GBP/USD: Sterling is under growing pressure now [Video]

![GBP/USD: Sterling is under growing pressure now [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/GBPUSD/new-style-twenty-pound-notes-3079195_XtraLarge.jpg)

GBP/USD

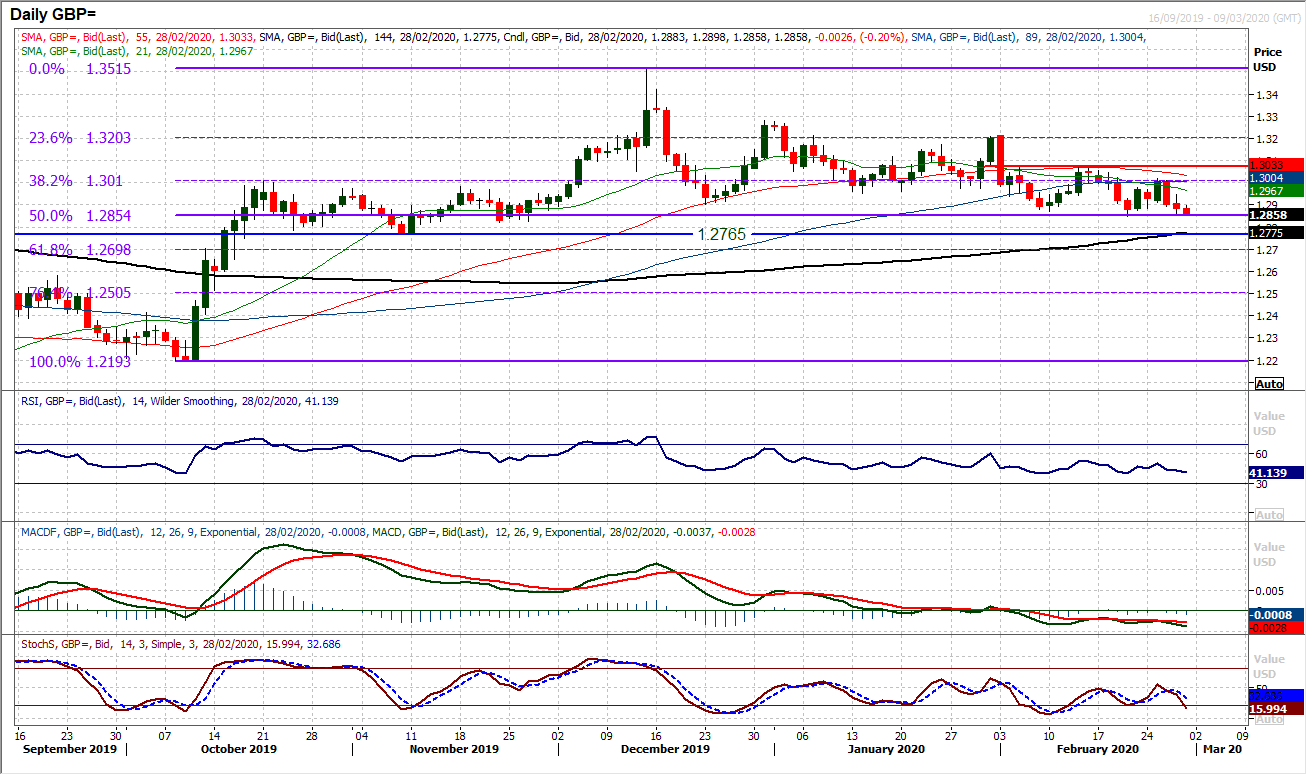

The dollar was smashed across the majors yesterday, but the fact that Cable fell on the day just goes to show that sterling is under growing pressure now. Testing the support at $1.2845 is coming and with the momentum indicators sitting with a negative bias, the selling pressure is mounting. Another lower low below $1.2845 would be a third key time this has been seen since December and the medium term sellers are gradually putting the squeeze on. The next support level is at $1.2820, however, the key level that needs to be watched comes in at $1.2765 which is the November low. Furthermore, closing decisively below the 50% Fibonacci retracement (of $1.2193/$1.3515) at $1.2850 would open the 61.8% Fib around $1.2700. The downside levels are becoming more realistic now. With the lower highs in place, rallies are being sold into. Resistance at $1.3015 is increasingly important, with yesterday’s high of $1.2945 initially the barrier today.

Author

Richard Perry

Independent Analyst