GBP/USD Weekly Outlook: Pound Sterling aims to resume uptrend in UK inflation week

- The Pound Sterling oscillated in a familiar 150-pip range against the US Dollar.

- The focus shifts to the UK inflation and global PMI data for fresh trading impetus.

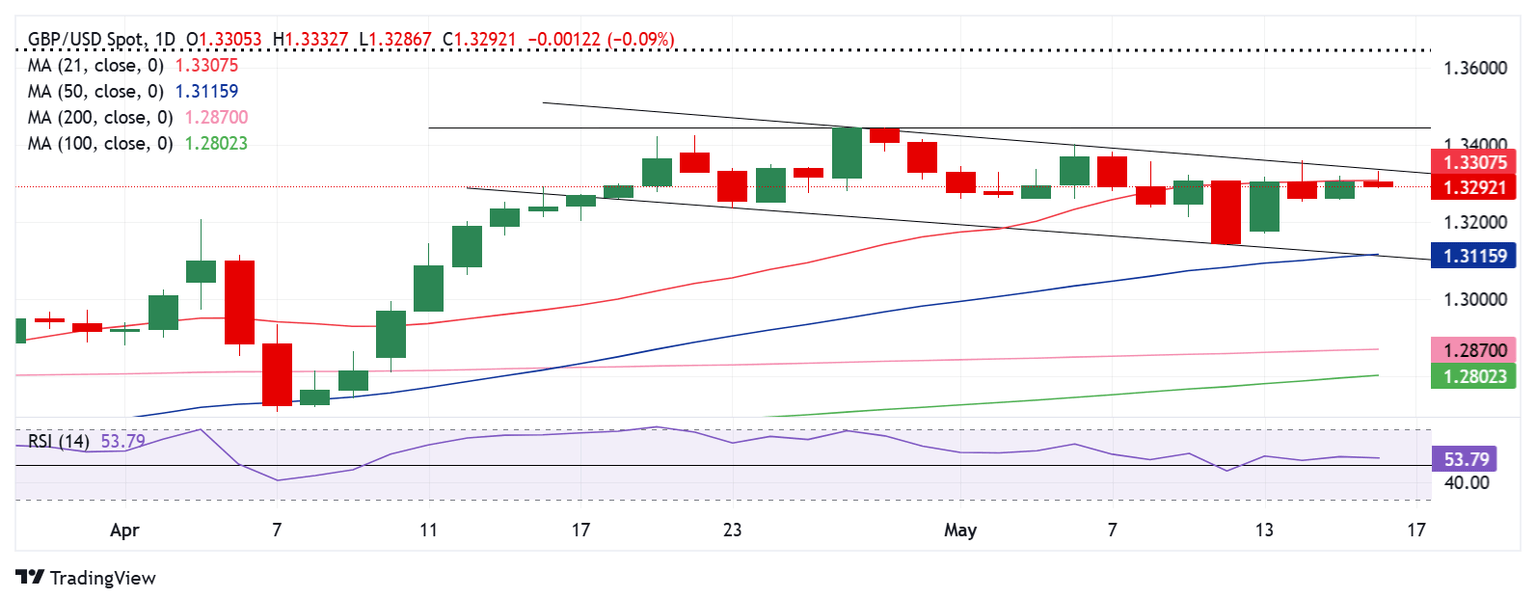

- GBP/USD is teasing a falling channel on the daily chart; bullish RSI favors an upward resolution.

The Pound Sterling (GBP) regained its footing against the US Dollar (USD) after the GBP/USD pair exhibited strong two-way price movements within a 150-pip range during the week.

Pound Sterling fought back as USD faltered

Following a painful start to the week, the GBP/USD managed to find its footing as the US Dollar lost its recovery momentum in the latter part, with optimism surrounding the US-China trade truce fading.

On Monday, the pair came under intense selling pressure, hitting a one-month low at 1.3140 after the US Dollar rallied hard following the news of the highly anticipated US-China trade truce. Following the weekend’s trade talks in Geneva, both sides agreed that the US would reduce levies on Chinese imports from 145% to 30% during a 90-day negotiation period, and China would lower duties from 125% to 10%.

