Get ready for SOFR : Low rates for foreseeable future

Executive Summary

At the time of our last SOFR update in early April, LIBOR rates and SOFR had diverged significantly due to the financial market dislocations that the pandemic imparted to the global economy. However, "normalcy" has more or less returned to money markets due, in large part, to the steps that the Federal Reserve has taken to ease tensions in financial markets. If, as we expect, the Federal Open Market Committee (FOMC) keeps its target range for the fed funds rate unchanged at 0.00% to 0.25% through at least the end of next year, then SOFR should remain at rock bottom for the foreseeable future. Market participants should continue to be prepared to transition from LIBOR to SOFR as soon as the end of 2021.

"Normal" Has Returned to Money Markets

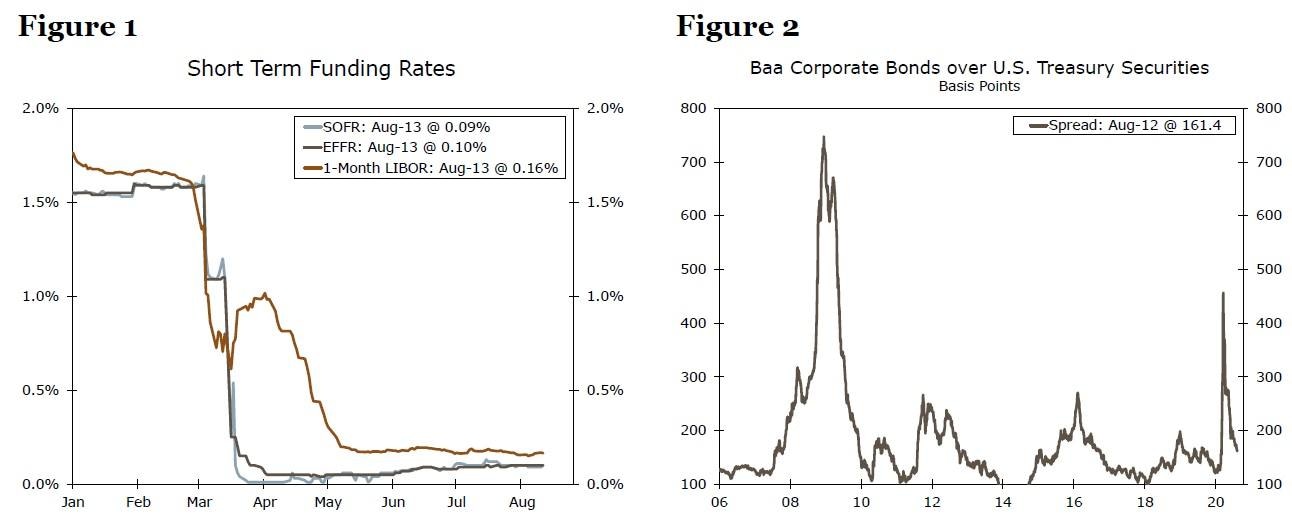

When we wrote our last SOFR update in early April, the global economy was still reeling from the initial shock of the lockdowns that many countries implemented in response to the pandemic. As we noted at that time, 1-month LIBOR and SOFR, which usually are highly correlated, diverged significantly starting in mid-March (Figure 1). Although SOFR followed the FOMC's target range for the fed funds rate lower, 1-month LIBOR moved higher in late March and early April. This rise in LIBOR, which is an unsecured interest rate, reflected, at least in part, general tensions in credit markets that surfaced in March (Figure 2).

Source: Bloomberg LP and Wells Fargo Securities

Fast forward four months, and the situation has returned largely to "normal." The prompt response of policymakers, especially steps that the Federal Reserve has implemented to support credit markets, has caused corporate bond spreads to compress nearly all the way back to levels that prevailed in late February (Figure 2). Consequently, 1-month LIBOR has receded from roughly 1.00% in early April to 0.17% at present. At the same time, SOFR has edged up from its late March low of 0.01% to 0.10% currently. What is going on here?

On the LIBOR front, improved liquidity and tighter spreads in short-term, unsecured lending markets, particularly commercial paper, have helped push 3-month LIBOR down.1 Diminished concern about bank credit quality has likely also helped, as have the Federal Reserve's numerous actions to improve access to dollar funding through its various liquidity programs. On the SOFR side, more tranquil financial markets have likely reduced the demand for secured places to park money on a short-term basis. At the peak of the crisis, owning Treasury bills outright or lending overnight in the Treasury repo markets were among the safest places to keep cash.

In addition, the flood of Treasury issuance in recent months has also helped to push up SOFR. Since February, the Treasury Department has issued a net $2.5 trillion of T-bills, and this deluge of supply has pushed down the price of bills (i.e., pushed up their yield). As the rate on the 1-month T-bill has crept up from its low of -0.107% in late March to 0.07% at present, so too has SOFR. That said, SOFR is more or less in the middle of the Fed's target range for the fed funds rate (currently between 0.00% and 0.25%), which is typical during "normal" times.

Author

Wells Fargo Research Team

Wells Fargo