GBP/USD outlook: Sharp fall in equities, Brexit and risk of stricter COVID-19 measures deflate pound

GBP/USD

Cable was sharply lower in Europe on Thursday (down 0.5% for the session), driven by increased risk aversion that pushed European equities lower and lifted safe-haven dollar.

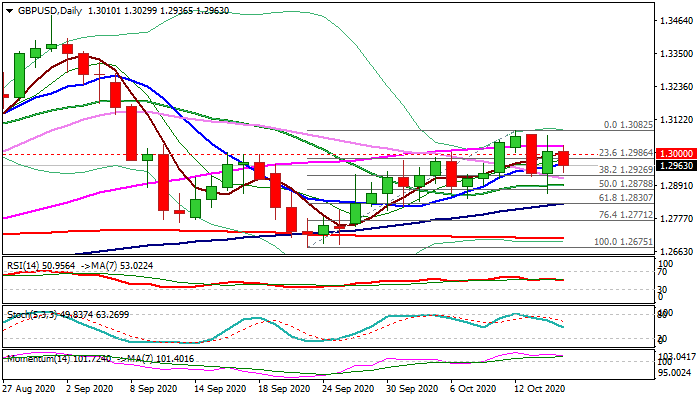

Fresh weakness returned below 1.30 mark, erasing so far the largest part of Wednesday's recovery and shifting near-term focus lower.

High volatility is maintained by Brexit talks as EU leaders meet today and said will pressure UK for more concessions as well as strong rise in new Covid-19 cases that prompts authorities to start imposing stricter measures, with London and Manchester facing new lockdown.

The pair is holding within choppy range of approx. 200-pips in past three days after bulls stalled above 1.30 level and conflicting news caused quick changes in direction.

Fresh bears pressure again pivotal Fibo support at 1.2929 (38.2% of 1.2675/1.3082) which was repeatedly cracked but without clear break so far.

Close below here is needed to signal reversal and open way for further retracement of 1.2675/1.3082 upleg, with break below the base of thinning daily cloud (1.2920) to boost negative signal and expose next pivotal support at 1.2830 (rising 100DMA/(Fibo 61.8% of 1.2675/1.3082).

Repeated failure to clear 1.2926/20 pivots would keep the pair in extended directionless mode, however near-term action is expected to remain biased lower while holding below 55DMA (1.3026).

Res: 1.3000; 1.3026; 1.3064; 1.3082

Sup: 1.2920; 1.2878; 1.2862; 1.2845

Interested in GBP/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.