Get ready for SOFR: What’s up with libor?

Executive Summary

LIBOR and the Secured Overnight Financing Rate (SOFR), which generally are highly correlated, have diverged significantly of late. Although SOFR fell sharply when the FOMC slashed its target for the fed funds rate, LIBOR has generally moved higher. The Fed's efforts to provide much needed liquidity to the banking system are helping to pull SOFR lower, as is elevated demand for ultra-safe, short-dated places to park cash in these uncertain times. But LIBOR, which is an unsecured rate, has moved higher due to concerns about the health of the financial system amid the adverse economic effects of the COVID-19 outbreak. The length of time it will take LIBOR to return to "normal" will really depend on the evolution of the pandemic, which is essentially impossible to predict presently.

SOFR and LIBOR Have Diverged Again

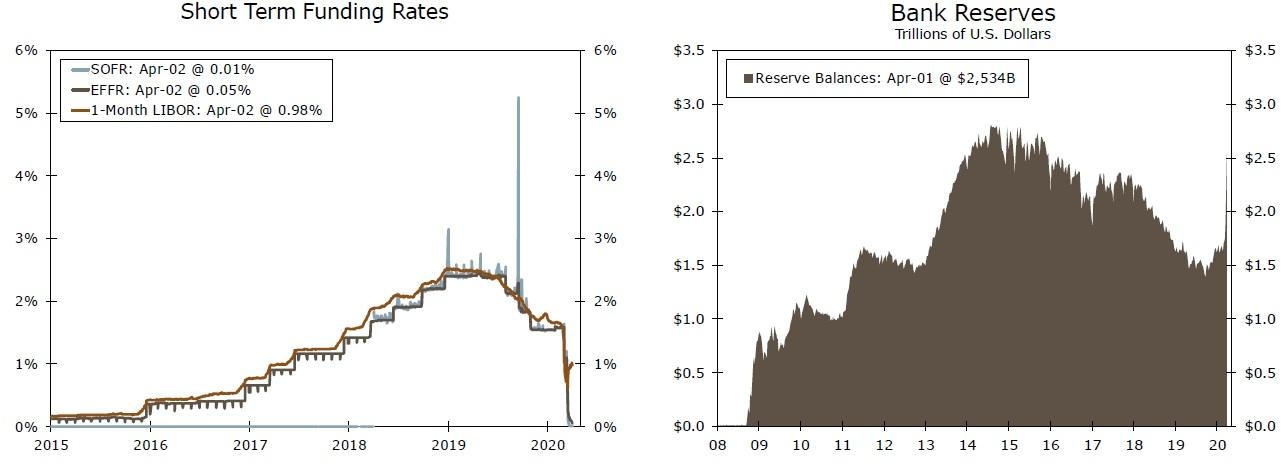

In a primer that we published on January 31, we noted that LIBOR will be replaced in the not-toodistant future by SOFR as the benchmark lending rate in the United States. In that primer, we wrote that there tends to be a high degree of correlation between LIBOR and SOFR, but there are times when the two rates can diverge sharply, as they did briefly in September 2019 (Figure 1). There were a few reasons why SOFR spiked higher for a few days last September, but the imbalance between the supply of Treasury securities and the level of reserves held at the Federal Reserve probably was a primary factor (Figure 2).

Source: Bloomberg LP, Federal Reserve Board and Wells Fargo Securities

Excess reserves are an important source of loanable cash in the financial system, and insufficient excess reserves can cause secured rates, such as SOFR, to spike, particularly during periods when the supply of collateral (in this case, Treasury securities) surges. That is, excess demand for cash among financial institutions pushes up the borrowing costs for that cash. The Federal Reserve responded to the dislocation in secured funding markets in September by increasing excess reserves via purchases of Treasury bills, as well as conducting overnight and term repo operations on an ongoing basis.1 SOFR came back in line with LIBOR, and the two rates moved largely together in subsequent months. However, the two rates have recently diverged again (Figure 1). This time the roles have reversed, as SOFR has tumbled toward 0%, whereas 1-month LIBOR has moved about 40 bps higher since mid-March despite the 100 bps reduction in the fed funds rate that the Federal Open Market Committee (FOMC) announced on March 15. What is going on?

