GBP/USD outlook: Cable remains constructive

GBP/USD

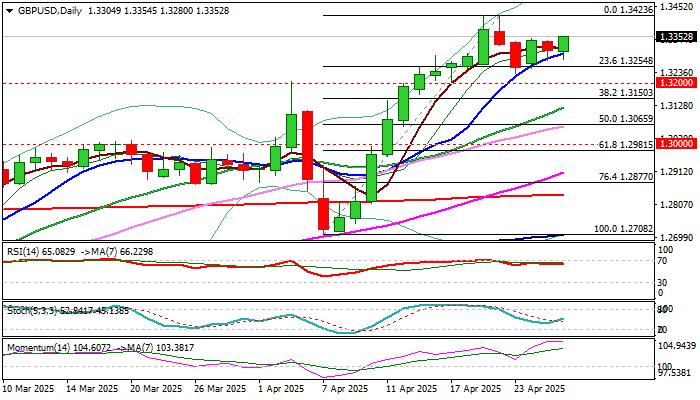

Cable edged higher early Monday and pressure pivotal barrier at 1.3350 (Fibo 61.8% of 1.3423/1.3232 pullback / former recovery peak of Apr 24).

Series of higher lows since 1.3232 correction low, with fresh recovery being tracked by ascending 10DMA add to near term bullish bias, with sustained break of 1.3350 needed to confirm that corrective phase is over, and larger bulls look for fresh attack at key 1.3434 barrier (2024 top).

On the other hand, sharp drop in confidence in the UK economy (at the historical low) and signal that already fragile economy may weaken further, add to warnings that larger bulls may stall on approach to 1.3434.

Growing optimism on fading threats from the negative impact from US trade tariffs and initial signals of Ukraine war peace talks may offer fresh support to US dollar and push sterling in defensive.

The notion is supported by overbought weekly studies, fading bullish momentum and strong upside rejection last week (weekly candle with long upper shadow).

Also, momentum is overstretched and turned sideways on daily chart, along with RSI being close the border of overbought zone, although daily studies are overall still bullish.

Expect prolonged consolidation while the price action remains limited by 1.3423 (recent recovery peak) and 1.3254 (Fibo 23.6% of 1.2708/1.3423 upleg / correction low).

Loss of 1.3254/ 1.3200 to weaken near term structure and risk deeper correction towards 1.3150 (Fibo 38.2%) and 1.3121 (20DMA).

Res: 1.3400; 1.3434; 1.3515; 1.3588.

Sup: 1.3298; 1.3254; 1.3200; 1.3150.

Interested in GBP/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.