GBP/USD outlook: Recovery above daily cloud likely to be limited

GBP/USD

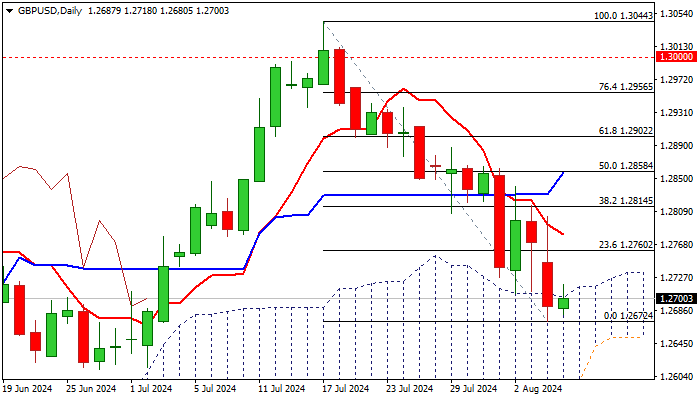

Cable started to gain traction and edged higher on Wednesday morning, after the latest drop penetrated rising daily cloud (cloud top at 1.2702) but found firm ground at 1.2682 (100DMA) where dips were repeatedly rejected.

Subsequent rise may generate initial bullish signal on return and close above daily cloud, though more work at the upside (violation of daily Tenkan-sen at 1.2780 and lift above Fibo 38.2% of 1.3044/1.2672 at 1.2814) will be required to validate signal.

On the other hand, bearish daily studies (daily Tenkan/Kijun-sen bear cross/strong negative momentum) warn of limited correction which would provide better selling levels for renewed attack at 100DMA and nearby 200DMA (1.2651).

Res: 1.2739; 1.2760; 1.2780; 1.2815.

Sup: 1.2682; 1.2651; 1.2612; 1.2584.

Interested in GBP/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.