One answer could simply be that the difference in the terms of the two rates. Since SOFR is an overnight rate and LIBOR often has a term component (e.g. 1-month or 3-month LIBOR), the two rates can diverge if markets expect the Federal Reserve to change its policy rate at some point in the near future. But pricing in the futures market implies that the Fed is unlikely to increase its policy rate at any point in the next year or two, let alone in the next few months. So, there must be something else going on to explain the divergence between SOFR and LIBOR.

SOFR has followed the target range for the fed funds rate lower in part because the banking system at present is flush with cash, in major part due to actions taken by the Federal Reserve. First, the Fed has been offering up to $500 billion in overnight repurchase operations (i.e., repos) and more than $1 trillion in repos with longer terms.2 Second, the Fed has restarted its quantitative easing (QE) program under which it buys Treasury securities and mortgage-backed securities (MBS) from the banking system on a "permanent" basis. The combination of massive repo operations and renewed QE has caused the reserves of the banking system to jump to over $2.5 trillion on April 1 from $1.6 trillion in mid-March (Figure 2).

Third, the Federal Reserve has re-instituted its swap lines with some major central banks and it has established repo facilities for other central banks. The swap lines and the repo facilities allow foreign central banks to borrow U.S. dollars from the Fed, which they can then use to lend to commercial banks in their own economies. This increased supply of U.S. dollars to foreign financial institutions helps to depress dollar funding rates on a global basis.

In addition, investor demand for ultra-safe, short-dated assets has skyrocketed during this period of heightened uncertainty. The bid-to-cover ratio, a measure of demand for Treasury auctions, remains elevated for four-week Treasury bills, and data for the past two weeks show that money market funds that invest only in government securities saw more than $500 billion of inflows. Because Treasury repurchase agreements are inherently secured by very safe collateral, parking money in this area of the financial system has become more attractive even at low yields.

In contrast, the movement higher in LIBOR reflects, at least in part, general tensions in credit markets. As shown in Figure 3, an index that measures the yield spread of Baa-rated corporate bonds over U.S. Treasury securities has risen considerably recently. In short, investors have become concerned about the credit quality of some U.S. corporations due to the adverse economic effects of the COVID-19 outbreak. Recall that LIBOR is an unsecured rate. That is, LIBOR reflects the interest rate that a bank would charge another bank for a loan on an unsecured basis. When overall credit quality starts to deteriorate, the rate that a borrower must pay a lender to borrow on an unsecured basis naturally rises.

A similar phenomenon occurred during the 2007-2009 financial crisis. Although the FOMC started to cut rates in September 2007, the spread between 3-month LIBOR, an unsecured rate, and the yield on the 3-month T-Bill, widely regarded as one of the safest securities in the world, widened considerably (Figure 4). But as the Fed's programs to provide liquidity in financial markets began to take effect in late 2008, tensions in financial markets began to subside (Figure 3) and LIBOR began to decline. This so-called "TED spread" returned to normal levels by early 2009.

Where Do We Go From Here?

If the experience of the financial crisis in the past decade is any guide, then LIBOR should eventually recede toward the target range for the fed funds rate, which is currently 0.00% to 0.25%. But the length of time it will take LIBOR to return to "normal" really depends on the evolution of the COVID-19 pandemic. If the outbreak is brought under control in the near term, then tensions in financial markets should soon subside and LIBOR will fall back to "normal" in due course. But if measures to contain the outbreak remain in place for months, then financial markets likely will remain concerned about the ability of businesses and households to remain current on their debt obligations. This in turn may raise questions about the health of the financial system, which could be reflected in continued elevated interbank rates, such as LIBOR. Under that scenario, LIBOR could remain fairly elevated relative to SOFR or the fed funds rate for an extended period of time.

In any event, there are no plans at this time to delay the eventual transition from LIBOR to SOFR as the benchmark lending rate in the United States. As shown in Figure 1, there tends to be a high correlation between SOFR and the effective fed funds rate. As we wrote in our report in January, the level of SOFR is determined largely by the monetary policy stance of the Federal Reserve. In that regard, we expect that the FOMC will maintain the 0.00% to 0.25% target range for the fed funds rate for the foreseeable future. In other words, SOFR likely will remain close to 0% for quite some time.

Author

Wells Fargo Research Team

Wells Fargo