Gold and Silver hit targets [Video]

![Gold and Silver hit targets [Video]](https://editorial.fxsstatic.com/images/i/Silver4_XtraLarge.png)

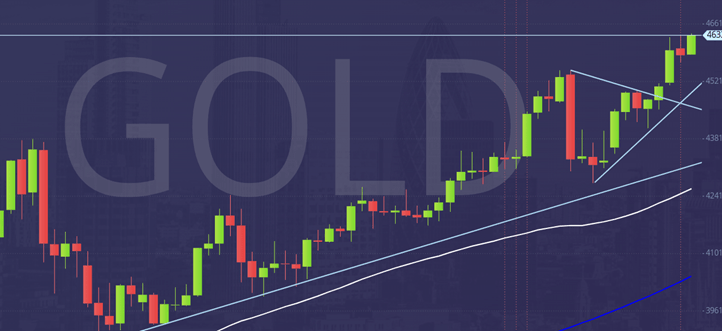

XAU/USD

Gold longs at support at 4580/70 worked perfectly with a low for the day twice here yesterday.

The first bounce offered up to $50 profit as we shot higher to my next target of 4633, with a new all time high almost exactly here.

The retest of the support at 4580/4570 made a low for the day at 4568.50 so again, the long trade worked perfectly & as I write we are trading at 4623 for another potential profit of $50.

Up to 1000 ticks profit on the day.

Further gains are expected to 4645, 4654 then eventually 4671/4674.

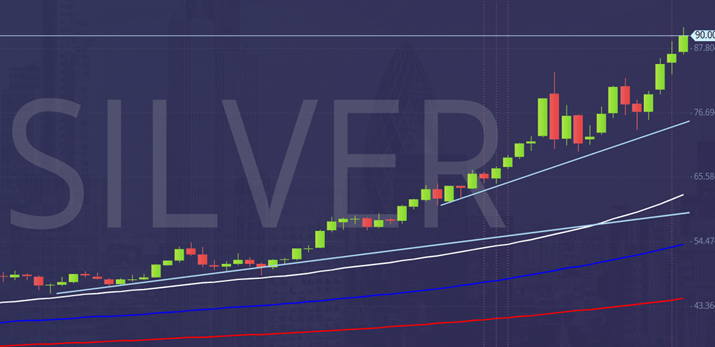

XAG/USD

Silver higher again as predicted with a push higher from support at 8340/8320.

We wrote: A break above 8630 targets 8680/90, 8710/15, 8760/75 & even 8810/8820 is possible.

All targets were achieved yesterday as we hit a new all time high at 9000.

Don't fight the bulls!!

Next targets are 9042/45, 9085/9090 & 9120/9130. Even 9185/9195 is possible.

Above here look for 9250/9260.

Just be aware that silver has soared 35% in just 4 days. Prices could collapse without any notice so be careful.

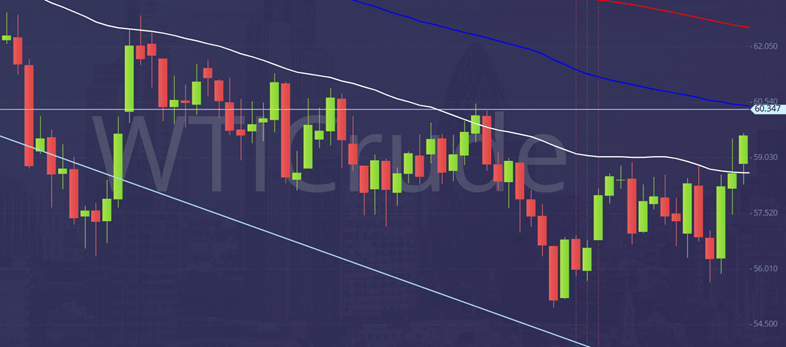

WTI Crude January futures

Last session low & high: 5947- 6150.

WTI Crude eventually beat resistance at the upper end of the 2 week range at 5850/5890 last week and this was my buying opportunity with a low for the week here on Monday, exactly as predicted.

Longs worked perfectly as we hit 5991 on Monday and my next target of 6110/6130 yesterday. A break above 6050 today is a buy signal targeting 6120/50, perhaps as far as 6230/6270.

Support at 6030/5980 & longs need stops below 5940.

Author

Jason Sen

DayTradeIdeas.co.uk