GBP/USD getting ready to lose more

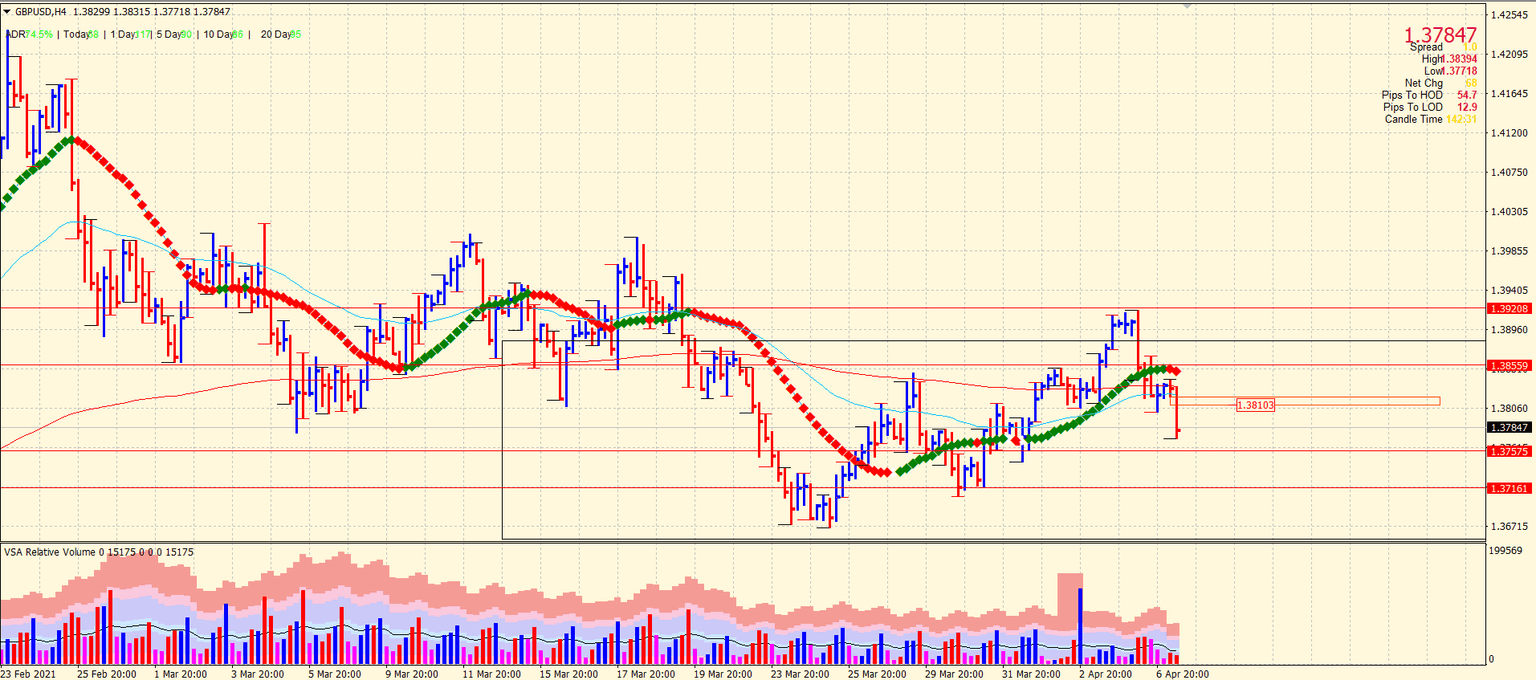

The British Pound saw three impulsive waves last week, extending the gains into Monday and Tuesday for this week as well. However, the up waves were continuously receding followed by a widespread down bar with very high volume on the 4-hour chart.

The 15-minute chart shows a recent break of yesterday’s low of New York session at 1.3800 just ahead of the London session. This could be a great entry point.

On the 1-hour chart, the price shows the same bearish action. The intraday support for the pair lies at 1.3778 ahead of 1.3731.

Trading scenario

Wait for the London session to open and then wait for the price to pull back to the 1.3800 to 1.3810 range. Here you can find the entry to your short position. The potential targets for the selling side could be at 1.3765 ahead of 1.3730 and then 1.3715.

Author

Saqib Iqbal

Black Pipper Forex

Saqib Iqbal is a technical analyst, mentor and funds manager with nine years of experience in the industry. His trading methodology is based on institutional orderflow and volume-spread which helps to identify setups with a great return.