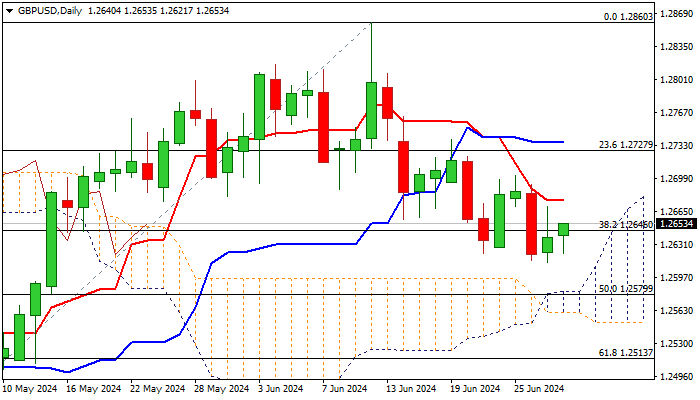

GBP/USD outlook: Initial signals of reversal above thickening daily cloud developing on daily chart

GBP/USD

Cable edged higher in European trading on Friday ahead of release of US inflation data, today’s key economic event, with better than expected UK Q1 GDP numbers adding to improving sentiment.

Technical picture shows conflicting signals from daily indicators (14-d momentum remains in the negative territory / MA’s are in mixed setup and thickening daily Ichimoku cloud continues to underpin near term action.

Several downside attempts have been contained recently by 55DMA, just above rising cloud top, which develops initial signals of basing, with current extended sideways mode, pointing to consolidation before bulls regain traction.

The notion is supported by formation on weekly inverted hammer, though verification of initial bullish signal will require lift and close above pivotal barriers at 1.2670 (10DMA) and 1.2702 (Jun 25 lower top), to shift near-term focus higher and expose targets at 1.2736/65.

Caution of break through daily cloud (currently spanned between 1.2582 and 1.2561) which would revive bears and risk deeper fall.

Res: 1.2670; 1.2702; 1.2736; 1.2765.

Sup: 1.2626; 1.2582; 1.2561; 1.2513.

Interested in GBP/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.