GBP/USD outlook: Cable extends lower after triple failure at 1.30 as UK government considers new lockdown

GBP/USD

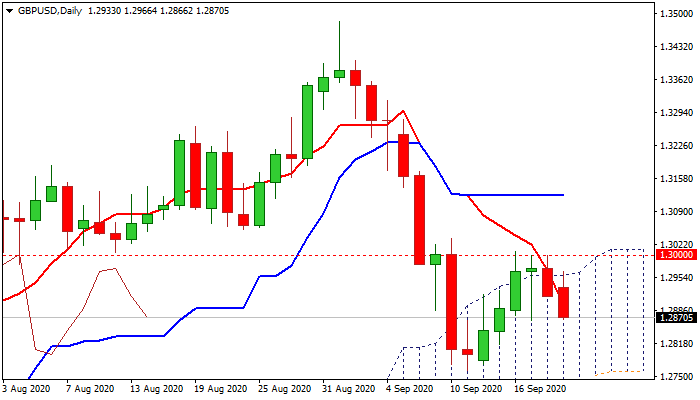

Cable keeps weak tone in early Monday, following triple failure at psychological 1.30 barrier last week.

Friday's action closed in red and within thick daily cloud, raising fears that probe above cloud was short-lived and reversal could be likely near-term scenario.

BOE's talks about negative rates weighs on pound, with the latest signals that the government considers the second national lockdown, as new Covid-19 cases rise sharply and the UK already has the biggest death toll in Europe.

The Britain is in the critical point in the pandemic and looking how to manage the situation ahead of very challenging winter period, as the economy has been already damaged, with new restrictions to further slowdown economic recovery process.

Weakening daily studies add to signals of recovery stall and reversal, as negative momentum continues to rise, stochastic turned south and 10/20/30/55DMA's returned to bearish configuration.

Another negative signal was generated on weekly chart as last week's action failed to close above 200WMA (1.2931). Fresh weakness probes below 50% of 1.2762/1.3007 recovery leg, adding to negative near-term outlook. Bears need break below 1.2856 (Fibonacci 61.8% of 1.2762/1.3007 to confirm reversal and expose key near-term supports at 1.2762 (11 Sep low) and 1.2727/18 (converged 200/100DMA's/daily cloud base), loss of which would point to deeper correction of Mar/Aug 1.1409/1.3482 rally. Daily cloud top (1.2958) offers solid resistance and guarding 1.30 pivot.

Res: 1.2913; 1.2958; 1.3000; 1.3037

Sup: 1.2856; 1.2820; 1.2762; 1.2727

Interested in GBP/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.