GBP/USD Weekly Forecast: Pound Sterling at risk as UK inflation to impact on BoE’s rate prospects

- The Pound Sterling fell for the second week in a row against the US Dollar.

- GBP/USD gears up for top-tier UK economic data in the holiday-shortened week ahead.

- Technically, risks remain skewed to the downside for the Pound Sterling.

The Pound Sterling (GBP) booked the second straight weekly loss against the US Dollar (USD), sending the GBP/USD pair to the lowest level in a month below 1.3050.

Pound Sterling failed again versus the US Dollar

A surprisingly strong United States (US) Nonfarm Payrolls (NFP) report for September suggested that the US labor market is in a healthier condition than initially feared, ruling out any possibility that the Federal Reserve (Fed) opting for a 50 basis points (bps) interest rate cut in November.

Markets expected a 94% chance of a 25 bps rate cut at its next meeting after the US employment report, the CME Group's FedWatch Tool showed. Currently, markets price in an 86% probability of such a move, and there is no big change despite the hot US Consumer Price Index (CPI) data for September, released on Thursday. Discouraging US Jobless Claims overshadowed the consumer inflation data, keeping the November rate cut hopes alive and kicking.

Data released by the US Labor Department showed on Thursday that Initial Jobless Claims surged by 33,000 last week to a seasonally adjusted 258,000 for the week ended October. 5. Meanwhile, US annual CPI inflation dropped to 2.4% in September from 2.5% in August, the lowest level since February 2021, although it still came in above the estimated 2.3% print. The CPI increased by 0.2% over the month in September, matching August’s increase and surpassing 0.1% expectations.

Expectations of a smaller rate cut by the Fed at its upcoming meeting remained the key driver throughout the week, allowing the US Dollar to extend its recovery to a fresh two-month high against its major rivals. Therefore, the GBP/USD pair continued its downside momentum, hitting the lowest level in a month below 1.3050.

From the UK side, there were no high-impact economic data releases until Friday’s monthly Gross Domestic Product (GDP). The UK economy grew 0.2% in August on a monthly basis, data published by the Office for National Statistics (ONS) showed. The reading aligned with the market forecast.

Pound Sterling traders continued to assess the odds of a Bank of England (BoE) rate cut next month, following the contradictory messages from BoE policymakers last week. BoE Chief Economist Huw Pill said earlier this month that there is “ample reason for caution in assessing the dissipation of inflation persistence.”

He added that the “need for such caution points to a gradual withdrawal of monetary policy restriction.” Just a day before Pill’s appearance, Governor Andrew Bailey noted that the UK central bank “could become a bit more activist on rate cuts if there’s further good news on inflation.”

