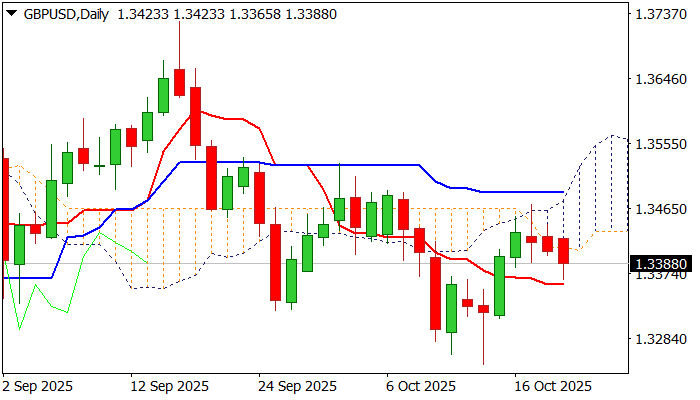

GBP/USD outlook: Biased lower while below thickening daily cloud

GBP/USD

Cable remains in red for the third straight day with fresh weakness on Tuesday, pointing to negative signals developing on daily chart.

Friday’s false break above daily cloud, left Doji candle with longer upper shadow and subsequent drop returned below cloud base, adding to negative signals.

Fresh bears need repeated close below the cloud base as minimum requirement, with thickening cloud providing pressure.

Violation of daily Tenkan-sen (1.3360) to confirm and expose last week’s spike low at 1.3248.

Negative momentum studies on daily chart contribute to scenario.

Cloud base (1.3406) marks solid resistance, although return and close within the cloud would sideline downside prospects.

Dily Kijun-sen reinforces cloud top (1.3487) which marks upper trigger, break of which would bring bulls in play.

Res: 1.3406; 1.3471; 1.3487; 1.3527.

Sup: 1.3360; 1.3323; 1.3311; 1.3261.

Interested in GBP/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.