Getting real on PMs and inflation

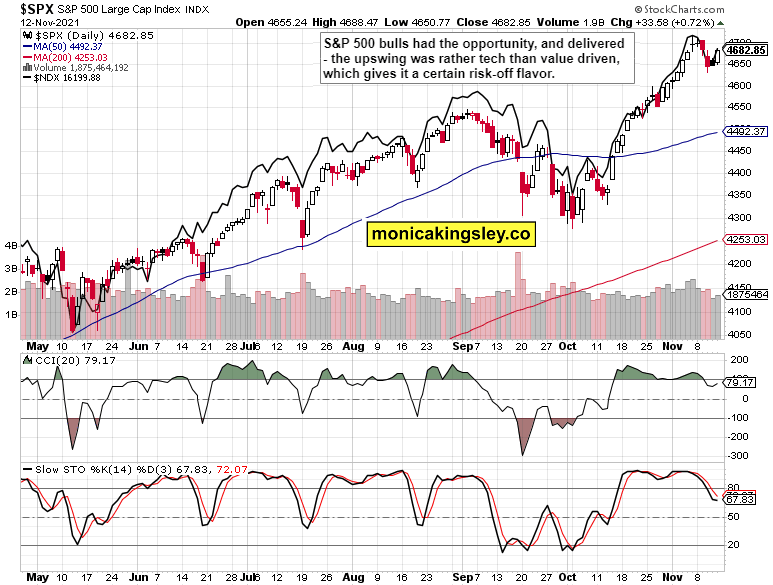

S&P 500 indeed rose but bond markets couldn‘t keep the encouraging opening gains. Can stocks still continue rallying? They look to be setting up for one more down leg of maximum the immediately preceding magnitude, which means not a huge setback. The medium-term path of least resistance remains up – the Fed is still printing a huge amount of money on a monthly basis, and it remains questionable how far in tapering plans execution they would actually get – I see the risks to the real economy coupled with persistently high inflation as rising since the 2Q 2022 (if not since Mar already, but most pronounced in 2H 2022).

Stocks are still set for a good Dec and beyond performance – just look at VIX calming down again. It‘s that the debt ceiling drama resolution would allow the Treasury to start issuing fresh debt, and that would weigh heavily on the dollar. That‘s a good part of what gold and silver are sniffing out, and if you look at the great white metal‘s performance, it‘s the result of inflation coming back to the fore as the Fed itself is now admitting to high inflation rates through the mid-2022, putting blame on supply chain bottlenecks. Oh, sure. The real trouble is that inflation expectations are starting to get anchored – people are expecting these rates to not go away any time soon.

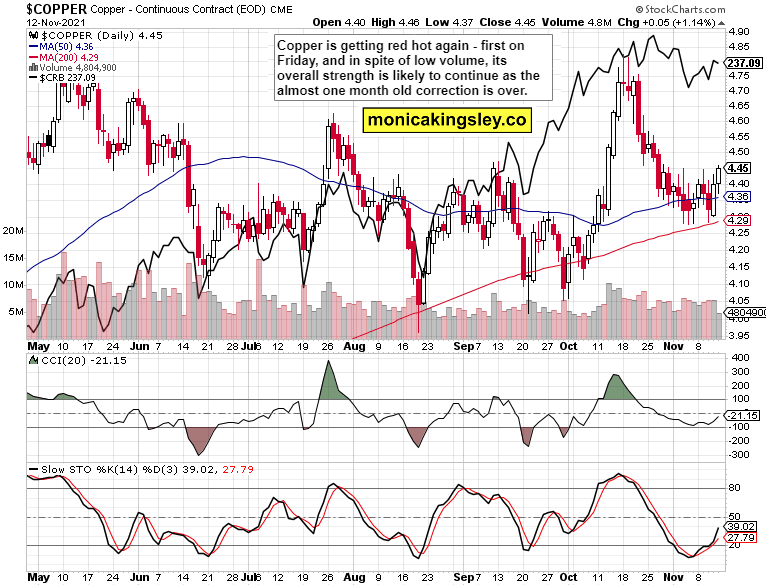

Precious metals are going to do great, and keep scoring excellent gains. Surpassing $1,950 isn‘t out of the realm of possibilities, but I prefer to be positioned aggressively while having more conservative expectations. Not missing a dime this way. Copper is awakening too, and commodities including oil would be doing marvels. If in doubt, look at cryptos, how shallow the corrections there are.

A few more words on yields – as more fresh Treasury issued debt enters the markets, look for yields to rise. Coming full circle to stocks and my Friday‘s expectations:

(…) TLT though is having trouble declining further, and that means a brief upswing carrying over into stocks, is likely.

TLT downswings would be less and less conducive to growth, so if you‘re still heavily in tech, I would start eyeing more value.

Let‘s move right into the charts.

S&P 500 and Nasdaq outlook

S&P 500 bulls are on the move, and let‘s see how far they make it before running into another (mild, again I say) setback.

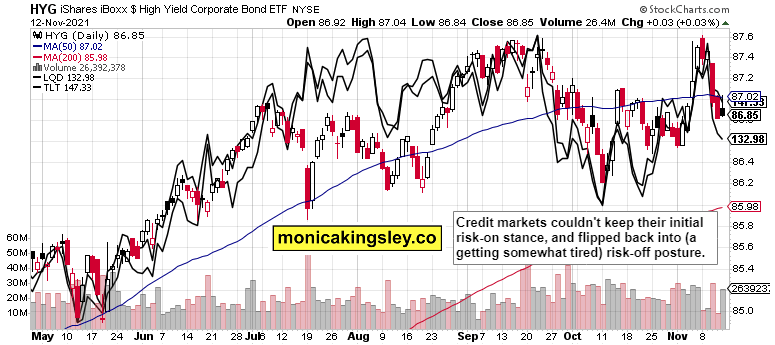

Credit markets

Credit markets opening strength fizzled out, but the weakness is getting long in the tooth kind of. I view it as a short-term non-confirmation of the S&P 500 upswing only.

Gold, silver and miners

Gold and silver are on a tear, and rightfully so – I am looking for further gains as both gold and silver miners confirm, and the macroeconomic environment is superb for PMs.

Crude oil

Crude oil bulls keep defending the $80 level, with $78 serving as the next stop if need be – after Friday, its test is looking like an increasingly remote possibility – the two lower knots in a series say. Anyway, black gold will overcome $85 before too long.

Copper

Copper ran while commodities paused – that‘s a very bullish sign, for both base and precious metals. The lower volume isn‘t necessarily a warning sign.

Bitcoin and Ethereum

Bitcoin and Ethereum are still consolidating, and the relatively tight price range keeps favoring the bulls – and they‘re peeking higher already.

Summary

S&P 500 bulls are holding the short-term upper hand, but the rally may run into headwinds shortly. Still, we‘re looking at a trading range followed by fresh highs as a worst-case scenario. Yes, I remain a stock market bull, not expecting a serious setback till probably the third month of 2022. Precious metals are my top pick, followed by copper – and I am definitely not writing off oil, let alone cryptos. Inflation trades are simply back!

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.