GBP/USD Weekly Forecast: Pound Sterling looks to 1.2450 in the UK inflation week

- GBP/USD extended the previous week's recovery and hit four-week highs near 1.2250.

- US Dollar crumbled as United States Consumer Price Index data ramped up dovish Federal Reserve bets.

- Further upside in GBP/USD remains on the card, with eyes on the United Kingdom Consumer Price Index data.

GBP/USD has booked the second straight week of 2023 in the green, as sellers refuse to give up on the United States Dollar (USD) amid dovish US Federal Reserve (Fed) expectations. Will the Pound Sterling bulls extend control in the United Kingdom Consumer Price Index (CPI) week?

GBP/USD saw a strong bullish reversal

The Pound Sterling gained over 100 pips against the United States Dollar in the week, which was all dominated by the US Federal Reserve rates outlook this year and the resultant collapse in the US Dollar in the second half. In the lead-up to the most critical data of the week, the United States Consumer Price Index (CPI), markets built expectations around a slowdown in the Federal Reserve's tightening pace while many also believed a dovish Fed pivot toward the end of this year. Despite the recent hawkish commentary from the Federal Reserve policymakers, endorsing a peak rate in the range of 5%-5.25% to tame inflation, investors failed to pay any heed and fuelled hopes of a Fed slowdown on rate hikes, which continued to exert bearish pressure on the US Dollar against its major rivals. Ahead of the United States Consumer Price Index (CPI), markets wagered a Federal Reserve terminal rate at around 4.95% in June, followed by a decline to 4.46% by December, implying rate cuts in 2023.

On Thursday, the US December Consumer Price Index arrived at 6.5% vs. 6.5% expected YoY from 7.1% in November, while the Core CPI dropped to 5.7% YoY vs. 5.7% expected and 6.0% previous. The monthly CPI data eased to -0.1% in December vs. 0% expected and 0.1% previous. The Core CPI came in at 0.3% MoM vs. 0.3% expected and November's 0.2%. The softer US Consumer Price Index report triggered a renewed sell-off in the US Dollar Index, as it tested the 102.00 level – fresh seven-month lows. The benchmark 10-year US Treasury bond yields breached the crucial 3.50% level, as the Fed-linked swaps showed a cycle policy peak of around 4.97% after the Consumer Price Index data. Markets priced in a roughly 75% probability of a 25 bps rate hike in March, while for the February meeting, a 25 bps increase was fully baked in. Federal Reserve Bank of Philadelphia President Patrick Harker said after the US inflation report that It's time to switch to 25 basis point increments for future Fed rate increases, adding that "once hikes end, the Federal Reserve will need to hold steady for a bit." The explicitly dovish comments from Harker exacerbated the pain in the United States Dollar.

On the Pound Sterling side of the story, an absence of top-tier economic data from the United Kingdom was seen as good news for Cable bulls. Comments from Bank of England (BoE) Chief Economist Huw Pill, also helped the Britsh Pound extend its recovery momentum. Pill sounded upbeat on the economic prospects, citing, "Supply disruptions appear to have eased in recent months." Meanwhile, Bank of England Monetary Policy Committee (MPC) member, Catherine Mann, spoke about the energy price caps and their impact on inflation.

Some optimism came from hopes of a potential end to England's rail strike misery, as a deal seemed "within touching distance" on Thursday as ministers scaled back their demands for driver-only operated trains. Earlier in the week, British Prime Minister, Rishi Sunak, said he was willing to discuss pay raises for nurses in an effort to end strikes that have deepened a crisis within the health service. Additionally, Friday's November Gross Domestic Product (GDP) data from the United Kingdom showed an unexpected expansion of 0.1% when compared to a -0.2% reading estimated. However, the GBP/USD pair failed to cheer the upbeat growth numbers, as the country's industrial sector activity suffered heavily in November.

The University of Michigan (UoM) reported on Friday that the Consumer Confidence Index improved to 64.6 in early January from 59.7 in December. Further details of the publication revealed that the year-ahead inflation expectations receded for the fourth straight month, falling to 4.0% in January from 4.4% in December. The US Dollar struggled to stage a rebound after this report and allowed GBP/USD to cling to its weekly gains.

Focus on United Kingdom Consumer Price Index data

With the all-important United States Consumer Price Index (CPI) having brought back volatility into markets, attention now turns toward a data-intensive week for the United Kingdom's economy. Meanwhile, it's a holiday-shortened week for the United States, as the market will remain closed on Monday in observance of Martin Luther King Jr. Day.

The World Economic Forum (WEF) annual meetings kick-off on Monday, panning throughout the week but are unlikely to have much market impact.

