GBP/USD shows bullish spark, but key resistance nearby

-

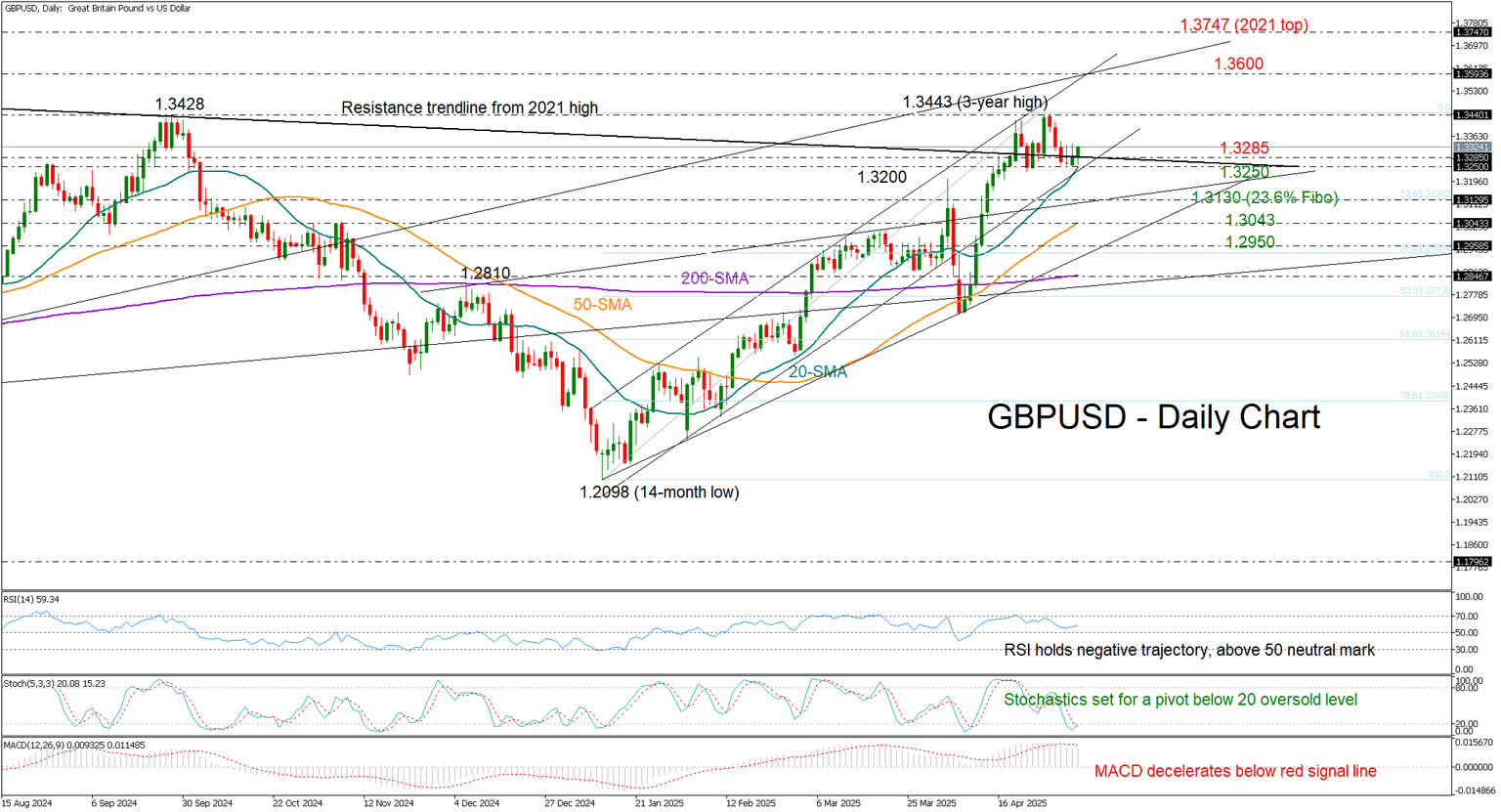

GBPUSD sends mixed signals near key support area of 1.3250.

-

Bulls need a decisive close above 1.3285.

GBPUSD seems to have ended Monday’s session with an inverted hammer candlestick - a potential sign of a positive reversal - just ahead of this week’s key FOMC and Bank of England (BoE) rate decisions on Wednesday and Thursday respectively.

The promising pattern is developing near 1.3250, a support area that has been holding for two weeks, with the rising 20-day simple moving average (SMA) adding extra credence to the region. This suggests a rebound could be brewing. However, the long-term resistance trendline from June 2021 has resumed its role near 1.3285 and the bulls will have to successfully breach that border to activate fresh buying.

Fundamentally, the Fed is expected to hold rates steady at 4.50%, while the BoE is forecast to cut by 25 basis points to 4.25%. The widening rate gap would slightly favor the dollar, but it remains to be seen whether the Fed will still consider cutting rates as early as June, especially after a disappointing Q1 GDP reading was followed by a surprisingly strong employment report.

Technically, a sustainable move above 1.3285 could lift the price straight to April’s three-year high of 1.3443. A victory there could cause a swift bull run towards the key trendline zone around 1.3600 and then up to the 2022 top of 1.3747.

Conversely, a drop below the 20-day SMA at 1.3250 could drag the pair toward 1.3130, where the 23.6% Fibonacci retracement of the 2025 uptrend is located. A break lower could meet the 50-day SMA currently near 1.3043, while a deeper decline might halt around the support trendline at 1.2950.

All in all, GBPUSD is still rangebound, sending conflicting signals, with traders awaiting a clear breakout above 1.3285 or a breakdown below 1.3250 to determine its next direction.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.