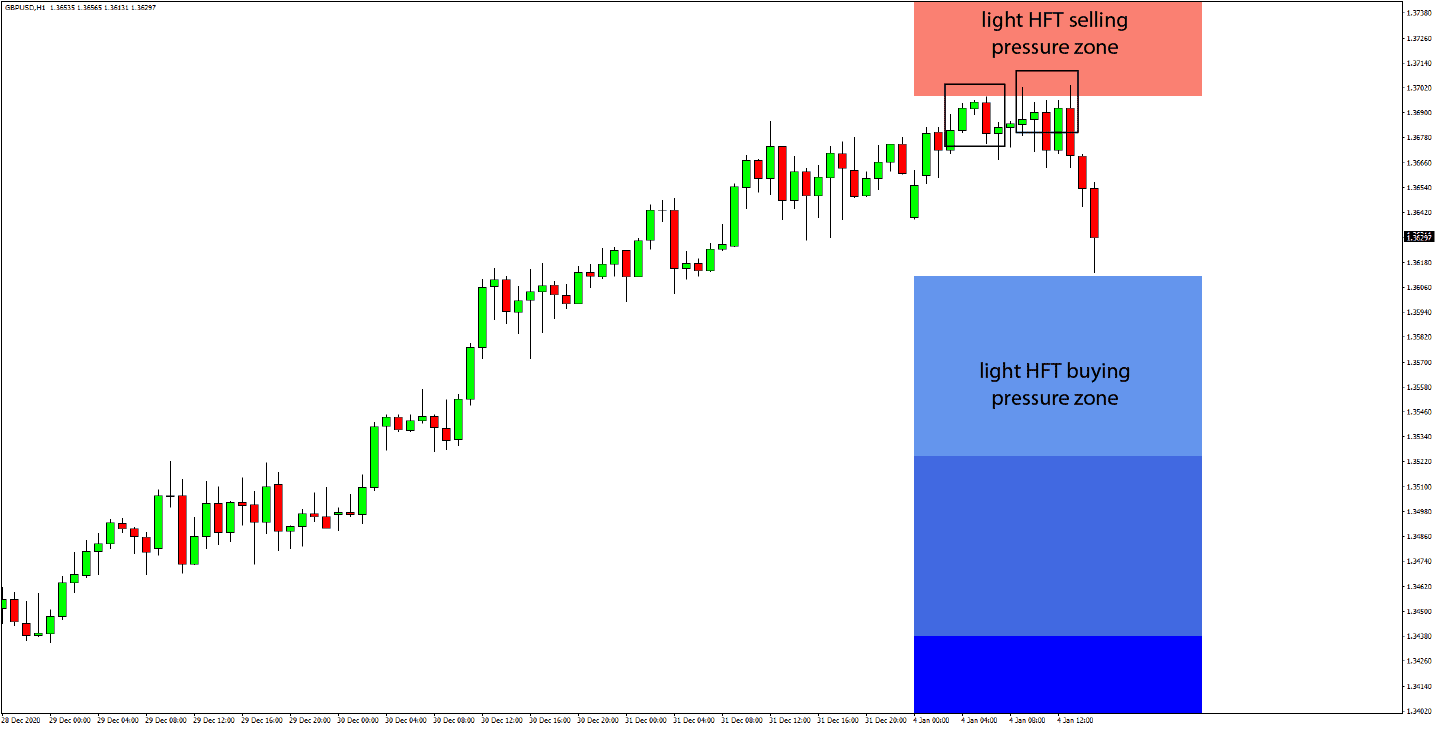

GBP/USD reverses at HFT sell zone and falls toward HFT buy zone

We are analyzing the activity of high-frequency trading algorithms today and find that the action is in the GBPUSD currency pair.

Cable reached the light HFT selling pressure zone in the morning and reversed there. The light HFT sell zone is noted at 1.3698 and above, and was the area where at least three separate bullish attempts were rejected today.

Then GBPUSD started to decline before New York's open and has come all the way down to the 1.3613 level. The light HFT buying pressure zone is very near and is standing at 1.3611 and below. GBPUSD bulls may be looking to enter fresh long positions at these levels.

GBP/USD Current Trading Positions

FX Trading Revolution - Your Revolutionary Forex Source

FX Trading Revolution - Your Revolutionary Forex Source

Author

FX Trading Revolution Team

FX Trading Revolution

The FX Trading Revolution website is a free independent FOREX source, and was founded to provide true and unbiased information about FOREX trading.