Receding recession fears and bets that the US Federal Reserve (Fed) could extend the pause on interest rates bolstered the USD recovery. However, traders quickly moved in on Tuesday to cash in on their USD long positions as the US Consumer Price Index (CPI) cooled slightly in April, reviving dovish Fed expectations and sending Wall Street indices soaring. The Greenback fell in the aftermath of US inflation data release, driving the pair back above the 1.3300 threshold.

The Pound Sterling paid little heed to the mixed UK employment data, which showed that the ILO Unemployment Rate ticked up to 4.5% in the three months to March from 4.4%. During the same period, the Employment Change increased by 112,000, compared to 206,000 previously.

Sellers returned on Wednesday as GBP/USD faced rejection again near the 1.3360 region. The pair hit multi-day highs early Wednesday, drawing support from Bank of England (BoE) policymaker Catherine Mann’s comments. Mann noted: “The UK labor market has been more resilient than expected,” adding, “increasing inflation expectations are worrying.”

Optimism over US-South Korea trade talks and expectations of a US-Iran nuclear deal refuelled the US Dollar’s upside, triggering a brief pullback in the major.

In the second half of the week, the Greenback felt the heat of declining US Treasury bond yields. Downside surprises in US economic data this week reinforced bets for more Fed rate cuts this year, weighing on the US Treasury bond yields and the US Dollar.

Headline Retail Sales rose 0.1% month-over-month in April, slightly above expectations of 0% and well below the 1.5% increase seen in March. Meanwhile, the Producer Price Index (PPI) rose 2.4% on a yearly basis in April, compared to the 2.7% increase recorded in March and below the estimated 2.5% print.

The pair also capitalized on UK growth optimism after the latest data showed that the UK economy grew 0.7% in the three months to March 2025, following a 0.1% increase in the final quarter of 2024. The data beat the expected 0.6% rise in the reported period.

The Greenback remained on the defensive against its currency rivals on increased speculation that Washington could be pushing for a weaker US Dollar as part of trade deals with its Asian trading partners.

A South Korean government official reported on Thursday that South Korea's Deputy Finance Minister Choi Ji-young met with Assistant Secretary for International Finance at the US Treasury, Robert Kaproth, to discuss the Dollar/Won market on May 5.

On Friday, the data from the US showed that the University of Michigan's Consumer Sentiment Index declined to 50.8 in May from 52.2 in April. The one-year Consumer Inflation Expectation component of the survey rose to 7.3% from 6.5%, allowing the USD to hold its ground heading into the weekend and causing GBP/USD to stretch lower.

Another data-packed week ahead

Pound Sterling traders brace for another action-packed week, filled with top-tier economic data releases from both sides of the Atlantic.

