GBP/USD: The downtrend continues

GBP/USD

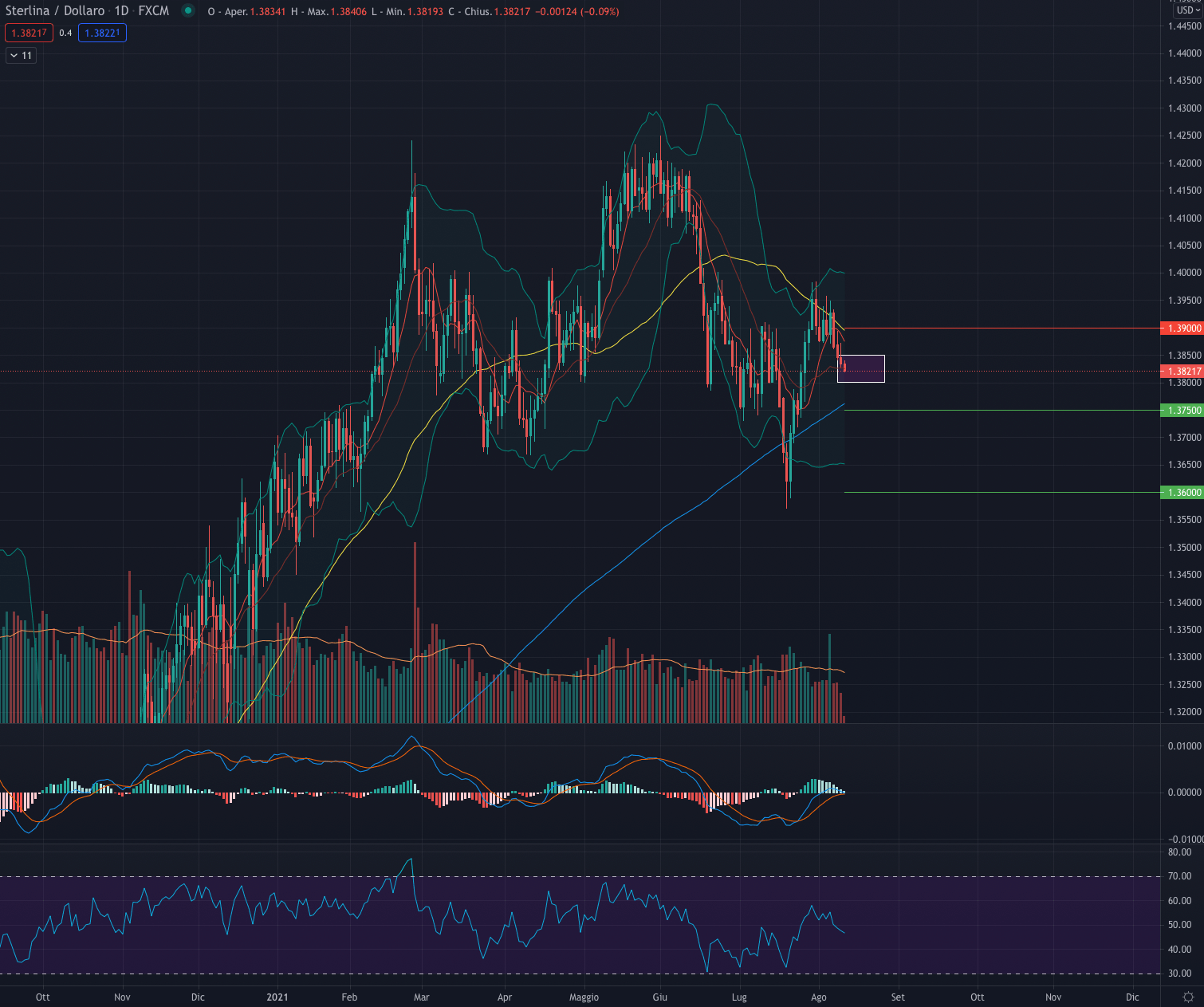

The GBP/USD after reaching 1.4250 in June has entered into a bearish trend which we believe might continue into the short term.

Cable recently backtested and got rejected by the 50MA strengthening our idea that is soon due to another downside. We will put our first target just above the 200MA and if the level is broken we could easily reach 1.36.

If it actually managed to fall till 1.36 we could assist at a double bottom formation, increasing the chances for a long position.

Indicators

MACD is crossing to the downside picturing the loss of momentum once rejected by the 50MA. RSI is as well pointing to the downside, the strong resistance level is still holding at 60.

To conclude, the MA are playing an important role so far: the rejection from 50MA confirms the bearish trend, however the 200MA might eventually act as support

Entry range: 1.3800 - 1.3850.

Target 1: 1.3750.

Target 2: 1.3600.

Stop loss: 1.3900.

Author

Francesco Bergamini

OTB Global Investments

Francesco, BSc Finance and Msc in Business Management, graduated with Merit, is a professional with experience in the financial services industry and a keen interest in the financial markets.