GBP/USD, EUR/GBP, GBP/NZD

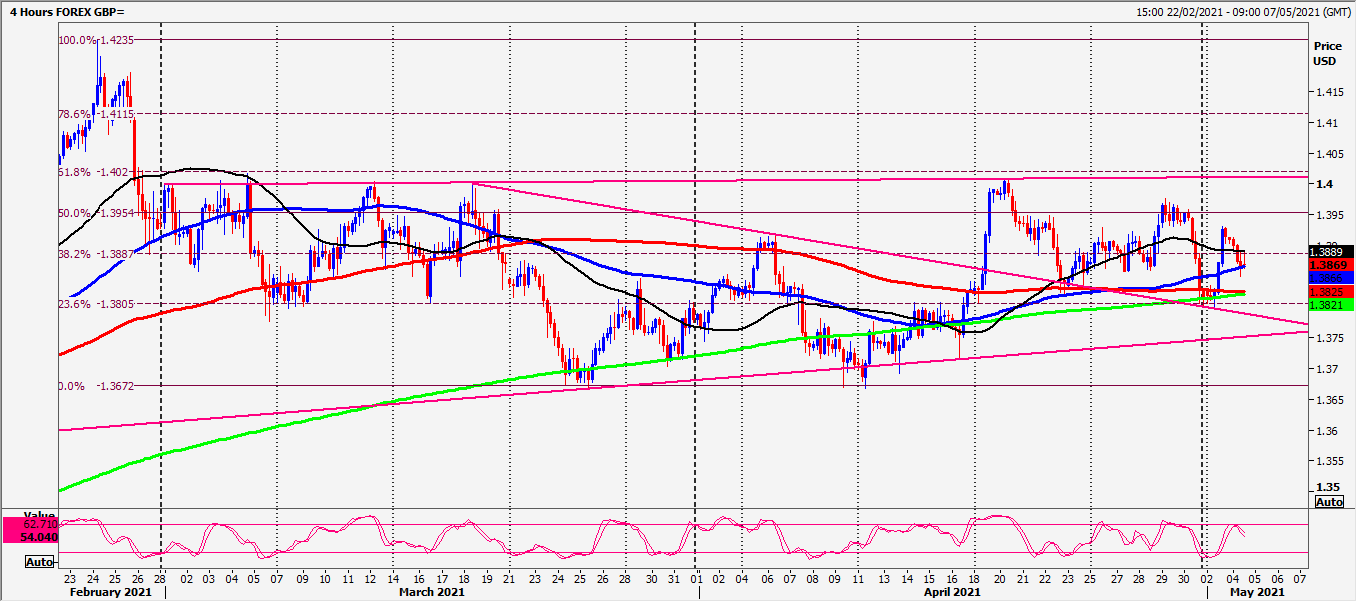

GBPUSD unexpectedly wiped out 5 days of gains as the pair collapsed 160 pips in the sideways trend on Friday then recovers most of the losses on Monday. This is an unpredictable erratic sideways trend.

EURGBP topped exactly here at first resistance at 8712/19 & bottomed exactly at first support at 8665/55 yesterday.

GBPNZD holding between 4 month ascending trend line & 200 day moving average resistance at 1.9330/40 & support at the 100 day moving average at 1.9190/80.

Daily analysis

GBPUSD has 2 support levels at 1.3815/05 (we bottomed exactly here yesterday) & at 1.3765/55.

Holding support at 1.3815/05 targets 1.3845/55 & 1.3890 perhaps as far as strong resistance at 1.3910/25. A break higher targets 1.3980/90.

EURGBP topped exactly at first resistance at 8712/19. A break higher targets 8750/60, perhaps as far as 8785/90.

The pair bottomed exactly at first support at 8665/55 but below 8645 can target 8630/20 before support at 8600/8590. Below 8585 can target 8565/60.

GBPNZD retests strong resistance at the 4 month ascending trend line & 200 day moving average 1.9330/40. If we continue higher look for strong resistance at 1.9410/20.

First support at the 100 day moving average at 1.9190/80. Longs need stops below 1.9165. A break lower to targets 1.9105/00.

Chart

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

AUD/USD rises to two-day high ahead of Aussie CPI

The Aussie Dollar recorded back-to-back positive days against the US Dollar and climbed more than 0.59% on Tuesday, as the US April S&P PMIs were weaker than expected. That spurred speculations that the Federal Reserve could put rate cuts back on the table. The AUD/USD trades at 0.6488 as Wednesday’s Asian session begins.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Ethereum continues hinting at rally following reduced long liquidations

Ethereum has continued showing signs of a potential rally on Tuesday as most coins in the crypto market are also posting gains. This comes amid speculation of a potential decline following FTX ETH sales and normalizing ETH risk reversals.

Australia CPI Preview: Inflation set to remain above target as hopes of early interest-rate cuts fade

An Australian inflation update takes the spotlight this week ahead of critical United States macroeconomic data. The Australian Bureau of Statistics will release two different inflation gauges on Wednesday.