GBP/USD outlook: Near-term bias remains neutral while the action holds within Aug range

GBP/USD

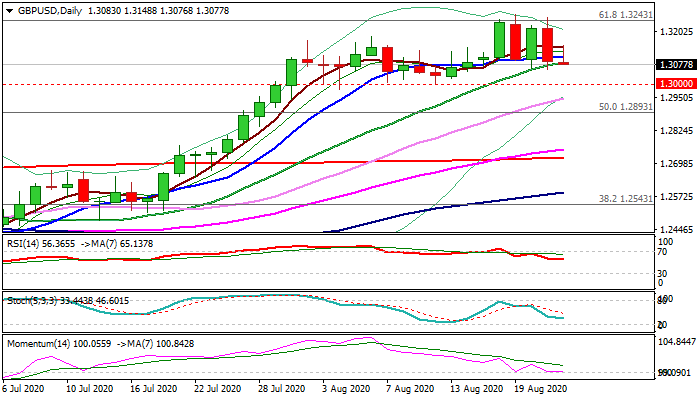

Limited rebound on Monday keeps cable at the lower side of two-hundred pips congestion which extends into fifth straight day.

Pullback from last week's new multi-month high (1.3266) was so far contained by rising 20DMA (1.3084) that keeps bulls alive and key support at 1.30 zone (psychological/higher base) intact.

Sideways-moving daily indicators point to neutral near-term bias, despite fresh risk demand on optimism over new method of Covid-19 treatment.

Traders look for clearer direction signal after the action in past three weeks was shaped in triple Doji and signaling strong indecision.

The extremes of August's range (1.2981 and 1.3266) mark pivotal points and break of either side would signal fresh direction.

Res: 1.3104; 1.3148; 1.3243; 1.3266

Sup: 1.3059; 1.3000; 1.2981; 1.2948

Interested in GBP/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.