GBP/USD: Minor support at 1.4115/05

GBP/USD, EUR/GBP, GBP/NZD

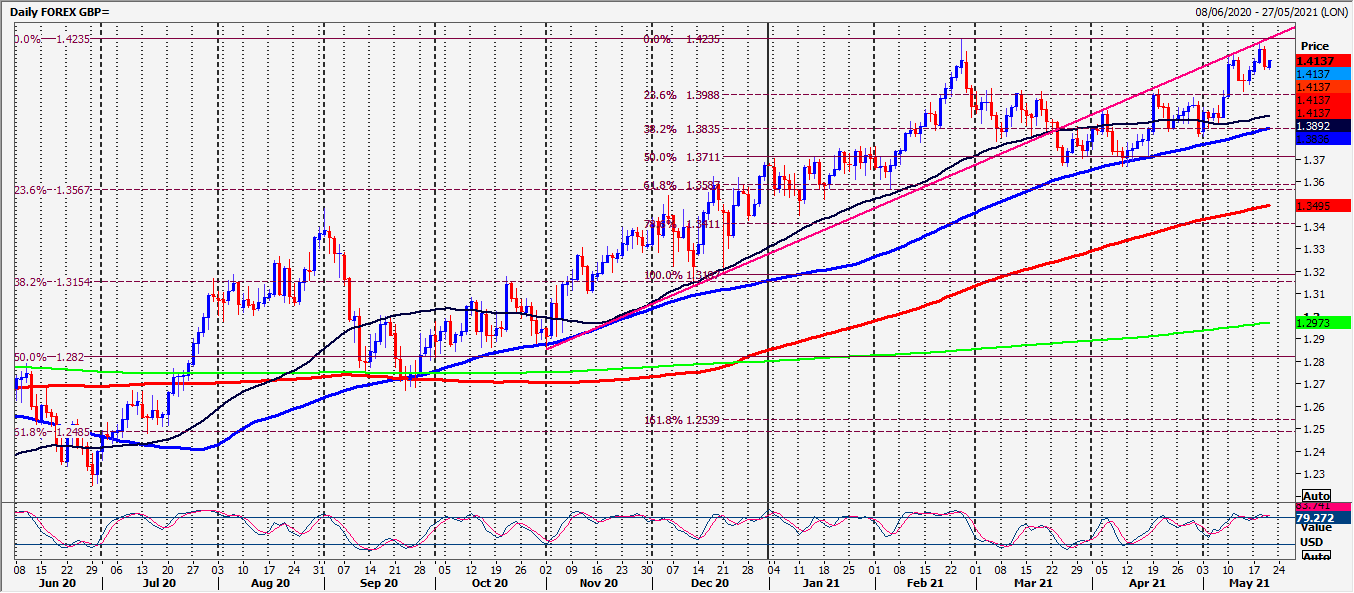

GBPUSD topped exactly at important 6 month trend line resistance now at 1.4220/30. We wrote: Shorts at 1.4220/30 target 1.4170/60. If we continue lower look for 1.4130/20.

Perfect!! A potential 100 pips profit as we hit 1.4130/20. WE HAVE A MAJOR DOUBLE TOP SELL SIGNAL.

EUR/GBP

GBPNZD we wrote: holding above 1.9550/60 targets 1.9620/30 (hit this morning) & the May high at 1.9660/70. A break above 1.9690 targets 1.9715/25.

All targets hit.

Daily analysis

GBPUSD minor support at 1.4115/05. A break lower targets 100 month moving average support at 1.4080/60, perhaps as far as support at 1.4025/15.

Gains are likely to be limited with minor resistance at 1.4135/40 & 1.4160/70. Important 6 month trend line resistance now at 1.4220/30. A break higher targets strong 200 week moving average resistance at 1.4300/10.

EURGBP first support at 8600/8590 but below here re-targets 8565/60. A break lower to today targets 8530/20.

First resistance at 8640/50. A break higher re-targets 8665 & 8712/19. A break higher targets 8750/60, perhaps as far as 8785/90.

GBPNZD reaches the target of 1.9715/25 & if we continue higher today look for 1.9750/60 with strong resistance at 1.9800/20.

First support at 1.9635/30 then strong support at 1.9600/1.9580. Longs need stops below 1.9560.

Chart

Author

Jason Sen

DayTradeIdeas.co.uk