GBP/USD: Increasingly negative skew to the Cable's outlook [Video]

![GBP/USD: Increasingly negative skew to the Cable's outlook [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/GBPUSD/iStock-1078115946_XtraLarge.jpg)

GBP/USD

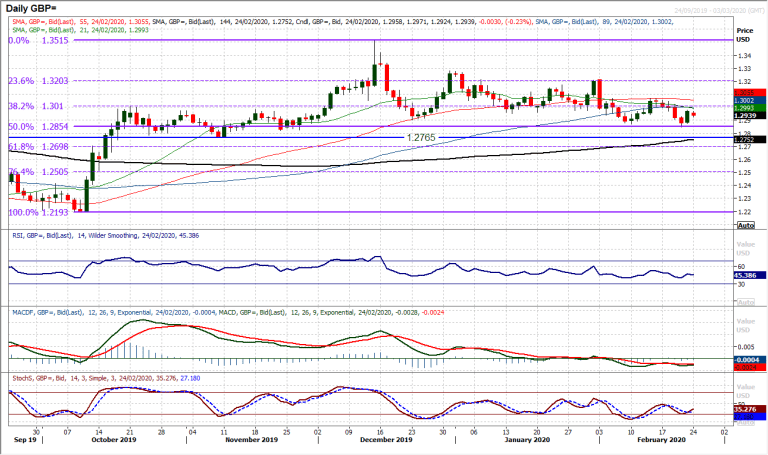

There is an increasingly negative skew to the outlook on Cable. Once more we saw a run of around a handful of sessions in one direction before a retracement move. This time, a bear run has ended with Friday’s decisive bull candle which added +90 pips. However, in the past few weeks, what had previously been a floor of support around $1.2940/$1.2960 is now consistently being breached and Thursday’s lower low at $1.2845 is the lowest level since late November. Lower highs (at $1.3070 in mid-February) and increasingly lower lows are now being formed. The market comes into the new week under short to medium term moving averages that are rolling lower (suggests growing deterioration) and momentum indicators increasingly struggling in corrective configuration. With an initial slip back this morning, Friday’s high of $1.2980 is initial resistance, now under the psychological $1.3000 and the 38.2% Fibonacci retracement (at $1.3010). And another failed rally under $1.3070 would put pressure back on $1.2845 again.

Author

Richard Perry

Independent Analyst