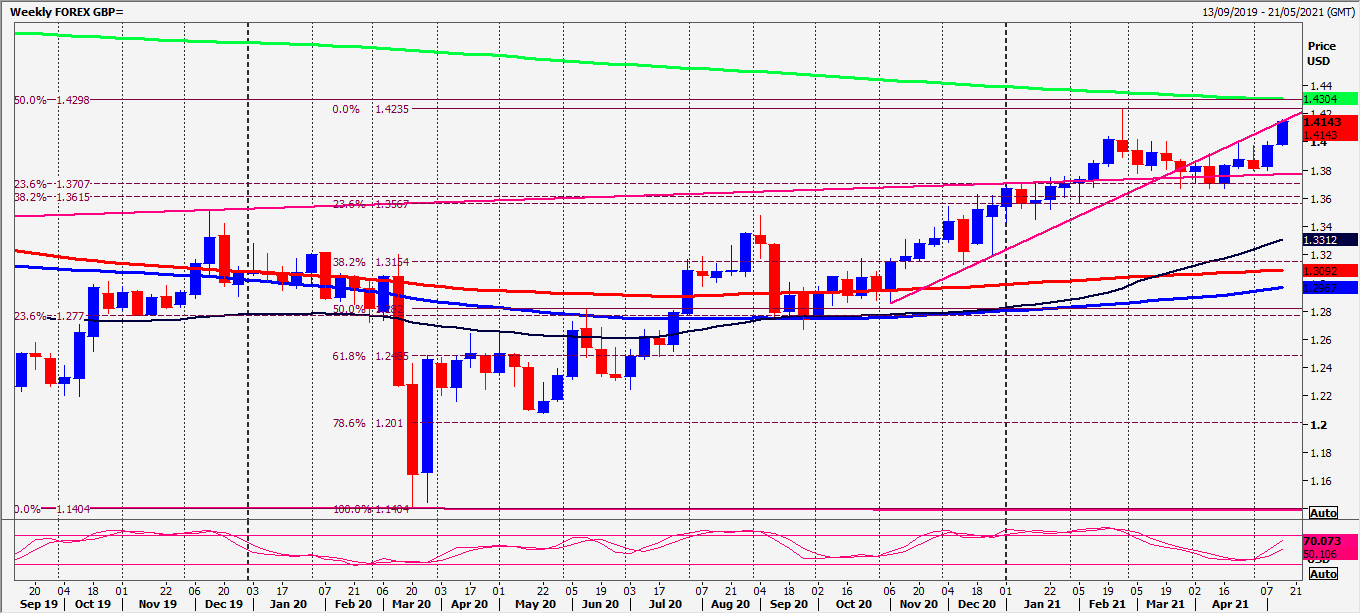

GBP/USD keeps the outlook positive

GBP/USD, EUR/GBP, GBP/NZD

GBPUSD shot higher through the 100 month MA at 1.4070/80 to hit 1.4158.

EURGBP collapsed through first support at 8665/55 & bottomed exactly at the next target & support at 8600/8590.

GBPNZD retests support at the 100 day moving average at 1.9220/10.

Daily analysis

GBPUSD holding above the 100 monthly moving average at 1.4080/60 keeps the outlook positive. Longs need stops below 1.4040.

A break above 1.4170 targets 1.4210/20 & strong resistance at the 200 week moving average at 1.4300/10.

EURGBP bottomed exactly at first support at the next target & support at 8600/8590. Below 8585 can target 8565/60.

First resistance at 8655/65 but above here can target 8712/19. A break higher targets 8750/60, perhaps as far as 8785/90.

GBPNZD breaks back above the 4 month ascending trend line & 200 day moving average 1.9330/40. Holding above 1.9420/00 targets 1.9490/1.9510. On further gains look for 1.9560/80.

Strong support at 1.9325/1.9295. Longs need stops below 1.9275.

Chart

Author

Jason Sen

DayTradeIdeas.co.uk