On Tuesday, China's Q4 Gross Domestic Product (GDP) and business activity data will be reported, which could have a significant bearing on risk sentiment, eventually influencing the high-beta Pound Sterling. The United Kingdom Employment data will drop on the same day while the United States data docket will be a relatively dry one.

Wednesday's Consumer Price Index data from the United Kingdom will be closely scrutinized for fresh hints on the Bank of England policy outlook this year. The UK annualized Consumer Prices Index (CPI) came in at 10.7% in November against the 11.1% registered in October while missing estimates of a 10.9% print, according to the UK Office for National Statistics (ONS).

Meanwhile, the US will publish on Wednesday the Producer Price Index data alongside the key Retail Sales report and a few minority reports.

Investors will brace for the Bank of England Credit Conditions Survey and US weekly Jobless Claims data on Thursday. On the final trading day of the week, the United Kingdom Retail Sales data will be released while the US will see the publication of the Existing Home Sales.

Apart from the economic releases during the week, the GBP/USD pair will also closely follow the speeches from the Federal Reserve and Bank of England policymakers while risk trends will continue to play a pivotal role.

GBP/USD: Technical outlook

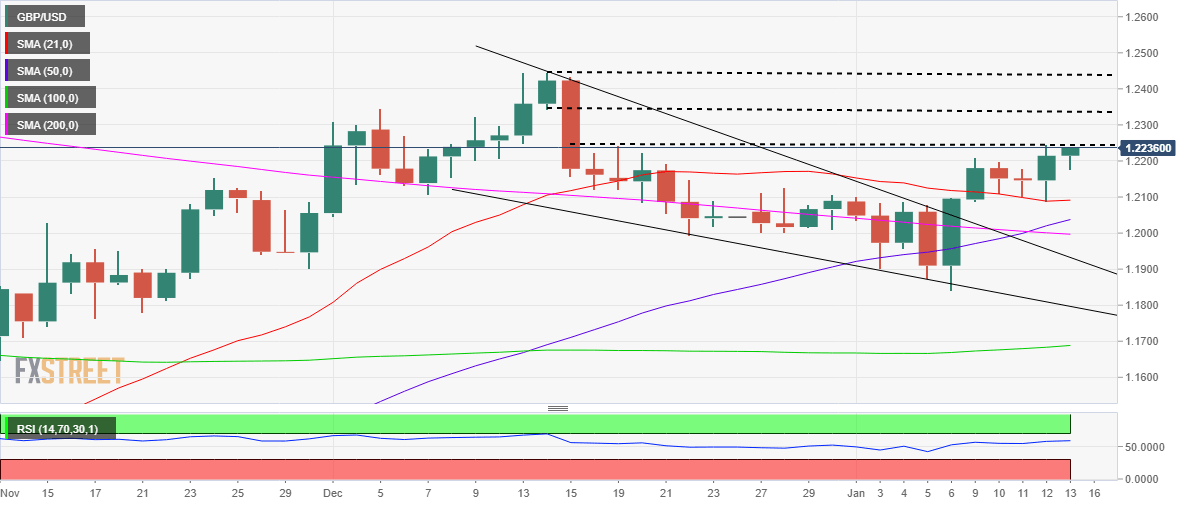

After confirming an upside break from a falling wedge pattern on January 6, GBP/USD added to the recovery gains gradually over the past week.

In doing so, the pair recaptured the critical short-term 21-Daily Moving Average (DMA), now at 1.2090. Although bulls seem to have run into a powerful horizontal resistance placed near 1.2250.

A weekly closing above the latter could provide additional legs to the ongoing recovery, allowing the Pound Sterling buyers to initiate a fresh upswing toward December 14 low at 1.2342.

Further up, the 1.2400 round level could be challenged, as GBP/USD optimists widen their target, envisioned at the six-month top of 1.2446.

The 14-day Relative Strength Index (RSI) is inching slightly higher above the midline, keeping the optimism alive for bullish traders. Adding credence to the move higher is the Golden Cross validated earlier in the week. The 50 DMA pierced through the 200 DMA from below on Wednesday.

On the flip side, any retracements from higher levels will test the 21 DMA resistance-turned-support, below which the bullish 50 DMA support at 1.2037 will come into play.

The additional downside will expose the 200 DMA once again, now aligned at 1.1996. The last line of defense for Pound Sterling bulls is seen at the wedge resistance now support at 1.1935.

GBP/USD: Forecast poll

The FXStreet Forecast Poll shows that a large portion of polled experts see GBP/USD moving sideways next week with the one-week average target sitting at 1.2195. The one-month outlook remains overwhelmingly bearish.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.