Top-tier UK economic data on tap

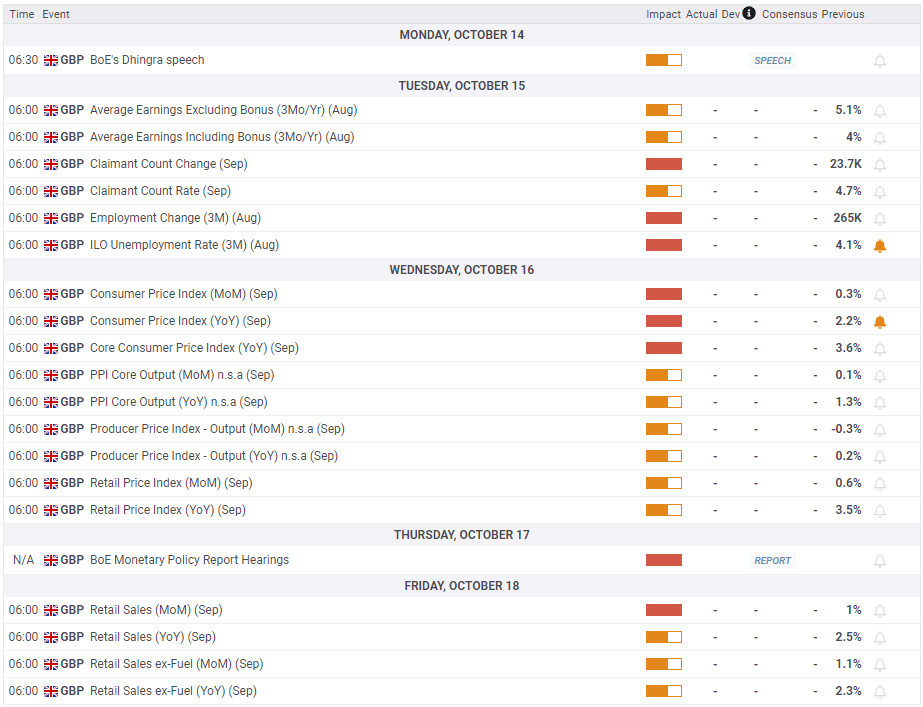

The focus now shifts to a batch of high-impact economic data from the United Kingdom, which could provide a sense of what markets expect from the Bank of England (BoE) next month.

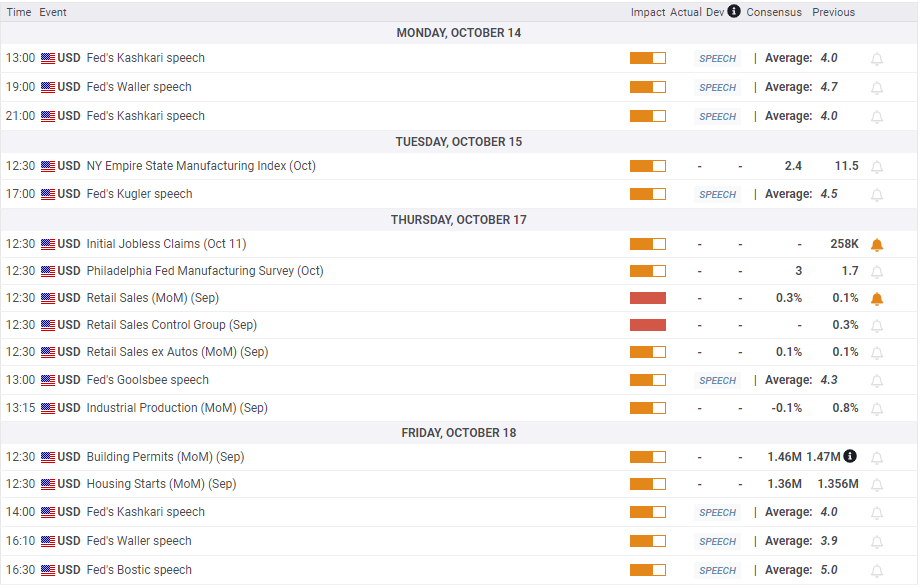

The US economic calendar is relatively data-light, with the only Retail Sales data for September of note.

It’s a holiday-shortened week, as US markets are closed on Monday on account of Columbus Day. That puts the focus on Tuesday’s UK labor data.

Wednesday will feature the UK CPI data for September, which will have a significant impact on the BoE’s interest rate move in November, as well as on the Pound Sterling. On Thursday, the US Retail Sales report will be published alongside the releases of the weekly Jobless Claims and Philly Fed Manufacturing Index for October.

The European Central Bank (ECB) is set to announce its policy decision on Thursday, which could have a EUR/GBP cross-driven ‘rub-off’ effect on the GBP/USD pair.

Chinese activity data on Friday could affect risk trends, eventually influencing the risk-sensitive British Pound. Later that day, the UK Retail Sales data for September will be reported, followed by the mid-tier US housing data.

Besides, speeches from Fed and BoE officials will grab attention while Mid-East geopolitical developments will also be closely eyed.

GBP/USD: Technical Outlook

The GBP/USD pair finally yielded a downside break of the critical 50-day Simple Moving Average (SMA) at 1.3101 on Wednesday, having managed to defend that support the prior week.

Acceptance under that level helped sellers to flex their muscles, with more downside likely on the cards, as the 14-day Relative Strength Index (RSI) remains well below the 50 level, currently near 40.

If the selling around the Pound Sterling intensifies, the 100-day SMA at 1.2945 would emerge as the next rescue point for buyers.

Further down, the 1.2790 region will be put to the test. That zone is the confluence of the August 15 low and the 200-day SMA.

Alternatively, recapturing the 50-day SMA at 1.3101 on a daily closing basis is crucial to initiate any meaningful recovery toward the 21-day SMA at 1.3225.

Pound Sterling will then target the 1.3300 round level should the upswing gather stream.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.