GDP estimates proven useless: It's time to replace them

Today's numbers highlight many of issues surrounding GDP reporting and estimates.

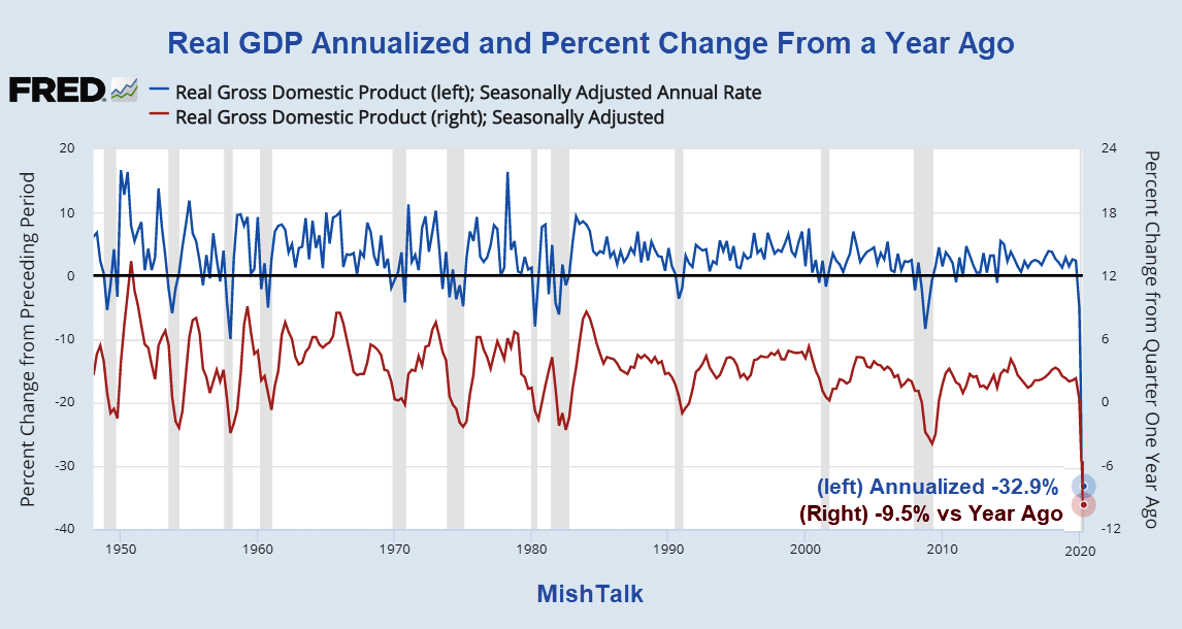

US GDP Down Record 32.9 Percent

Earlier today, I noted the US Economy Declines by a Record 32.9 Percent.

The economy did not drop by a third. But that is what it looks like when you take quarterly numbers and annualize them.

That we can deal with, but the process of taking inaccurate estimates then annualizing the data and revising them multiple times, with enormous delays on top of it all serves no purpose.

Rick Davis at the Consumer Metrics Institute finished his column today with a rant on that idea. Let's tune in.

Fatally Flawed Reporting

The BEA's quarterly regimen and methodologies renders their data useless for policy making purposes. It is perhaps an academic treasure trove for PhD candidates, but the policy informing purpose that FDR envisioned for the agency in 1939 is simply no longer being met. In the 21st century -- with millisecond transacting -- there is no excuse for not replacing this exercise with a monthly series, published in the middle of the following month. The "consistency" mantra for maintaining the current series helps the PhD candidates, but it utterly fails the American people. Let the PhD candidates figure out how to reconcile a new monthly series to the historical quarterly data.

This sets the stage for an equally outrageous up-side quarterly report, to be published just days before the US 2020 election -- although most voters by that time will be in a "who cares" mode.

There is not much more we can say. Things are bad, but reports like this don't help any ongoing policy or response debates. And the next release will merely be more of the same. Luckily, the pandemic will probably keep most people from taking note of this mess of a report.

Grossly Distorted Procedures

In addition to Davis' ideas the GDP has additional flaws with imputations and hedonics.

I once proposed changing the meaning of GDP from Gross Domestic Product to Grossly Distorted Procedures.

Three Examples

- The BEA takes the alleged value of "free checking accounts" and ads that to the total GDP. That the bank gets use of customer money so the checking accounts are not really "free".

- Those who own their own home are alleged to pay rent on it. That adds to GDP.

- Government spending, no matter how useless, allegedly adds to GDP. I often wonder "Where's the Product?"

Economists worry about the numbers, What can we do to get more of it? The answer is always spend more money with deficits and debt soaring as a result.

If government wants to boost GDP, why not add the value of free marital sex on the theory that if men were not married they would have to pay for it. And what about free massages? Why not, that's what we do to "free" checking accounts?

Or, we can do what Davis suggests and just scrap the mess as fatally flawed.

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc