GBP/USD monthly: Support at 1.3514, resistance at 1.4229 and 1.4242 [Video]

![GBP/USD monthly: Support at 1.3514, resistance at 1.4229 and 1.4242 [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/GBPUSD/strong-pound-weak-dollar-17536259_XtraLarge.jpg)

Overview

Watch the video for a summary of today’s news releases, a review of the USD Index, and a complete Top-Down Analysis of the GBPUSD.

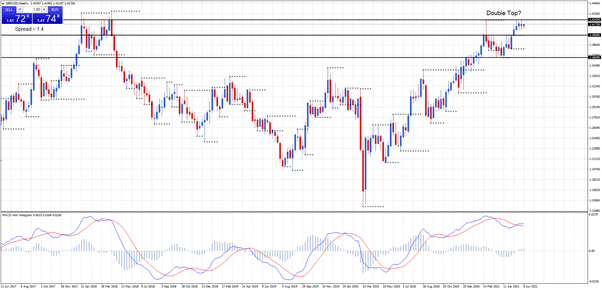

GBPUSD monthly

Monthly support at 1.3514, resistance at 1.4229, and 1.4242.

Over the last 4 months, price has been testing and holding at 1.4229 monthly resistance. Last week price retested 1.4229 and 1.4242 monthly resistance and sold off.

GBPUSD weekly

Weekly support at 1.4009 and 1.3669, resistance at 1.4242.

Price last week tested 1.4242 weekly/monthly resistance and formed a negative spinning top. Price breaking below last week’s low would start to confirm a reversal and a double top on this time frame.

GBPUSD daily

Daily support at 1.4091, daily resistance at 1.4248.

Price has broken below the last higher bottom changing the trend to down. MACD is showing negative divergence. Price trading below last weeks low of 1.4083 would confirm the weekly double top and a further decline. Long-term targets for the double top would be 1.3669 weekly support and then 1.3100 should 1.3669 weekly support be taken out.

Watch the video for a complete Top-Down Analysis of the GBPUSD.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Duncan Cooper

ACY Securities

Duncan Cooper is a full-time trader and mentor. He has been actively trading the financial markets for more than 15 years and has traded stocks, options, futures, and the Forex Market since 2005.