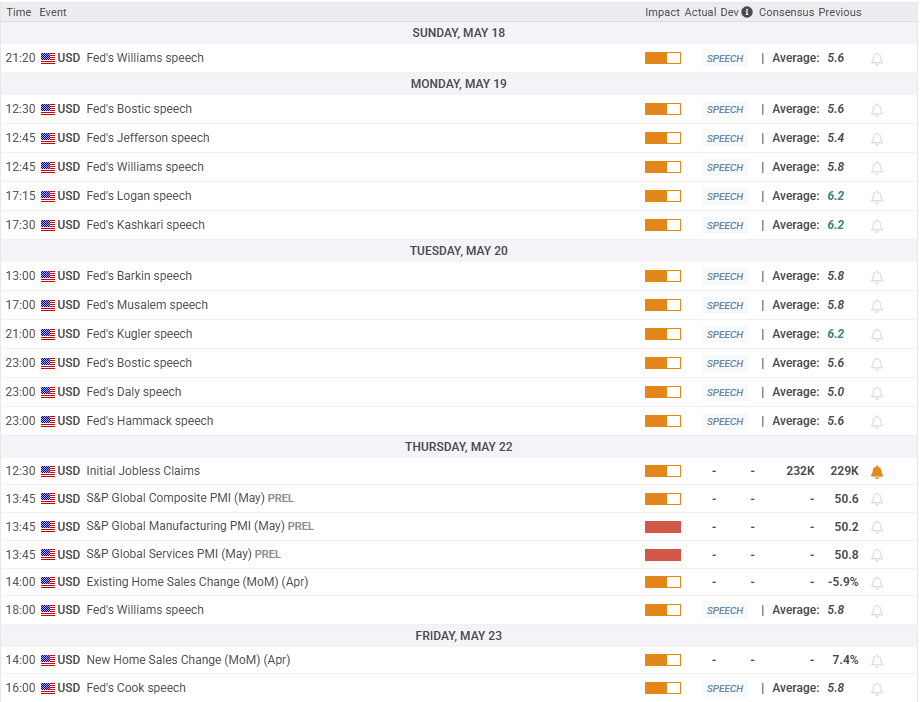

Monday is relatively empty data-wise, but a raft of speeches from the Fed policymakers will make up for it. Tuesday is again light, and hence, attention will remain on BoE Chief Economist Huw Pill’s appearance.

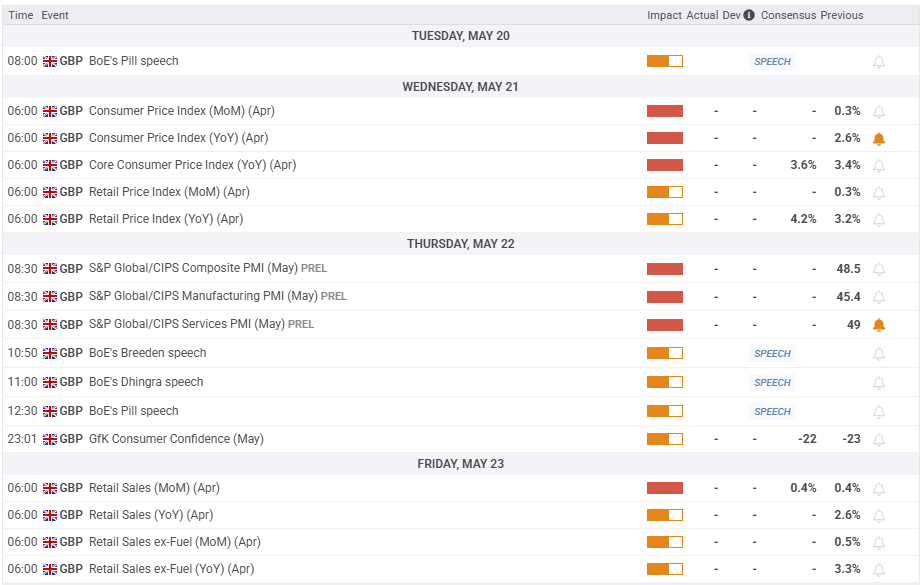

The UK CPI inflation data will stand out on Wednesday, in the absence of high-impact US macro news. Thursday will be the busiest day of the week in terms of data flow, as the S&P Global preliminary Manufacturing and Services PMIS from the UK and the US are due for release.

On Friday, the UK Retail Sales data will be the only relevant data on the cards, while the US New Home Sales will be of interest to American traders.

Other key highlights for the week will likely include trade talks and geopolitical developments surrounding the Israel-Hamas conflict and the Russia-Ukraine situation. Central bank speak will also hold the key in guiding the markets’ pricing of the future rate cuts by the Fed and the BoE.

GBP/USD: Technical Outlook

After reaching a three-year high of 1.3445 on April 28, GBP/USD has been in a steady decline, carving out a falling channel on the daily time frame.

The 14-day Relative Strength Index (RSI) remains above the midline, currently trading near 55, indicating bullish conviction.

If buyers find acceptance above the falling trendline resistance at 1.3390, it will confirm a break to the upside from the channel.

Doors will then open up toward the three-year high of 1.3445. The next topside targets are at the 1.3500 round level and the February 2022 high of 1.3644.

Upon rejection at the aforementioned trendline resistance at 1.3390, the pair could correct toward the May 13 low of 1.3270.

Additional declines will challenge the strong demand area near 1.3115, where the falling trendline support and the 50-day Simple Moving Average (SMA) coincide.

The last line of defense for buyers is aligned at the 1.3050 psychological level.

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.