred strategy as long as price holds above $4200 support zone.

Author

Sunil Kumar Dixit

SK Charting

Sunil Kumar Dixit is Chief Technical Strategist and founder of SK Charting, a research firm based in India. He tracks Precious Metals, Energy, Indices and Currency Pairs. He also participates as an expert panellist on Channel Television, Nigeria.