Gold: A break below 1816 targets 1808

Gold – Silver

Gold Spot topped exactly at first resistance at 1859/61 targeting 1851/49 & 1840/37 but holding first support at 1830/28.

Silver Spot shorts at our selling opportunity at 2565/75 worked perfectly on the dip to minor support at 25.20/15 for some profit taking. This support also held. Same levels apply for today.

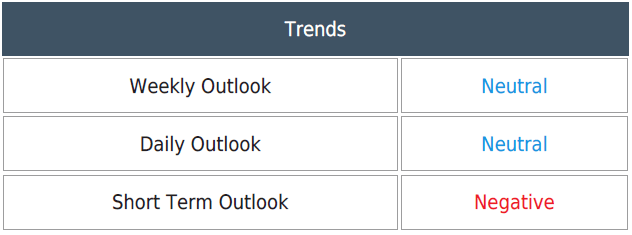

Daily Analysis

Gold holds 2 points above first support at 1830/28. First target is 1850/52 with first resistance at 1859/61. Shorts need stops above 1863 for a test of minor resistance at 1869/71. Try shorts at 1880/85 with stops above 1890.

Minor support at 1830/28 but below here retests 1819/16. A break below 1816 targets 1808/06, perhaps as far as 1800.

Silver minor support at 2520/15 & a selling opportunity at 2565/75 with stops above 2590. A break higher targets 2620/25.

Minor support at 2520/15 but below here targets 2480, perhaps as far as 2455/50. Further losses retest the 2430 low. I would not rely on this level holding again today. A break lower targets 2415/10. Below 2400 look for 2360/50.

Chart

Author

Jason Sen

DayTradeIdeas.co.uk