Global stocks crash accelerates as Omicron risks rise

Global stocks continued their sell-off as investors reacted to the rising number of Omicron cases and the travel restrictions. US futures added to the losses that they made on Friday. Futures tied to the Dow Jones, Nasdaq 100, and S&P 500 index declined by more than 5%. At the same time, the VIX index jumped by double-digits. This happened as countries like the UK, Netherlands, and Australia announced new Omicron cases. In the United States, Anthony Fauci announced that the US could face a more severe “fifth wave” that could disrupt holiday travels. Among the worst performers were companies in the hospitality and aviation industry.

The US dollar index tilted higher as traders rushed to safety as the number of Covid-19 cases rose. The index will react to the latest testimony by Jerome Powell, the Federal Reserve chair. Together with Janet Yellen, the Fed chair will testify about the CAREs act and the potential for a government shutdown. This will be the first testimony by Jerome Powell since he was reappointed as the Fed chair. The US dollar will also react to the latest pending home sales numbers. Analysts expect the data to show that the number of pending home sales rose by 1% after crashing in October.

The economic calendar will have some key events today even though the focus will be on the virus. In Germany, the statistics agency is expected to publish the latest preliminary inflation data. Analysts expect the data to show that inflation rose to a high of 5%. Spain will also publish the latest inflation data. Another key data to watch will be the latest Eurozone industrial, services, and consumer confidence data by the European Commission. In Canada, the statistics agency will publish the latest industrial and retail prices data.

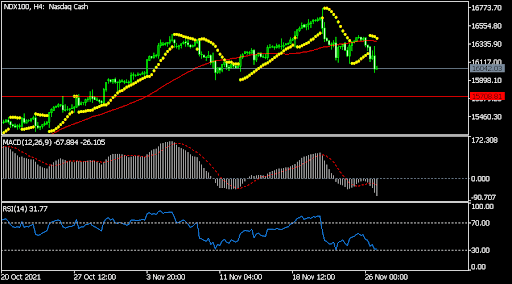

NDX 100

The Nasdaq 100 index crashed hard as investors focused on the Omicron variant. The index declined to $16,050, which was the lowest level since November 15th. It remains below the parabolic SAR dots and moved below the 25-day moving average. The Relative Strength Index (RSI) and MACD have been in a decline. Therefore, the index will likely keep falling as bears target the key support at $15,700, which will be the lowest level since November 1.

EUR/USD

The EURUSD pair held steady on Monday morning. It rose to a high of 1.1317, which was the highest level since November 22. On the four-hour chart, the pair managed to rise above the 25-day moving average. It also approached the 23.6% Fibonacci retracement level. The Relative Strength Index (RSI) and Stochastic have also risen. The pair will likely keep rising today.

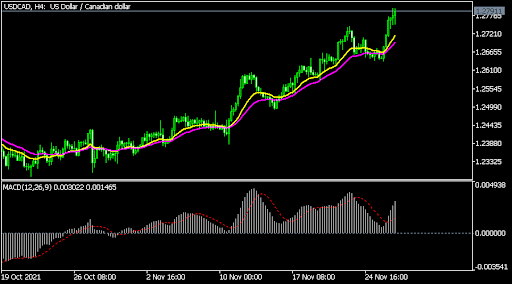

USD/CAD

The USDCAD pair jumped to the highest level since September 23rd. The pair rose to 1.2790, which was significantly higher than October’s low of 1.2285. The pair moved above all moving averages on the four-hour chart. The MACD and the RSI have also been rising. Therefore, the pair will likely keep rising ahead of Jerome Powell testimony.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.